This blog was last updated on February 23, 2021

Understanding unclaimed property dormancy periods by state and executing the appropriate decisions can make or break your company’s unclaimed property program. This is due primarily to the fact that each state has varying dormancy periods. To complicate matters even further, each state has specific dormancy periods for each corresponding property type. As a result, determining eligibility for escheatment becomes an extremely confusing and difficult process for companies.

What are unclaimed property dormancy periods?

A dormancy period is the statutory period of time without owner initiated contact or activity, that must elapse before a state can consider a property dormant or abandoned. Once the dormancy period has elapsed, the property is then eligible to be escheated to the appropriate state. The states act in a custodial manner over that asset until it is claimed by the rightful owner.

- The dormancy period for securities begins with the last instance of owner generated contact and/or the first instance of mail being returned as undeliverable, commonly referred to as returned from post office (RPO).

- Dormancy triggers common for other asset types can include:

- The check issue date

- Date of last contact

- Date of death

- Date that property becomes mandatorily distributable

- Maturity date

- Dormancy periods vary by the unclaimed property type

- The dormancy period resets each time there is owner generated activity on the account or asset. This may include actions such as:

- A deposit or withdrawal from an account

- The payment of a premium

- Cashing of a check or written communication from the owner of the property

As technology evolves in the financial services industry, new electronic indicators of owner interest, such as accessing an online banking platform, are also being considered.

Constantly Changing State Dormancy Periods

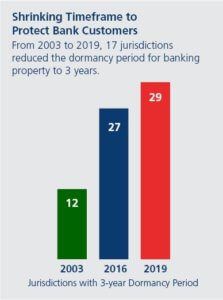

A growing trend in recent years has been the reduction of unclaimed property dormancy periods. Many states have reduced their dormancy periods for a variety of property types, most are reducing their dormancy period from five years to three years on selected property types. Over a 16 year period, 17 jurisdictions reduced their dormancy periods for banking properties to three years, from either five or seven years.

The decision to introduce legislation that alters the dormancy periods on these property types is purely at the discretion of the states and their legislatures. However, it is the holders’ duty to stay on top of these changes. Failure to monitor these changing dormancy periods can have a variety of consequences. Reporting a property too early may result in an upset customer, shareholder, or investor. It can also result in asset liquidation by the state and the holder’s loss of indemnification by the state. Reporting IRA accounts too early can significantly impact a persons’ retirement planning. On the opposite end of the spectrum, reporting unclaimed property too late will likely result in costly fines and penalties from the state. In addition to passing reporting deadlines, it may also land your company on the state’s radar for an audit.

It is crucial to be aware of the rules and processes that are set in place regarding dormancy periods. It can have a great impact not only on investor relations, but an impact on the financial position of your company if not completed and dealt with in a correct and timely manner.