Blog

Significant inflation increases have impacted most of the world’s economies, with the UK still above 10% in 2023. This increase means a reduction in the purchasing power of consumers. Together with increases in the cost of raw materials, this has created uncertainty regarding growth of entire industrial departments and reduced profit margins for companies. The […]

By Tom Wark, Executive Director, National Association of Wine Retailers Politics breed myths. This has always been the case as politics is, at its most fundamental, a form of storytelling. So it should be no surprise that myths have arisen as various elements of the wine industry have fought against consumers and specialty wine retailer seeking […]

Much of the discussion on the Location of Risk triggering a country’s entitlement to levy insurance premium tax (IPT) and parafiscal charges focuses on the rules for different types of insurance. European Union (EU) Directive 2009/138/EC (Solvency II) set out these rules. However, a related topic of growing importance in this area concerns territoriality, i.e. […]

Japan’s new e-invoice retention requirements are part of the country’s latest Electronic Record Retention Law (ERRL) reform. Along with measures such as the Qualified Invoice System (QIS) and the possibility to issue and send invoices electronically via PEPPOL, Japan is implementing different indirect tax control measures, seeking to reduce tax evasion and promote digital transformation. […]

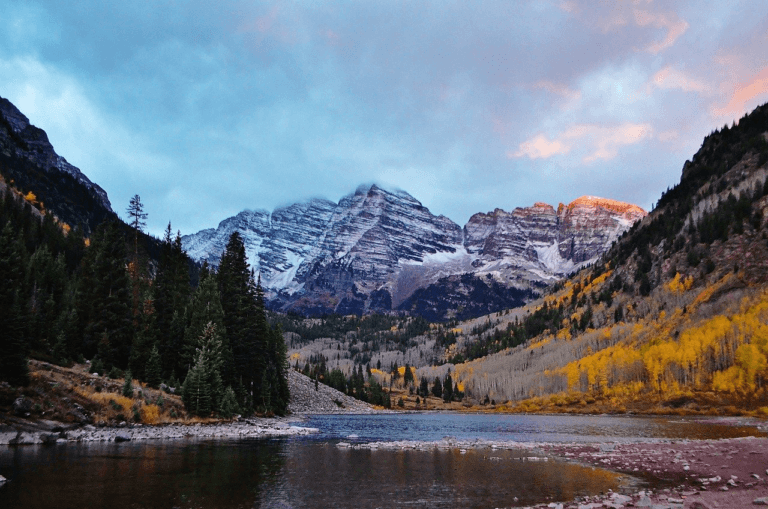

Colorado enacted changes to the state’s Retail Delivery Fee (RDF) effective in May, which should provide some relief to wineries engaged in direct-to-consumer (DtC) wine shipping in the state. The RDF was adopted by Colorado in 2022 as a 27-cent fee that applied to all retail sales that involved the delivery of goods using motorized […]

The chorus to “California, Here I come,” a popular showtune from the Great American Songbook, starts with the lyrics, “California Here I come, right back where I started from.” For holders trying to stay on top of their California unclaimed property reports, it sometimes feels like a piece of musical déjà vu. Wait, didn’t we […]

In-person conferences are back in full force for Sovos in 2023. It’s likely that you, or your employees, have been invited to several industry conferences that offer high-impact keynote speakers and a great depth of potential insights into our industry. How do you evaluate the true value in terms of return on investment for you, […]

For fully remote sellers, sales tax compliance in Alabama can feel daunting. However, just prior to Wayfair, Alabama created the Simplified Sellers Use Tax system. Today, remote sellers with economic nexus in Alabama can apply to participate. Once accepted, their transactions become subject to a special flat rate (currently 8%), which represents an amalgam of […]

By Sovos Compliance and ZenLedger As digital currency gains traction across the globe, businesses must stay on top of international crypto compliance guidelines more than ever. These regulations safeguard consumers and ensure ethical conduct by businesses. In today’s digital age, the world of cryptocurrencies is an investment option for both individuals and businesses. However, navigating […]

