All-in-one indirect tax compliance platform

The Sovos Indirect Tax Suite Includes

Are you doing indirect taxes right?

74% of companies say digital tax compliance has raised overall tax risk (EY).

Integrated Compliance and Risk Reduction

Automated real-time compliance minimizes risks and reduces audit triggers across 185+ countries.

43% of businesses say compliance with evolving tax laws is a top challenge (Deloitte).

Automated Tax Compliance Across Jurisdictions

Continuous regulatory updates keep companies aligned with evolving tax laws, reducing the complexity of compliance.

60% of tax leaders anticipate increased reporting and compliance duties (PwC).

Automated Tax Compliance Across Jurisdictions

Continuous regulatory updates keep companies aligned with evolving tax laws, reducing the complexity of compliance.

Tax Compliance Automation That Drives Results

Sovos IntelligenceNEW

Get deep financial insights from the world’s first unified tax compliance data model

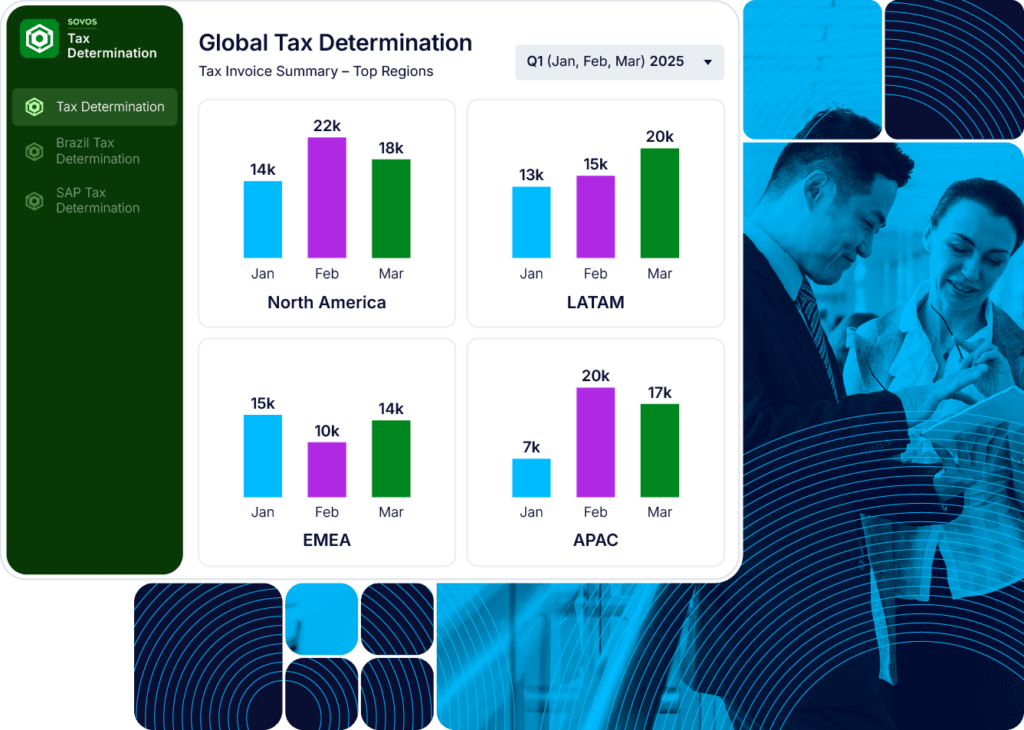

Tax Determination

Get precise, real-time global tax calculations for SUT, VAT, and GST compliance across 185+ countries with seamless ERP integration.

