Blog

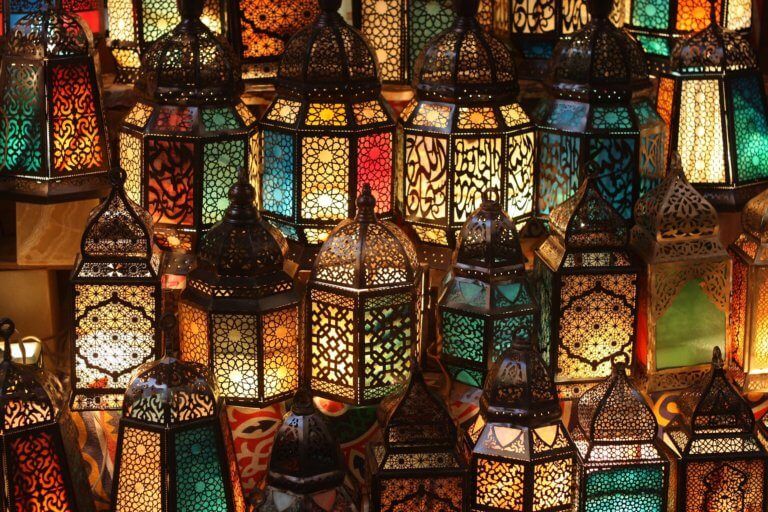

Update: 20 November 2023 by Dilara İnal E-invoicing systems in the Middle East and North Africa are undergoing significant transformations, aiming to modernise the financial landscape and improve fiscal transparency. Recent updates have seen numerous countries implementing electronic invoicing solutions designed to streamline tax collection and reduce VAT fraud. E-invoicing Trends in the Middle East […]

InsurTech companies are really getting their claws into the insurance industry. New products are coming to market, processes are being overhauled and end customers are benefiting from the positive disruption. From Zego’s flexible policies to By Miles pay-per-mile car insurance, new solutions are rewriting the rules of insurance to better serve customers. But are these […]

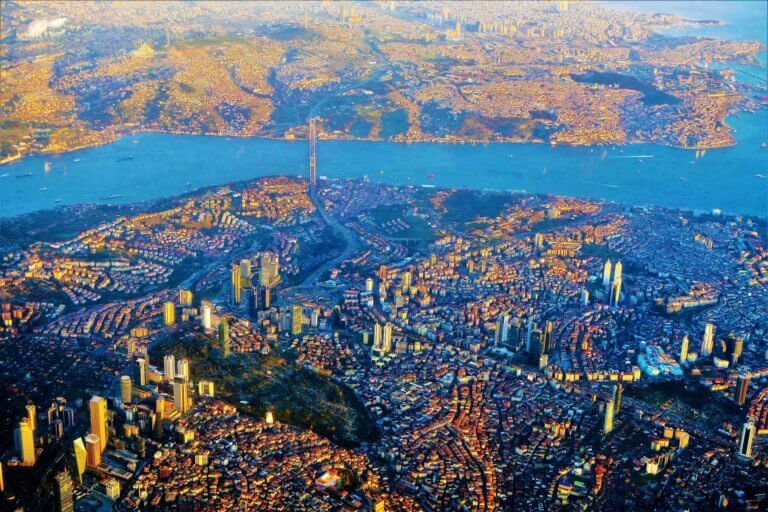

The era of paper invoices is coming to an end. With the e-arşiv invoice system, you can issue an electronic invoice, even to non-registered e-invoice taxpayers. This regulation enables companies to send invoices directly to the end-user via e-mail removing the need for paper invoices. Due to the official statement from the Turkish Revenue Administration […]

