Blog

In September, the Ningbo Municipal Taxation Bureau (NMTB) of the State Taxation Administration (STA) announced a pilot programme enabling selected taxpayers operating in China to issue VAT special electronic invoices on a voluntary basis. China’s VAT invoices China has two types of VAT invoices: VAT special invoices and VAT general invoices. The first type may […]

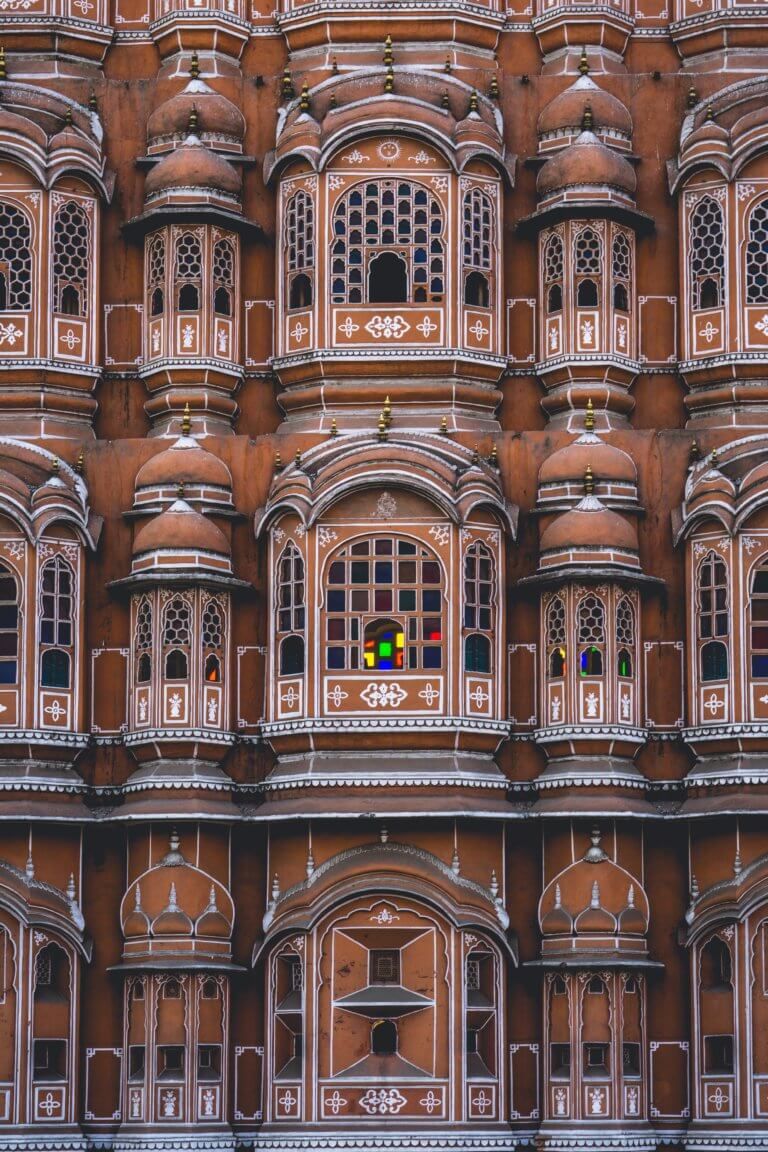

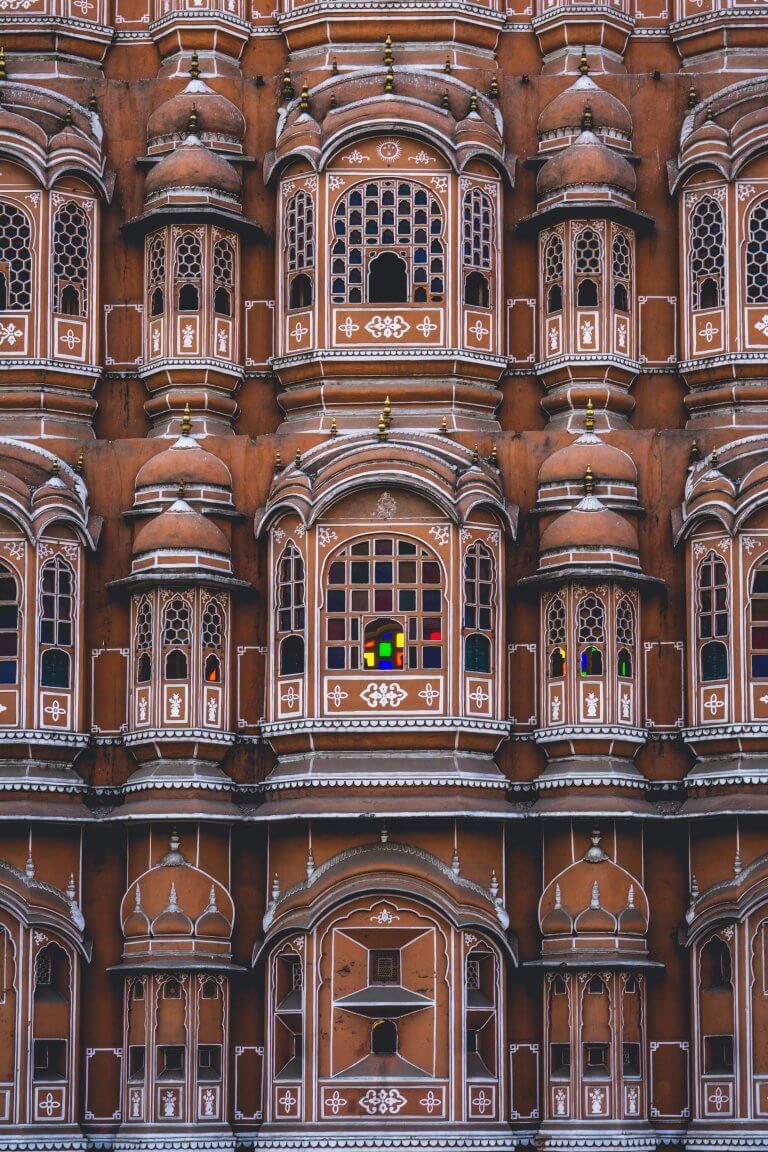

The October deadline is fast approaching for the Indian CTC invoicing mandate, but it remains a moving target. In a swift move that was published just two months prior to go-live, authorities have now changed the scope of India’s e-invoicing system and who is affected by the reform, as well as updated the JSON format. […]

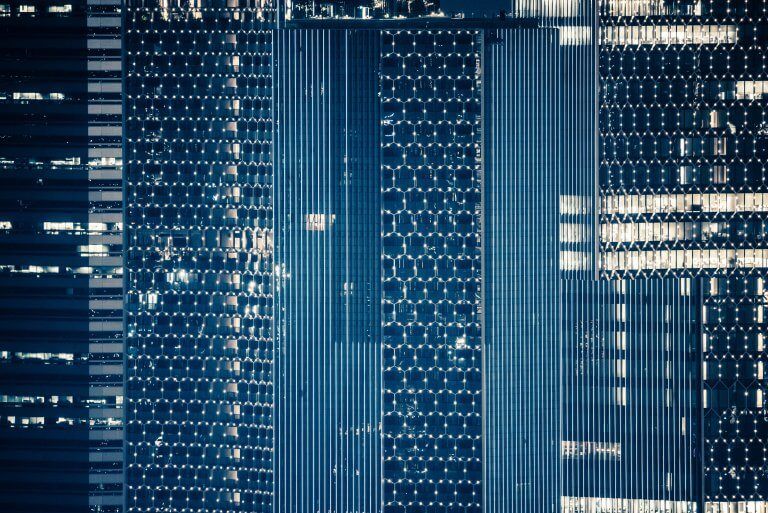

Addressing Base Erosion and Profit Shifting (BEPS) has been a key priority of governments around the world. The Organisation for Economic Co-operation and Development (OECD) has been working for years to tackle taxation issues across the globe. Much of the world has expressed concern about tax planning by multinational enterprises that make use of gaps […]

The world has witnessed how several Latin American countries have successfully adopted e-invoices to replace paper versions and close VAT gaps – the difference between the revenue governments are entitled to receive and what they de facto manage to collect. The positive effects of mandatory e-invoicing regimes, such as achieving simplification of the invoicing […]

For the first time in history, international business and governments have come together. Their aim was to define and agree a guiding set of principles for tax compliance in a world where continuous tax controls (CTCs) are becoming the norm. The International Chamber of Commerce‘s (ICC) executive board has now formally approved the first set […]

