Blog

Mandatory SAF-T (Standard Audit File-Tax) reporting will be introduced in Norway from 1 January 2020. Use of SAF-T, a standardized XML format containing exported accounting information, remains voluntary until that date. SAF-T is designed to reduce compliance and administrative costs for businesses and revenue bodies and enhance audit outcomes. Its standardized, easily readable layout and […]

For the first time in state history, the Illinois state legislature has enacted form 1099-K reporting requirements as part of the FY20 Budget Implementation Act. This change is a new direct state reporting requirement for payers of income made to Illinois residents. For 2019 reporting, Illinois requires form 1099-K reporting to be submitted to them […]

As we sit on the cusp of 2020, we find ourselves living in a world where almost every state imposes tax collection and remittance obligations on remote sellers (an increase of 50 percent from last year) and where a majority of states have enacted rules that impose new tax collection and remittance responsibilities on third […]

First legislation of the myDATA The requirement for the mandatory submission of tax data to the Independent Authority for Public Revenue (IAPR) has finally been established in law, specifically in the new tax bill approved by the Greek parliament just a few days ago. The tax bill further mandates the IAPR to finalize, by way […]

Companies are dealing with a fundamental shift in the way they do business with trading partners. In a rapidly increasing number of countries, there’s a third party inserting itself into every transaction. It’s the government, and it’s wedging its way into every order a company ships or receives. In an effort to close a massive […]

When people think of sales and use tax, Alaska is generally not top of mind. Alaska is the “A” in “NOMAD,” an acronym typically used to describe the states that do not impose sales tax. While it’s true that Alaska is one of the few states without a state-level sales tax, many of the state’s […]

We are now more than 16 months removed from the groundbreaking Supreme Court decision of South Dakota v. Wayfair. This decision unlocked the ability for U.S. states to impose a sales tax collection and remittance responsibility on remote sellers based solely on their economic connection to that state. Within that time, virtually every state imposing […]

In Europe, Poland seems to be the first country to move away from the traditional VAT return replacing it with a detailed Standard Audit File for Tax (SAF-T). This is basically an expansion of the SAF-T system already used in Poland since 2016. Large enterprises must start working with the expanded SAF-T system from April […]

Since July 2018, taxpayers in Hungary have been obliged to disclose the data of electronic invoices issued for transactions with accounted VAT exceeding HUF 100,000 (approximately €300). This data must be transmitted to the National Tax and Customs Administration of Hungary (NAV) in a structured manner once the electronic invoice has been issued. This fiscal obligation […]

The value of data is rising The value of data is becoming more precious than oil. Technology has transformed market dynamics across all sectors and the way businesses operate. Big data has grown in importance and data-based platforms are today’s new technology giants. On one hand; Facebook, Google and other data-based platforms are collecting data […]

Part 4 – Call-Off Stock Arrangements This is the last in a series of four blogs providing explanatory detail to the EU’s “2020 Quick Fixes” that aim to standardise certain VAT rules throughout the EU. Part one of this series focussed on VAT Identification of the Customer, part two provided guidance on the Exemptions of […]

The Italian government has introduced an ambitious new program for collecting VAT, under which the tax authorities will pre-populate VAT returns on behalf of taxpayers. This program is aimed at reducing the VAT gap in Italy, which reached 33.5 billion Euros in 2017 – in absolute terms, the largest loss of revenue in the European […]

Full compliance when it comes to unclaimed property requirements can be difficult to determine. For many businesses, it isn’t until they are audited and fined that they find out they made a mistake. Below are the most common mistakes businesses make when complying with unclaimed property requirements. 1. Reporting is mandatory Reporting unclaimed property is […]

Part 3: Chain Transactions This is the third in a series of four blogs providing explanatory detail to the EU’s “2020 Quick Fixes” that aim to standardise certain VAT rules throughout the EU. Part one of this series focussed on VAT Identification of the Customer, whilst part two provided guidance on the Exemptions of Intra-Community […]

Two months after closing the public consultation on the myDATA scheme, the Greek tax authority, IAPR, has yet to share the feedback received from the industry on the proposed scheme or make any official announcement in this regard. However, local discussions indicate that, the IAPR may reintroduce its initial agenda proposed back in August 2018, […]

A recent fact sheet released by the IRS shows the latest tax gap estimates and overall taxpayer compliance, and demonstrates why the IRS is likely to strengthen its tax reporting enforcement policies. The findings are based on data from tax years 2011, 2012 and 2013. The purpose of this document is to let the public […]

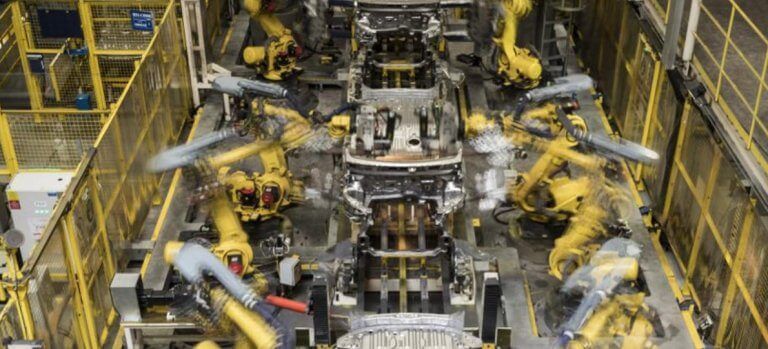

Managing manufacturing sales tax is complex for a number of reasons. You may have thousands of SKUs with taxability rules that differ across states, as well as hundreds, if not thousands, of exemption certificates to track and keep up to date for your customers. Additionally, tracking your own inventory for materials used internally that are […]

Part 2: The Exemptions of Intra-Community Supplies of Goods This is the second in a series of four blogs providing explanatory detail to the EU’s “2020 Quick Fixes”. This article focuses on updated guidance around the Exemption of Intra-Community Supplies of Goods coming into effect on 1 January 2020. The EU Implementing Regulation contains a […]