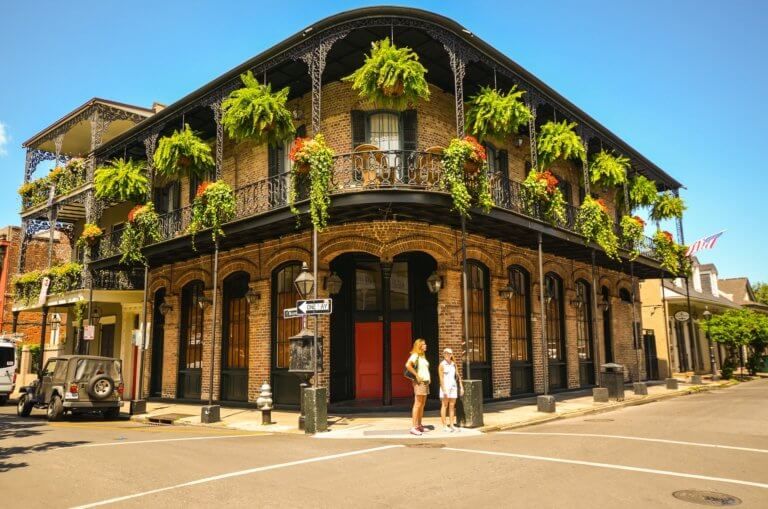

On July 1, 2020, new economic nexus laws will come into effect in Louisiana, requiring all remote sellers who meet certain sales thresholds to collect and remit all state and local sales taxes on their sales into the state. Wineries and retailers making direct-to-consumer (DtC) shipments of wine to Louisiana residents may be affected by […]

Throughout this year, one development we’ve seen substantially increase is the use of targeted VAT rate changes by governments around the world. Given the large proportion of transactions in an economy that attract VAT, these changes are used as a key tool in economic stimulation, especially as economies throughout Europe slowly start to re-open following […]

France is usually known for the complexity of its insurance premium tax filing system with many parafiscal charges potentially applying to insurance premiums and with many overseas territories where IPT should be filed directly. Over the last decade, France has either introduced new taxes and contributions on insurance premiums or increased rates. Now, as for […]

After a period of solid work around the myDATA framework, with little documentation left to implement the entire scheme in Greece, the IAPR has shifted its attention to e-invoicing. Last week the IAPR and the Ministry of Finance signed the long-awaited myDATA bill, which once turned into law will enforce the myDATA system within Greece. […]

This is a common question wineries face when entering the direct-to-consumer (DtC) market, and the answer is yes. In order to ship wine DtC, a winery needs to have a DtC shipper’s license. This can be challenging as the rules and requirements to obtain this license vary by state. Because of this, an increasing number […]

The Coronavirus pandemic revived a longstanding debate amongst lawmakers about what unemployment benefits to provide to independent contractors and how to decrease the underreporting of income. Chairman of the Senate Finance Committee’s Taxation and IRS Oversight Subcommittee, John Thune, believes simplifying tax requirements would ensure that self-employed workers report accurately, pay all taxes owed and […]