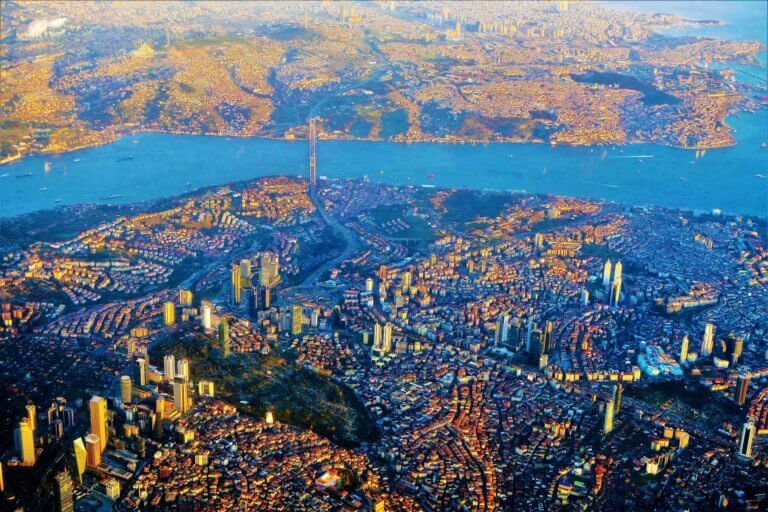

The General Communiqué no. 509 (communiqué) established the date of transition to the e-delivery note application and the full scope of the mandate. Whilst the communiqué addressed the general use of the application and the basic practices, it didn’t contain all the information businesses require and although the FAQ and information from the Turkish Revenue […]

The era of paper invoices is coming to an end. With the e-arşiv invoice system, you can issue an electronic invoice, even to non-registered e-invoice taxpayers. This regulation enables companies to send invoices directly to the end-user via e-mail removing the need for paper invoices. Due to the official statement from the Turkish Revenue Administration […]

Renowned for its diversity, India is taking the same approach to its e-invoicing framework. There have been several changes and new possibilities included in the required processes and technical (“JSON”) invoice schema since e-invoicing was introduced. Such changes are unsurprising as many of the existing Continuous Transaction Controls (CTC) systems regularly bring new elements to […]

The Ministry of Finance in Vietnam recently presented a draft decree to the Prime Minister for ratification, indicating that the go-live date for mandatory e-invoicing in the country will be delayed from 1 November 2020 to 1 July 2022. This proposed delay is in response to difficulties encountered by local companies to implement a compliant […]

India’s e-invoicing reform has been introduced as a very important step towards digitizing the country´s tax controls. Even though the reform has been under discussion for more than a year, the initial roll-out for the implementation process would have been a challenge for all stakeholders which was finally set to begin mandatorily on 1 April […]

In the past five years, transaction automation platform vendors who embraced e-invoicing and e-archiving compliance as integral to their services grew on average approximately 2.5 to 5 times faster than the market. Two decades of EU e-invoicing: many options, different models Until 1 January 2019, when Italy became the first European country to mandate B2B […]

For companies operating in Turkey, 2019 was an eventful year for tax regulatory change and in particular, e-invoicing reform. Since it was first introduced in 2012, the e-invoicing mandate has grown, and companies are having to adapt in order to comply with requirements in 2020 and beyond. According to the General Communique on the Tax […]

With roughly two weeks to go until the first mandatory phase of India’s e-invoicing reform was set to go live, the GST Council has now decided to slam the breaks and halt the go-live. Or at least, bring it to a significant temporary standstill of 6 months, until 1 October 2020. Following a long list […]

For more than a year, India has been on the path to digitizing tax controls, with the first mandatory go-live for transmission of invoice data to a governmental portal scheduled for 1 April 2020. The very high pace of the roll-out of this reform has made many taxpayers concerned that they might not realistically be […]

The Government Accountability Office (GAO), a U.S. Congress watchdog, published a report evaluating the IRS’s approach to regulating virtual currency (crypto) and the guidance it has offered the public. The GAO’s Recommendation However, a portion of the report was directed at the IRS and the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. […]

With little over a month left to go before the first phase of Indian invoice clearance reform goes live, authorities are still busy finalizing the technical framework and infrastructure to support it. Just a few days ago, changes were made to the explanatory schema of the JSON file that will report data to the tax […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]