Blog

EESPA, the European E-invoicing Service Providers Association, recently published EESPA Standard Definitions for Legally Compliant Electronic Invoicing and their usage. This document aims to provide a basis for e-invoicing service providers and their customers to agree on allocation of responsibility of the legal compliance of processes supported by the services. These standard definitions will contribute […]

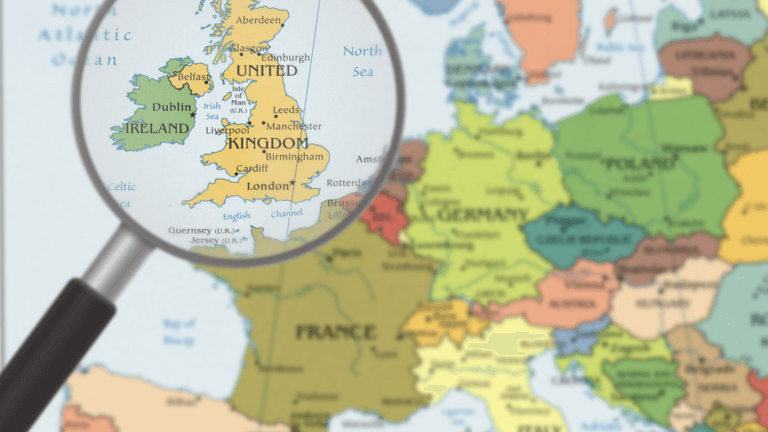

The digitization of tax authorities has come a long way since its beginnings in 2003. Tax administrations have realised the benefits that technology can bring to VAT reporting. Countries around the world have adopted continuous transaction controls (CTCs) and e-invoicing, with new tax administrations joining the trend every year. There are four trends that all […]

Digital transformation continues to evolve and develop, introducing new solutions and cloud technologies for enterprises around the world. These technologies provide flexibility, agility and reduce operational costs for the companies. Advantages of cloud-based technologies Moving to cloud-based technologies provides many advantages including quality, increased efficiency, and profitability. It’s important to work with a service provider […]

The Sultanate of Oman has imposed a Value Added Tax from 16 April 2021. The VAT system is scheduled to be implemented in phases, with businesses required to register for VAT at different points over the next year based on their turnover. Turnover Mandatory Registration Deadline Effective Date of Registration Greater than 1,000,000 OMR March […]

EU VAT E-commerce VAT package: the basics The European Union’s VAT e-commerce package is scheduled to come in to force 1 July 2021 to reduce admin burdens and increase efficiency. Your business needs to assess it’s current processes to determine how the changes will affect you. In this episode of the Sovos Expert Series, Andy […]

Mexico’s Miscellaneous Fiscal Resolution (MFR) for 2021 includes a number of changes, the first of which you can read about in our previous blog on the subject. In this blog we will discuss the approved specific technical modifications related to the validations Authorised Certification Providers (PACs) should make to electronic invoices sent to them for […]

Tax authorities have increased their focus on the insurance industry to ensure Insurance Premium Tax (IPT) and parafiscal taxes are collected correctly, accurately, and on time. Operating in multiple countries inevitably means also having to comply with many local regulations in line with IPT statutory and parafiscal filing. Compliance regimes can be simple or complex, […]

Update: 25 August 2023 by Carolina Silva Croatia to Introduce E-Invoicing and CTC Reporting System According to official sources from the Ministry of Finance, the Croatian tax authority will introduce a decentralised e-invoicing model alongside a continuous transaction control (CTC) real-time reporting system of invoice data to the tax authority. This move is part of […]

VAT accounts for 15-40% of all public revenue globally. We estimate that the global VAT gap – i.e. lost VAT revenue due to errors and fraud – could be as high as half a trillion Euros. The GDP of countries like Norway, Austria or Nigeria are at a similar level and this VAT gap is […]

Brexit continues to create a stir and the only absolute is that confusion dwarfs certainty when it comes to understanding the new tax laws that went into effect when Brexit became a reality. To address some of the more pressing questions, we gathered three industry experts for a webinar to provide some clarity into this […]

The Norwegian tax authority’s project for modernising VAT, the MEMO-project, has announced a new digital VAT return. It will take effect from the beginning of 2022 following a pilot program in August this year. This new VAT return seeks to provide simplification in reporting, better administration, and improved compliance in the VAT system. Currently VAT […]

When managing any e-transformation project the deadline is determined after careful planning. It should be based on the project scope and consider the available resources. However, when the project is to ensure regulatory compliance, the government determines the project’s deadline and it must be met. Many taxpayers choose to work with an external integrator to […]

Bulgaria could be the next EU Member State to introduce continuous transaction controls (CTCs) following Italy, France and Poland. Introducing CTCs provides tax administrations with more granular and continuous visibility into tax-relevant business data. Bulgaria announced it’s considering mandating e-invoicing and the transmission of invoices to the tax authority. This could be done either via […]

The General Authority of Zakat and Tax (GAZT) has published draft rules for the controls, requirements, technical specifications and procedural rules for implementing the provisions of the e-invoicing regulation. In addition to the draft rules, the associated technical specifications (Electronic Invoice Data Dictionary, Electronic Invoice XML Implementation Standard and Electronic Invoice Security Implementation Standards) are […]

From April, insurers will start to make their first electronic filing of Insurance Premium Tax (IPT) in Luxembourg using the new online submission portal – myGuichet. Along with other European territories, the Luxembourg tax authority has sought to streamline and improve IPT collection and administration. Using an online portal is an efficient and secure way […]

Given the complexity of international VAT and the potential risk, pitfalls and associated costs, finance directors face a predicament. Unlike direct taxes, which tend to be retrospectively determined, VAT is effectively calculated in real-time. It’s linked to various aspects of the supply chain. If the related transaction has incorrect VAT calculations or erroneous codes, these […]

Although insurance companies do their best to settle their tax liabilities in the most compliant manner, historical liabilities may still occur. Here is an overview of the different types of historical declarations with some insurance premium tax (IPT) examples. When a tax liability becomes a historical liability Let’s start with a simple chart: Are we […]

Mexico introduced changes to the Miscellaneous Fiscal Resolution (MFR) this year. The Miscellaneous Fiscal Resolution is a group of regulations issued by the Mexican tax administration (SAT). The regulations contain the official interpretations of the rules enacted for the application of the taxes, levies and related obligations applicable to taxpayers in Mexico. The MFR is […]