Lithuania E-invoicing

Lithuania E-invoicing While there is no B2B mandate in Lithuania, B2G e-invoicing has been implemented since 2017, and things have changed over recent years. Knowing

Lithuania E-invoicing While there is no B2B mandate in Lithuania, B2G e-invoicing has been implemented since 2017, and things have changed over recent years. Knowing

Latvia E-invoicing Latvia has been working towards implementing mandatory electronic invoicing for years. It has seen mixed success, with B2C e-invoicing being mandated while the

Cyprus E-invoicing Cyprus may not have mandated e-invoicing so far, but there are still rules and requirements you need to be aware of—especially given the

Malta e-invoicing While the Government of Malta supports and encourages the usage of electronic invoices, there is no mandate for e-invoicing in the country. The

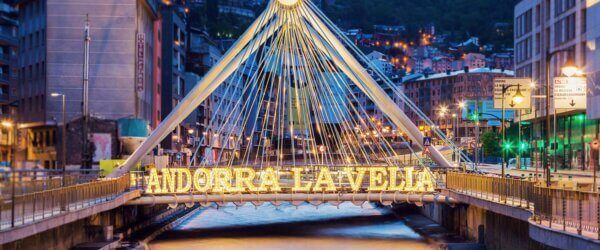

Andorra E-invoicing Andorra is earlier in its e-invoicing journey than many other countries, but it still has some rules and requirements around electronic invoicing. In

Slovenia E-invoicing Slovenia is in the middle of its journey towards mandatory e-invoicing. It is already in place for B2G transactions, and the current plan

Belarus E-invoicing While B2B and B2G e-invoicing has been mandatory since 2016, Belarus is still working towards implementing electronic invoicing across a variety of transactions.

Estonia E-invoicing Estonia has been working on its electronic invoicing regulations for many years, mandating B2G e-invoicing since 2019. B2B is more complicated, however. This

Portugal E-invoicing Portugal, like every other country, is on a unique e-invoicing journey. While it was early in adopting digital reporting requirements, the country still

Luxembourg E-invoicing Luxembourg is on a typical trajectory regarding its e-invoicing adoption. It wasn’t an early mover, yet it already has a mandate in place—specifically

Austria E-invoicing While Austria does not have a full e-invoicing mandate in place for B2B and B2G transactions, it has systems and processes to encourage

Bulgaria E-invoicing Based on the European Directive 2014/55/EU, Bulgaria has legislated the use of e-invoicing in public administrations to receive and process electronic invoices. However,

Czech Republic E-invoicing Like many countries, the Czech Republic has experience with e-invoices for the purposes of reducing administrative strain, reducing associated costs and greater

Hungary E-invoicing While Hungary does not explicitly mandate the issuance of electronic invoices for most transactions, the country’s real-time invoice reporting (RTIR) scheme applies to

Denmark E-invoicing Denmark has mandated the use of electronic invoices, though not in all contexts, since 2005 – making it an early adopter of the

Norway E-invoicing Norway is widely regarded as one of the more forward-thinking European countries when it comes to e-invoicing. Serving as one of the original

Ireland E-invoicing Ireland gave electronic invoicing the same legal weight as paper invoices in 2013. Since then, there have been no major developments regarding mandating

Bulgaria SAF-T: Everything You Need To Know Bulgaria is on its way to introducing mandatory SAF-T reporting requirements for businesses, with implementation starting in January

Sweden E-invoicing As a pioneer in tax digitization, Sweden is one of the early adopters of electronic information exchange, with its journey starting in 2003.

Netherlands E-invoicing The Netherlands’ e-invoicing journey started in 2019 when all public authorities were obligated to receive electronic invoices from their suppliers. It is estimated

Switzerland E-invoicing Switzerland is on its e-invoicing journey, having mandated its use for transactions between suppliers and federal government entities since 2016. That said, electronic

Belgium e-invoicing Belgium is gearing up to mandate e-invoicing for B2B transactions, having already introduced it for governmental transactions in 2024. It’s important to stay

VAT Compliance in Germany: An Overview for Businesses Tax compliance in Germany is fragmentary by nature and requires resources to ensure compliance. Consider that compliance

e-invoicing in Germany Germany, like many European countries, is on its way to implementing electronic invoicing requirements for domestic taxpayers of all shapes and sizes.

Greece e-invoicing Electronic invoicing is mandatory for B2G supplies and optional for B2B and B2C supplies. However, the Greek authorities are on the way to

E-invoicing: An Overview Turkey was an early adopter of electronic invoicing when considering the global landscape of tax digitization. As part of its larger e-Transformation

VAT Compliance in Poland: An Overview for Businesses Poland VAT compliance can be a tall task for those yet to devise a future-proof strategy. Considering

Poland SAF-T framework Poland is one of many countries to use the Standard Audit File for Tax (SAF-T) to streamline tax compliance and reporting for

Romania e-invoicing E-invoicing in Romania is developing fast. With a current B2G and High Fiscal Risk B2B mandate already in place and a new obligation

Romania SAF-T declaration Since 2022, medium and large taxpayers in Romania have had to report their VAT electronically to the tax authority under the international

Spain e-invoicing: What you need to know Spain e-invoicing Spain is one of many European countries to adopt e-invoicing for taxpayers. With several standards to

Serbia E-invoicing Aligning with other Eastern European countries such as Poland and Romania, Serbia has forged a path towards mandating e-invoicing for B2B and B2G

Lithuania’s VAT Requirements Lithuania’s SAF-T Standards Framework Seeking to modernise and digitize its tax systems, the Lithuanian Customs Office of the State Tax Inspectorate announced

Luxembourg VAT Requirements Luxembourg to implement SAF-T and e-invoicing Luxembourg is one of many European countries to implement SAF-T and e-invoicing to provide greater visibility

Slovakia E-invoicing The modernisation of tax and tax controls remains a high priority for Slovakia’s tax authority. The Slovakian Ministry of Finance plans to introduce

Tax in Romania: All you need to know about Romania’s VAT regime Romania introduces measures to digitally transform its tax administration and close the VAT

The VAT Import One Stop Shop (IOSS) Simplify EU VAT with IOSS in one single return The Import One Stop Shop (IOSS) is here. Simplify your EU

Portugal’s VAT Regime Portugal pushes further ahead with VAT digitization Back in 2019, Portugal passed a mini e-invoicing reform consolidating the country’s framework around SAF-T

Making Tax Digital: All You Need to Know What is Making Tax Digital? Making Tax Digital is part of the UK government’s plans to reduce

What is Turkey’s E‑Transformation? While many governments and tax authorities are now on an e-Transformation journey, this trend began in Latin America in the early

Norway SAF-T: Everything You Need to Know Designed to reduce the compliance burden and administrative costs associated with audits—while providing tax authorities with greater visibility

E-invoicing France France will implement mandatory B2B e-invoicing, as well as an e-reporting obligation. This mandate impacts all companies operating in France. This new e-invoicing mandate is complex

Tax in Hungary: All you need to know about RTIR Hungary RTIR Hungary In 2018, Hungary established a legal framework requiring taxpayers to use a

The 2021 EU E-Commerce VAT Package and One Stop Shop (OSS) VAT package simplifying cross-border B2C trade in the EU From 1 July 2021, the

E-invoicing Italy: All you need to know Italy was the first country in the region to introduce a clearance e-invoicing model with the Sistema di

Greece myDATA In 2020, Greece introduced a continuous transaction controls (CTC) scheme, called myDATA – an e-audit system. myDATA requires taxpayers to transmit transactional and