Blog

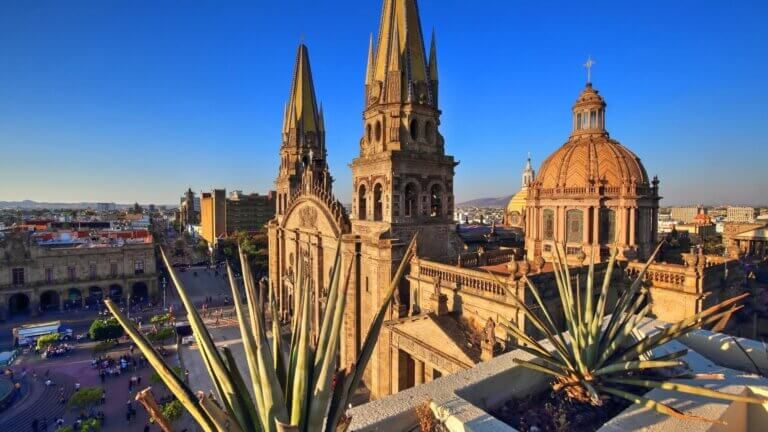

On 1 May 2021, the Mexican tax administration (SAT) enacted a new requirement via the new Bill of Lading Supplement (locally known as Complemento de Carta Porte), making it mandatory for taxpayers moving goods between addresses within the country to inform and receive authorisation from the SAT. This Complemento is required whenever taxpayers move goods within Mexico via […]

In the “Statement on a Two-Pillar Solution to Address the Tax Challenges Arising From the Digitalization of the Economy” issued on 1 July 2021, members of the G20 Inclusive Framework on Base Erosion and Profit Shifting (“BEPS”) have agreed upon a framework to move forward with a global tax reform deal. This will address the […]

While many Latin American countries have begun to implement taxation on digital services, Mexico is currently leading the charge and has established a strong track record that other countries are hoping to match. Chile and Ecuador have both recently passed similar legislation with hopes of finding similar success and attracting more global fintech brands. The […]

Update: 25 October 2023 by Maria del Carmen Mexico releases Carta Porte Version 3.0 On 25 September 2023, the Tax Authority in Mexico (SAT) published Version 3.0 of the Carta Porte Supplement on its portal with some adjustments. The use of Version 2.0 of the Carta Porte became mandatory as of 1 January 2022 in […]

EESPA, the European E-invoicing Service Providers Association, recently published EESPA Standard Definitions for Legally Compliant Electronic Invoicing and their usage. This document aims to provide a basis for e-invoicing service providers and their customers to agree on allocation of responsibility of the legal compliance of processes supported by the services. These standard definitions will contribute […]

Mexico’s Miscellaneous Fiscal Resolution (MFR) for 2021 includes a number of changes, the first of which you can read about in our previous blog on the subject. In this blog we will discuss the approved specific technical modifications related to the validations Authorised Certification Providers (PACs) should make to electronic invoices sent to them for […]

Mexico introduced changes to the Miscellaneous Fiscal Resolution (MFR) this year. The Miscellaneous Fiscal Resolution is a group of regulations issued by the Mexican tax administration (SAT). The regulations contain the official interpretations of the rules enacted for the application of the taxes, levies and related obligations applicable to taxpayers in Mexico. The MFR is […]

Part 2: Main Aspects of the 2nd Modification of the Miscellaneous Fiscal Resolution for 2020 In addition to the provisions related to digital services explained in Part I of this blog, the second Modification to the Miscellaneous Fiscal Resolution for 2020 (RMF2020) also introduced the following changes related to VAT obligations, the use of electronic […]

Part 1: Main Aspects of the 2nd Modification of the Miscellaneous Fiscal Resolution for 2020 The Mexican Tax Administration (SAT) released the second modification of the Miscellaneous Fiscal Resolution for 2020 (RMF2020). This is the first of two blogs, where we address some of the main changes in compliance obligations for suppliers of digital services […]

In the past five years, transaction automation platform vendors who embraced e-invoicing and e-archiving compliance as integral to their services grew on average approximately 2.5 to 5 times faster than the market. Two decades of EU e-invoicing: many options, different models Until 1 January 2019, when Italy became the first European country to mandate B2B […]

The Government Accountability Office (GAO), a U.S. Congress watchdog, published a report evaluating the IRS’s approach to regulating virtual currency (crypto) and the guidance it has offered the public. The GAO’s Recommendation However, a portion of the report was directed at the IRS and the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

As part of the recently updated “new NAFTA,” or USMCA, Mexico is enticing companies to move operations into its maquiladora zone of factories along the US border. Major benefits of relocation include exemptions from value-added tax (VAT) and other taxes for qualifying manufacturers, along with a VAT rate reduced by half applied to local transactions […]

The following is an excerpt from “Trends in Continuous Global VAT Compliance,” the 11th edition of the industry’s most comprehensive guide to e-invoicing, e-archiving and VAT reporting. The full report is available for download. To reduce the VAT gap, countries are pushing taxable organizations to comply with VAT requirements and enforcing different types of legal […]

Mexico is introducing a tax reform to be enforced on 1 January 2020, implementing a general anti-abuse rule. Its aim is to increase governmental control over the transactions carried out by taxpayers. To counter abuse of tax law, the anti-abuse rule will allow tax authorities to adjust the nature of the operations reported and, consequently, […]

Companies are dealing with a fundamental shift in the way they do business with trading partners. In a rapidly increasing number of countries, there’s a third party inserting itself into every transaction. It’s the government, and it’s wedging its way into every order a company ships or receives. In an effort to close a massive […]