Blog

By Kelsey O’Gorman & Denise Hatem In the United States, food is the third-largest expense for lower-income households, after housing and transportation. For higher-income households, food ranks fifth, following housing, transportation, pension contributions and health care. While income disparity can skew percentages of spending on essential items such as food and housing, there are also […]

Idaho is one of many states to impose collection requirements on sellers with economic nexus following the South Dakota v. Wayfair, Inc. decision. The details of the Idaho economic nexus standard are found below. Enforcement date: June 1, 2019. Sales/transactions threshold: $100,000. Measurement period: Threshold applies to the previous or current calendar year. Included transactions/sales: […]

The South Dakota v. Wayfair, Inc. decision paved the way for many states to implement economic nexus requirements. Prior to Wayfair, Alabama had its own “economic nexus” collection requirement under Rule 810-6-2-.90.03. With Wayfair, Alabama no longer has a constitutional obstacle to enforcing its rule. Below, we’ve highlighted the major points of the Alabama economic […]

Following the South Dakota v. Wayfair, Inc. decision, the majority of the country has started to adopt its own economic nexus laws on a state-by-state basis. However, there are a small number of states that have not enacted any such legislation. For example, there is no sales tax nexus in Montana because Montana has no […]

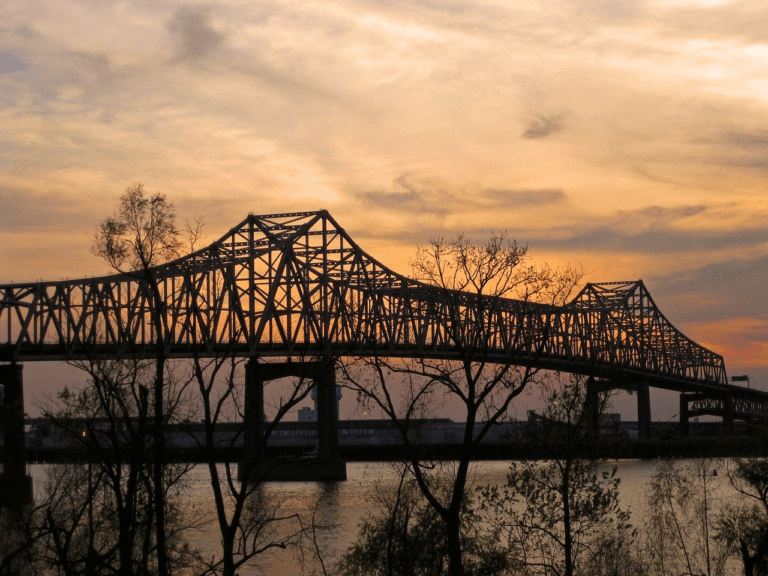

We’ve previously discussed the Louisiana economic nexus sales tax, and how remote sellers will need to collect and remit all state and local sales taxes on their sales into the state once certain thresholds are met. In the wake of South Dakota v. Wayfair, Inc., the state created a new Louisiana Sales and Use Tax […]

The Kentucky sales tax nexus is one example of how states have started to evolve their economic nexus requirements after the South Dakota v. Wayfair, Inc. decision. Kentucky adopted HB 487, which kept the same thresholds as were in the Wayfair case. Even so, we have outlined key points for remote sellers and marketplace facilitators […]

This blog was last updated on July 18, 2024. The South Dakota v. Wayfair, Inc. decision impacted how numerous states require businesses to collect and remit sales tax. The economic nexus in Maine is one such example. However, Maine enacted its own statute prior to Wayfair, saying that “a person selling tangible personal property, products […]