Learn more about Tax Determination:

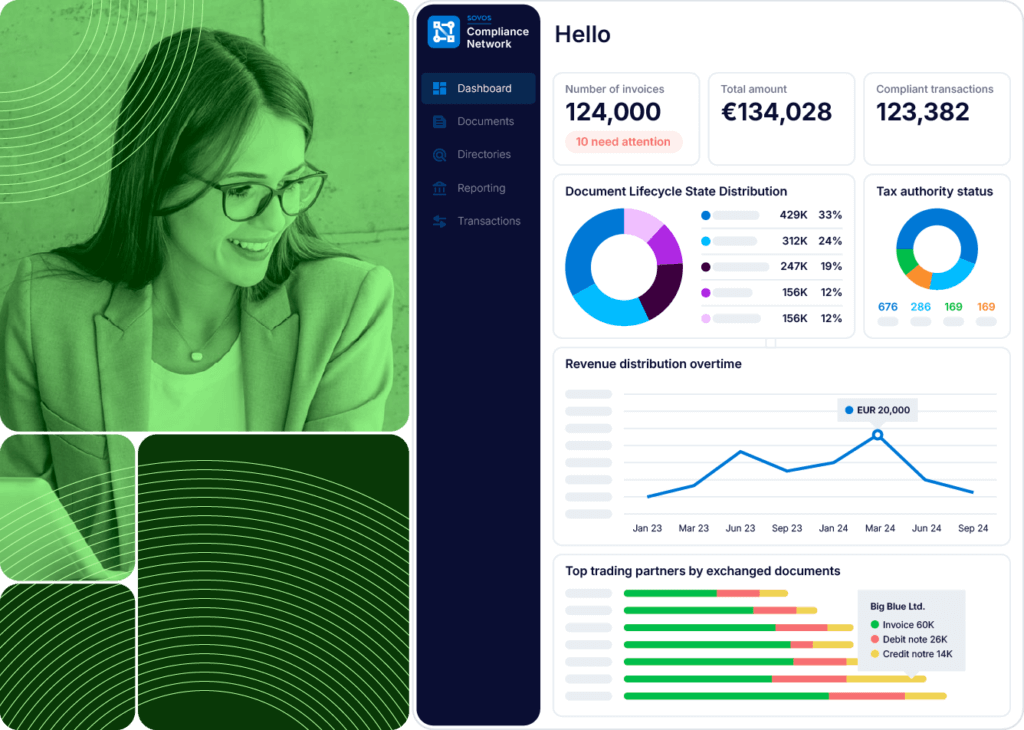

Compliance Network

Simplify global tax compliance with global e-invoicing solutions, continuous transaction controls, e-receipts, and e-archiving across 60+ countries.

Learn more about Compliance Network:

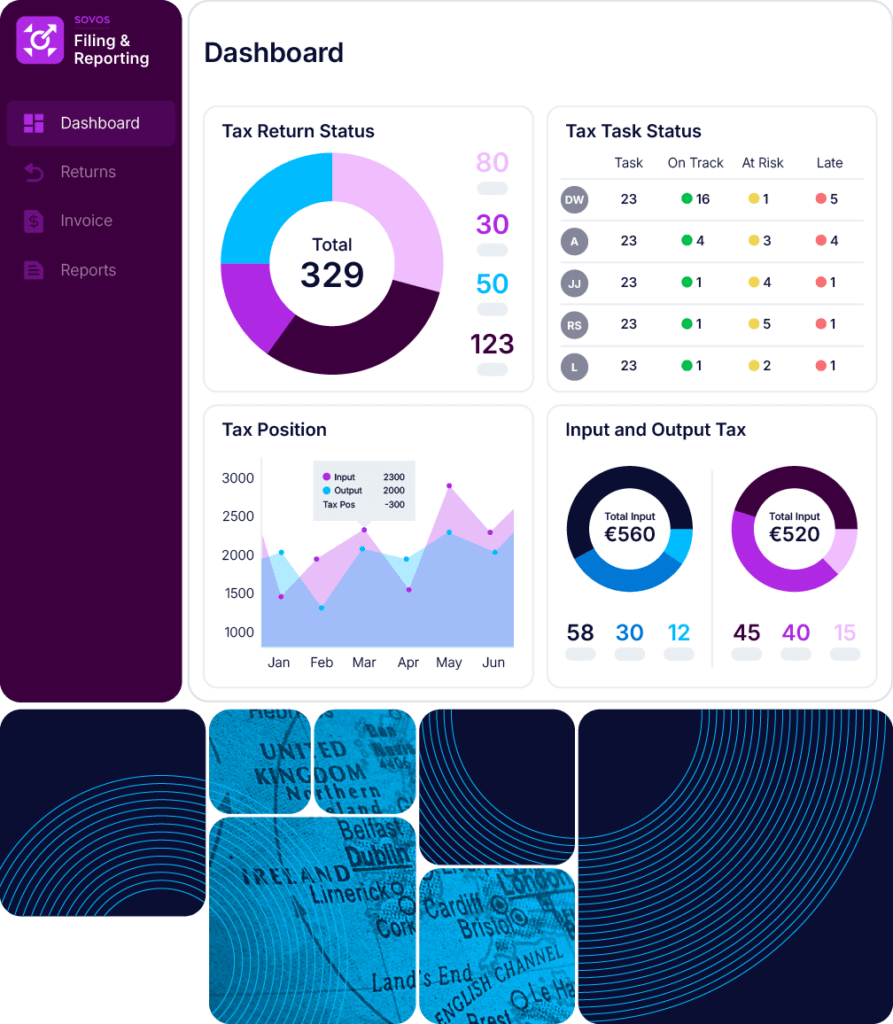

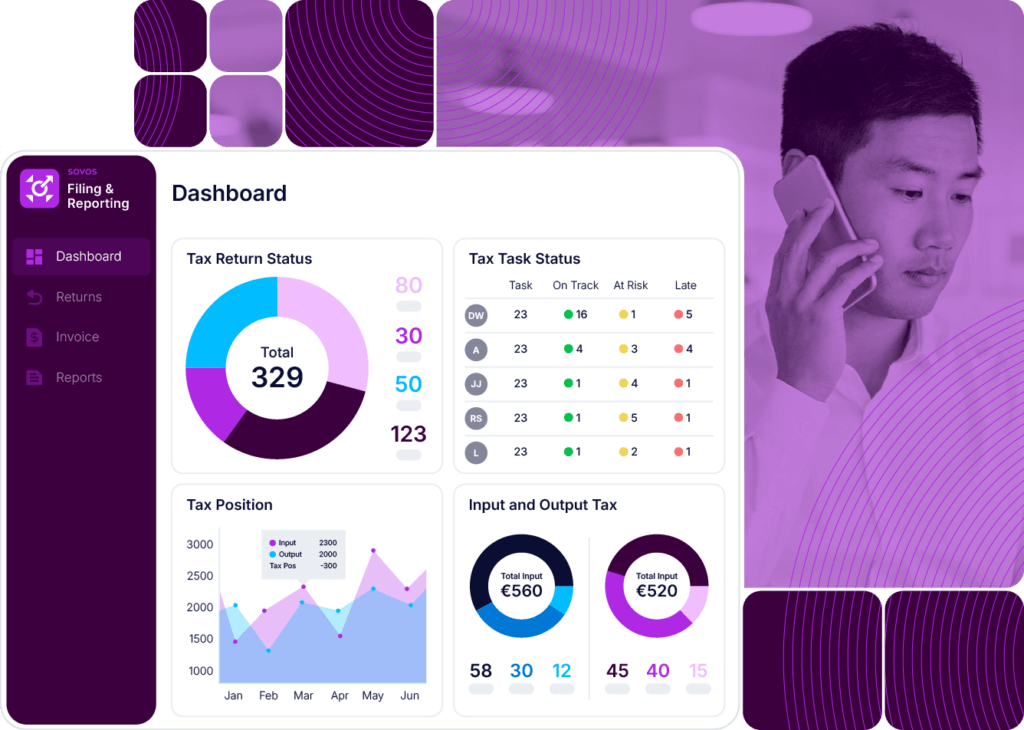

Filing and Reporting

Automate all tax filings with integrated reporting solutions, ensuring audit-ready data and real-time compliance monitoring across the world.

Learn more about Filing & Reporting:

Explore the Suite

Explore the Suite