Blog

Let’s face it: no one likes dealing with tax, and no one likes learning they’ve done something wrong when it comes to their organization’s compliance. Sovos launched the Sales Tax Learning Series to guide you through revamping your team’s sales tax strategy. This learning series was designed with industry-leading partners to help you navigate the […]

Suppliers looking to get into the valuable and growing market of direct-to-consumer (DtC) alcohol shipping often need support from third parties. From setting up sales to managing shipping logistics to handling complicated tax filings, DtC alcohol shipping is often too much for any one business to deal with entirely on their own. Within the ecosystem […]

Managing sales tax doesn’t have to be a complicated, overwhelming and time-consuming process. Assuming of course that you properly evaluate your internal capabilities, existing technology and varying levels of expertise correctly. With thousands of tax regulations that can change at a moment’s notice, it can seem a nearly impossible task for businesses to remain compliant. […]

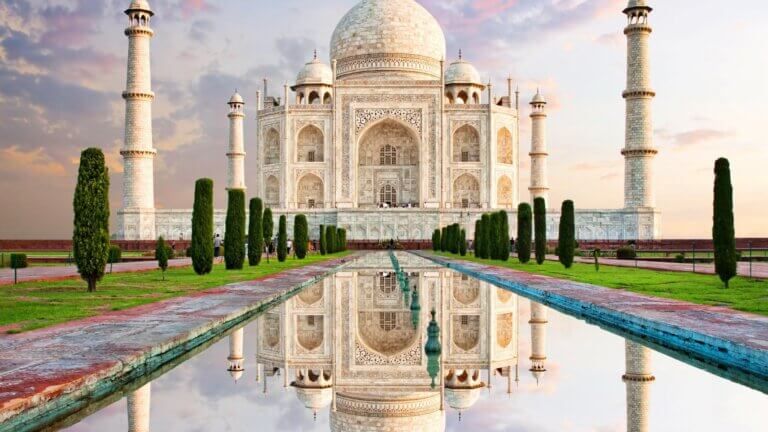

On 24 February 2022, the Indian Central Board of Indirect Taxes and Customs (CBIC) issued a notification (Notification No. 01/2022 – Central Tax) that lowered the threshold for mandatory e-invoicing. In India, e-invoicing is mandatory for taxpayers when exceeding a specific threshold (businesses operating in certain sectors are exempted). The current threshold for mandatory e-invoicing […]

Update: 7 December 2023 by Carolina Silva Spain Establishes Billing Software Requirements The long-awaited Royal Decree, establishing invoicing and billing software requirements to secure Spanish antifraud regulations, has been officially published by the Spanish Ministry of Finance. The taxpayers and SIF developers, defined further below in this article, must be aware of several new official […]

Among the many facts and analysis shared during our recent webinar on the 2022 Direct-to-Consumer Wine Shipping Report, a few really stood out. We gathered some highlights and key stats from the session. The report is an annual collaboration between Sovos ShipCompliant and Wines Vines Analytics, providing detailed insights into the DtC wine channel. The […]

Annual reporting requirements vary from country to country, making it complex for cross-border insurers to collect the data required to ensure compliance. Italy has many unique reporting standards and is known for its bureaucracy across the international business community. Italy’s annual reporting is different due to the level of detail required. The additional reporting in […]

It’s no secret that sales tax is complex for businesses. But many NetSuite users are unaware of capabilities within their ERP that could help reduce the risk and burden around organizational compliance. SuiteTax was built to replace the legacy tax engine within NetSuite that supports basic client needs for compliance in multiple countries. The additional […]

In 2020, the European Commission (EC) adopted a four-year plan to develop a fairer and simpler taxation framework. The Action Plan aspires to tighten up the tax system, ensure that digital platforms are made to follow transparency rules and utilise data better, reducing tax fraud and evasion. In 2021, the Commission implemented e-commerce changes – […]

On February 16, 2022, California introduced AB 2280, allowing the California Controller to establish a California Voluntary Compliance Program (VDA Program). This is a significant development as California has long declined to provide a formal or informal unclaimed property voluntary disclosure agreement (VDA) program, despite automatically assessing 12% interest on late reported property. In the […]

By Andrew Adams, Editor, Wine Analytics Report This year’s annual Direct-to-Consumer Wine Shipping Report featured an additional set of data to help put the past two years of unprecedented winery shipment growth in context. Since the surge of shipment volume in March and April 2020, there has been sustained interest in trying to understand just […]

If the last two years have been any indication, no industry is safe from the Great Resignation. The latest PwC Pulse Survey found that 77% of respondents said hiring and retaining employees is their most critical growth driver this year. As we have previously covered, many employees see the current job market as the perfect […]

Insurance is a dynamic sector in constant flux to accommodate with insured’s needs. An increase in holidays abroad following WWII saw the need for Assistance insurance for any unforeseen events that occurred away from the insured’s home country. Council Directive 84/641/EEC regulated Assistance insurance for the first time, and a new class of insurance was […]

The three-tier system is the prevailing way that alcohol is distributed and sold in the United States, based on a clear cut distinction between different sectors (or “tiers”) of the beverage alcohol market. In the three-tier system, suppliers, such as producers and importers, are required to sell to wholesalers and distributors, who in turn sell […]

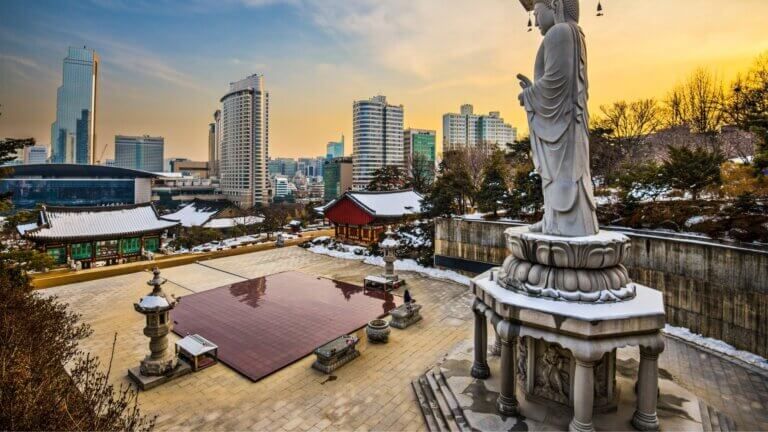

South Korea has an up-and-running e-invoicing system that combines mandatory e-invoicing with a continuous transaction controls (CTC) reporting obligation. This mature and well-established system, launched over a decade ago, is seeing its first significant changes in years. Presidential Decree No. 31445 (Decree) has recently amended certain provisions of the Enforcement Decree of the Value-Added Tax […]

As unclaimed property regulations continue to change and the methods that states implement to engage holders evolve, it is important for holders to gain from the lessons learned and make adjustments to remain compliant and effectively manage unclaimed property liabilities. The following information captures just a few of the insights and lessons Sovos learned throughout […]

Whilst the UK leaving the European Union (EU) on 31 December 2020 seems like a long time ago, UK businesses still have to deal with changes to the processes in place when importing goods from suppliers in the EU. Customs Declarations Throughout 2021, goods imported into Great Britain from the EU were subject to several […]

On February 9, the Treasury Department issued a report on competition in the beverage alcohol industry, identifying several areas where possible reforms could foster a more level playing field for small businesses, craft producers and new market entrants. The report was part of Executive Order 14036, initiated by the Biden Administration to investigate ways to […]