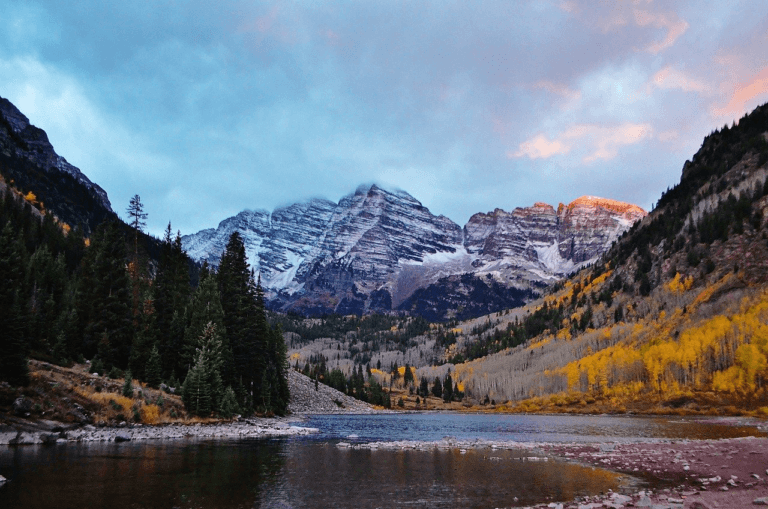

The South Dakota v. Wayfair, Inc. decision impacted the Colorado economic nexus sales tax details. Colorado joined nearly every other state (and Washington, D.C.) in clarifying economic nexus for remote sellers and in how marketplace facilitators collect and remit sales tax. While Colorado enacted legislation similar to what was laid out in Wayfair, there are […]

When South Dakota v. Wayfair, Inc. was decided, remote sellers across the country had to start ensuring that they were staying compliant with how they collected and remitted sales tax. The sales tax nexus laws in Oklahoma are just one example of where businesses without a physical presence in the state had to change their […]

Even with the South Dakota v. Wayfair, Inc. decision, there is no impact to the Delaware economic nexus. Delaware does not have state or local sales tax. The Delaware Division of Revenue states that “merely creating an Internet site by a non-Delaware business does not, by itself, create nexus. But, locating a server in Delaware […]

The Ohio economic nexus was one of many state-specific regulations that changed in the wake of the South Dakota v. Wayfair, Inc. decision. Both remote sellers and marketplace facilitators that have gross sales into Ohio should ensure that they are compliant with the latest regulations. Below, we have highlighted the key points for businesses. Enforcement […]

After effects of the South Dakota v. Wayfair, Inc. decision swept across the nation and pushed nearly every state to adjust its economic nexus. New Jersey economic nexus rule is fairly consistent with the Wayfair decision, but there are a few differences remote sellers and marketplace facilitators should know. Below, we have highlighted key points […]

Following the South Dakota v. Wayfair, Inc. decision, economic nexus laws began to change around the country. Sales tax nexus in Hawaii was one of many that adjusted how remote sellers and marketplace facilitators must collect and remit sales tax. We have highlighted the major points below for organizations. Enforcement date: July 1, 2018. Sales/transactions […]

Connecticut was one of many states that quickly implemented sales tax nexus rules in response to the South Dakota v. Wayfair, Inc. decision. In fact, while Connecticut initially enacted a $250,000 threshold in December 2018, the state has already made adjustments to its economic nexus law by lowering its threshold to $100,000. Connecticut Governor Ned […]

Following the South Dakota v. Wayfair, Inc. decision, Arizona, like many other states, enacted economic nexus standards that required sellers without a physical presence in Arizona to collect and remit tax. Arizona Governor Doug Ducey signed House Bill (H.B.) 2757 into law on May 31, 2019, which specified how remote sellers and marketplace facilitators must […]

The Maryland sales tax nexus was impacted by the South Dakota v. Wayfair, Inc. decision. The Maryland General Assembly’s Joint Committee on Administrative, Executive, and Legislative Review (AELR) approved emergency regulations (03.06.01.33) to support Maryland’s implementation of the Wayfair decision. The Maryland Comptroller requires out-of-state vendors to register with its office “to collect and remit […]

The Georgia economic nexus requirements have changed because of the South Dakota v. Wayfair, Inc. decision. The Peach State has also made adjustments from 2019 to 2020, in changing its threshold requirements and by repealing a notice and reporting option. Below, we have highlighted some of the major points that businesses operating in Georgia need […]

Arkansas was one of many states that updated its sales tax nexus after the South Dakota v. Wayfair, Inc. decision. The Arkansas Legislature enacted Act 822, which required remote sellers and marketplace facilitators to collect and remit sales and use tax. Below, we have highlighted some of the major points of the Arkansas sales tax […]