Blog

The digitization of tax authorities has come a long way since its beginnings in 2003. Tax administrations have realised the benefits that technology can bring to VAT reporting. Countries around the world have adopted continuous transaction controls (CTCs) and e-invoicing, with new tax administrations joining the trend every year. There are four trends that all […]

We hosted a webinar about the IPT regulation changes in Europe with our IPT team. Topics included Spain’s IPT increase, Portugal Stamp Duty reporting and other IPT changes across Europe, including Germany, France, Luxembourg, Belgium and Denmark. Although our expert team answered plenty of questions, they didn’t have time for everyone. Here’s a helpful summary. […]

Digital transformation continues to evolve and develop, introducing new solutions and cloud technologies for enterprises around the world. These technologies provide flexibility, agility and reduce operational costs for the companies. Advantages of cloud-based technologies Moving to cloud-based technologies provides many advantages including quality, increased efficiency, and profitability. It’s important to work with a service provider […]

Sales tax is a necessary evil for all businesses but you don’t want to spend more time thinking about it than you have to. Implementing the right sales tax technology solution can help your business continue to grow while ensuring you meet all sales tax obligations. Choosing an efficient, reliable, always-up-to-date solution will help you […]

Florida Governor Ron DeSantis signed SB 50 into law on April 19, which makes Florida the latest state to adopt economic nexus rules to impose a sales tax liability on remote sellers, including direct-to-consumer (DtC) shippers of wine. Unlike most other states, Florida does not currently require DtC wine shippers to assume a sales tax […]

We’ve recently seen several Eastern European countries begin their journey of implementing continuous transaction controls (CTC) as an efficient tool for combating tax fraud and reducing the VAT gap. The CTC frameworks may vary in nature, scope and implementation, but they all have one thing in common: an ambition to achieve operational efficiency for businesses […]

Historically, the healthcare industry has experienced challenges in identifying and reporting unclaimed property. This is due to several reasons including a lack of clear statutory guidance, limited understanding of the potential unclaimed property liabilities which they are truly subject, and conflicting laws (i.e., refund recoupment, prompt payment, HIPAA, etc.). The fundamental understanding that healthcare entities […]

Fluctuation in the wine market is not showing any signs of easing as producers, retailers and consumers continue to navigate the impacts of a global pandemic. It has never been so critical to keep a pulse on marketplace data given these shifting dynamics. Nielsen is collaborating with Wines Vines Analytics and Sovos ShipCompliant to provide […]

The Sultanate of Oman has imposed a Value Added Tax from 16 April 2021. The VAT system is scheduled to be implemented in phases, with businesses required to register for VAT at different points over the next year based on their turnover. Turnover Mandatory Registration Deadline Effective Date of Registration Greater than 1,000,000 OMR March […]

EU VAT E-commerce VAT package: the basics The European Union’s VAT e-commerce package is scheduled to come in to force 1 July 2021 to reduce admin burdens and increase efficiency. Your business needs to assess it’s current processes to determine how the changes will affect you. In this episode of the Sovos Expert Series, Andy […]

Brazil E-Invoicing: New rules on NF-e invoices Although Brazil is known for its complex tax laws that make compliance a difficult task in the country, it is undeniable that the Continuous Transaction Control (CTC) system implemented more than a decade ago is one of the most stable in the world. However, even a sophisticated […]

Mexico’s Miscellaneous Fiscal Resolution (MFR) for 2021 includes a number of changes, the first of which you can read about in our previous blog on the subject. In this blog we will discuss the approved specific technical modifications related to the validations Authorised Certification Providers (PACs) should make to electronic invoices sent to them for […]

Form 1099-NEC changes in 2020 Since the IRS released Publication 1220, announcing that Form 1099-NEC—for nonemployee compensation—would not be included in the Combined Federal/State Filing (CF/SF) program starting tax year 2020, 37 states have implemented direct state reporting requirements for new Form 1099-NEC. Though there are 32 states that participate in the CF/SF program, the […]

When are unclaimed property reports due? This is a fairly common question asked by holders that are new to the escheat reporting process, or not as well versed in the intricacies of escheatment reporting. Fortunately, Sovos has provided answers to some of the most frequently asked escheat reporting questions to help your organization survive unclaimed […]

Most unclaimed property professionals are familiar with the story of Verus Analytics, LLC’s (“Verus”)[1] appearance on the contract audit “field of play” some ten years ago, as it cut a swath across the life insurance industry with audits focused on the industry’s failure to report and remit unclaimed life insurance proceeds based on the insurers […]

Increased visibility into, and control over, taxpayer financial and trade data is the key benefit highlighted by governments that have introduced continuous transaction controls (CTC) regimes. Its importance cannot be overstated. Transactional data cleared by or exchanged through a tax administration authorised platform becomes the new source of truth for tax authorities to assess the […]

Tax authorities have increased their focus on the insurance industry to ensure Insurance Premium Tax (IPT) and parafiscal taxes are collected correctly, accurately, and on time. Operating in multiple countries inevitably means also having to comply with many local regulations in line with IPT statutory and parafiscal filing. Compliance regimes can be simple or complex, […]

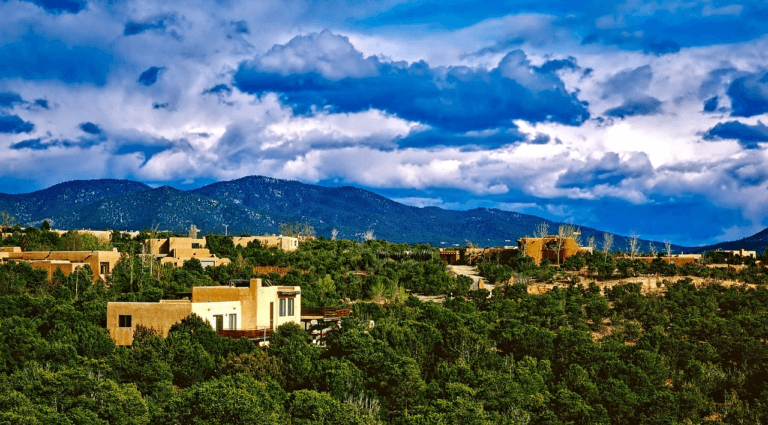

New Mexico is one of many states that updated its economic nexus following the South Dakota v. Wayfair, Inc. decision. With the passing of New Mexico House Bill (H.B.) 6, the Land of Enchantment adopted a sales tax collection requirement for out-of-state sellers and marketplace facilitators. The below outlines several of the major points in […]