Oftentimes, small companies hold unclaimed property without realizing it, mistakenly assuming only mid-sized and large companies have the potential to generate it. In fact, many are not aware that such liabilities even exist. If small businesses do have some awareness, they do not fully understand the numerous responsibilities concerning unclaimed property and the consequences for […]

For the third year in a row, the U.S. Department of the Treasury’s annual General Explanations of the Administration’s FY2024 Revenue Proposals (Greenbook) includes a proposed update that would expand the federal backup withholding requirements. The proposed change would help facilitate more accurate tax information, supporting “the broader goals of improving IRS service to taxpayers, […]

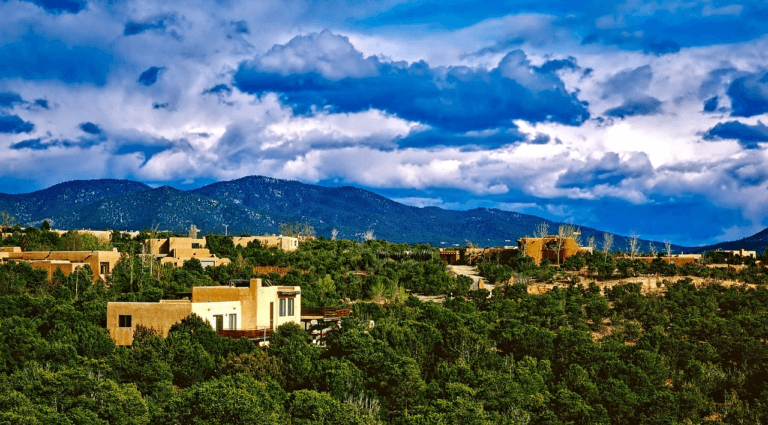

New Mexico used to be one of a minority of states that applied origin-based local sales tax sourcing while also not applying a complimentary “seller’s use” tax to its local sales tax. Both of these things have changed in recent years. Today, New Mexico joins the majority of states in applying a destination-based tax system […]

Direct-to-consumer (DtC) wine shipping represents 8% of total off-premise domestically-made wine sales, totaling $3.94 billion in 2024. It’s no wonder that wineries from across the country are looking to expand their reach by shipping their bottles to consumers in every corner of the nation. In response, we’ve seen an increasing number of third-party shipping businesses […]

What is TicketBAI? TicketBAI is a joint project of the Provincial Treasuries and the Government of the Basque Country with the objective of implementing a series of legal and technical obligations for the taxpayers’ invoicing software. These obligations allow the tax authorities to control their economic activities, especially those in the sector of sales of […]

Despite Louisiana’s struggles to adopt meaningful sales tax simplifications, it implemented the Sales and Use Tax Commission for Remote Sellers, creating a single spot for state and local sales tax filing. Unfortunately, this system does not address the complexities of local sales tax rules. Prior to Wayfair, Louisiana allowed “volunteer” remote sellers to use their 8.45% […]

Until recently, Florida required sellers to calculate sales tax using a “bracket schedule,” which determines how much tax applies to the portion of sales priced under $1.00. While other states also publish tax brackets, those schedules are readily broken down into a clear mathematical formula. This was not the case with Florida, which previously continued […]

For the past couple of years, businesses have been emerging from their pandemic work settings at varying degrees. And during that time, we’ve been listening to your feedback. Sovos Booke (also known as Sovos Education) finally has multiple in-person continuing education opportunities coming your way this year. Your first chance to join us is coming June […]

Direct-to-consumer (DtC) shipping of wine comes in two general categories: on-site and off-site. Both ultimately involve the use of a third-party common carrier to fulfill an order by a consumer, but they differ in how the consumer places their order. “On-site” DtC shipments are those where the consumer was physically present at the winery’s premises […]