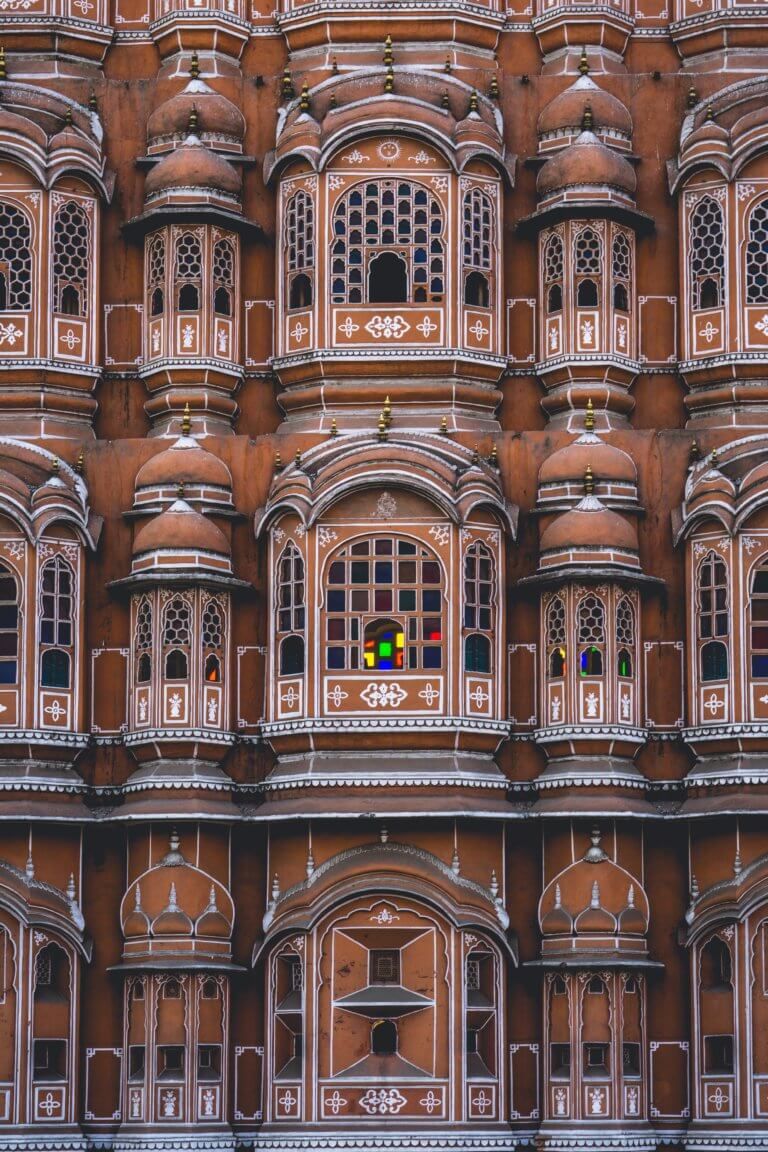

Renowned for its diversity, India is taking the same approach to its e-invoicing framework. There have been several changes and new possibilities included in the required processes and technical (“JSON”) invoice schema since e-invoicing was introduced. Such changes are unsurprising as many of the existing Continuous Transaction Controls (CTC) systems regularly bring new elements to […]

From 1 July 2020, all taxpayers with revenue above 25 million TL in 2018 or subsequent years must switch to the e-delivery note system. E-invoice instead of e-delivery note With the deadline fast approaching, one of the questions on taxpayers’ minds is whether e-invoices can be used to replace e-delivery notes as paper invoices can […]

The coronavirus pandemic’s full effect on insurance is yet to be revealed, however one thing is for certain, the shockwaves will be felt for years to come. Looking at the numbers, Lloyds of London have recently forecast that COVID-19 will cost the insurance industry £167bn globally this year resulting from claims related to the pandemic […]

How much can change in fifteen years? It was May 2005 when the U.S. Supreme Court issued a ruling in Granholm v. Heald, one of the most consequential beverage alcohol-related cases the Court has heard. The case challenged laws in Michigan and New York that permitted in-state wineries to make direct-to-consumer (DtC) shipments to their […]

In the midst of ongoing negotiations following the UK’s exit from the European Union (EU), the Court of Justice of the European Union (CJEU) has ruled that the UK has impermissibly expanded the scope of its 0% VAT rate on futures trading. And, that this has been occurring over a period spanning more than forty […]

In the field of global e-invoicing and tax control, most eyes have been focused on trailblazing initiatives in Asia, as countries such as India, Vietnam and Thailand look set to introduce new reforms in this area. However, even in the home of mandatory digital tax controls – Latin America – where mandatory clearance of B2B […]

Premium tax and parafiscal compliance for insurers authorised to operate under the Italian regime can be challenging. For the experienced, it may seem that each year brings a different obligation to be met with new requirements often being introduced. There are almost always links between an upcoming year’s reporting requirements and declarations made in previous […]

With the acquisition of Eagle Technology Management (ETM) and Booke Seminars, Sovos has united the very best in statutory reporting solutions, technology and expertise. Below is an overview of our strategy following these acquisitions: Sovos’s SaaS and Security Strategy Sovos at its core is a Software as a Service (SaaS) and cloud-first company. This means […]

Do you have questions about the rules, regulations, and compliance requirements of the beverage alcohol industry? This series, Ask Alex, is a perfect opportunity to get those pressing questions answered straight from one of the industry’s regulation and market experts, Alex Koral, Senior Regulation Counsel, Sovos ShipCompliant. To take advantage of this opportunity and get […]