This blog was last updated on January 19, 2024

A recent joint webinar with ASUG, “How the Wayfair Ruling Will Impact Your SAP S/4HANA® Journey,” covered the effects of Wayfair, including changing economic nexus thresholds, challenges for sellers and buyers brought on by the ruling, and how to plan for SAP S/4 HANA.

Impact of Wayfair and economic nexus

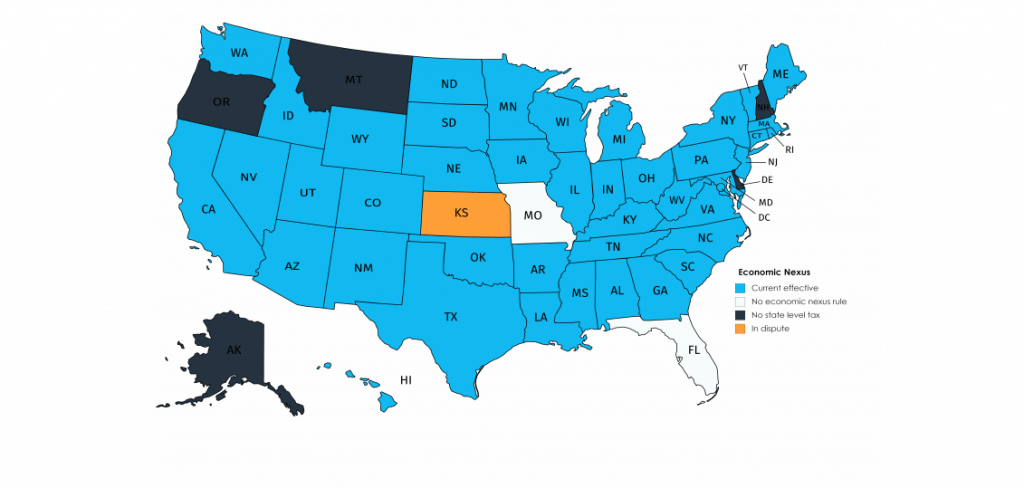

Since the Wayfair decision, when the question of physical presence was replaced with “undue burden,” states are starting to move into enforcement mode. With new taxpayers being added to the jurisdiction, states are looking for unique and “creative” ways to enable compliance and tighten enforcement.

The economic nexus threshold requirements vary by state. More states are considering changing the standard of 200 transactions and $100,000 in gross sales to look for the “sweet spot” of maximum revenue at minimal burden.

Challenges from Wayfair

In addition to Economic Nexus standards changing and varying by state, there are additional challenges to consider for buyers and sellers alike.

Though some states like Alabama, Texas and Louisiana recognize that simplification is necessary, others see Wayfair as a signal that remote sellers must comply with the rules regardless of the complexity.

As it does with sellers, Wayfair brings new challenges for buyers, especially those entitled to entity and use-based exemptions:

- Joint and several liability remains;

- Vendors/marketplaces with new obligations need to start collecting tax and are likely doing it wrong;

- Overpaid tax remains money out the door;

- Underpayment still creates audit risk and exposure;

- Companies that have central purchasing entity will need to consider the Wayfair impact.

Planning for SAP S/4 HANA

When considering how to stay updated with accelerating regulatory changes, there are two approaches—proactive and reactive. A proactive strategy of adopting a modern, cloud-based tax strategy can support digital transformation and IT modernization.

SAP S/4 HANA implementation approaches

There are several approaches to implementing SAP S/4 HANA, depending on your business goals: greenfield, brownfield and hybrid.

Greenfield: A rapid adoption of S/4 HANA functional and technical benefits. When looking at tax considerations, greenfield improves your processes, supports the Universal Journal, improves data visibility, eliminates custom code and reduces or eliminates manual processes and reporting.

Brownfield: Leveraging an existing investment of SAP ECC ERP. For tax considerations, brownfield allows simplification of the S/4 transition, preserves existing configurations during the changeover and ensures compliance throughout the change.

Hybrid: The selective migration and consolidation of multiple systems. A hybrid approach enables compliance for transactional applications, supports the move to a central database with Central Finance (universal journal) and supports elective innovation for eCommerce, AP and AR.

Sovos assists in S/4 HANA plans

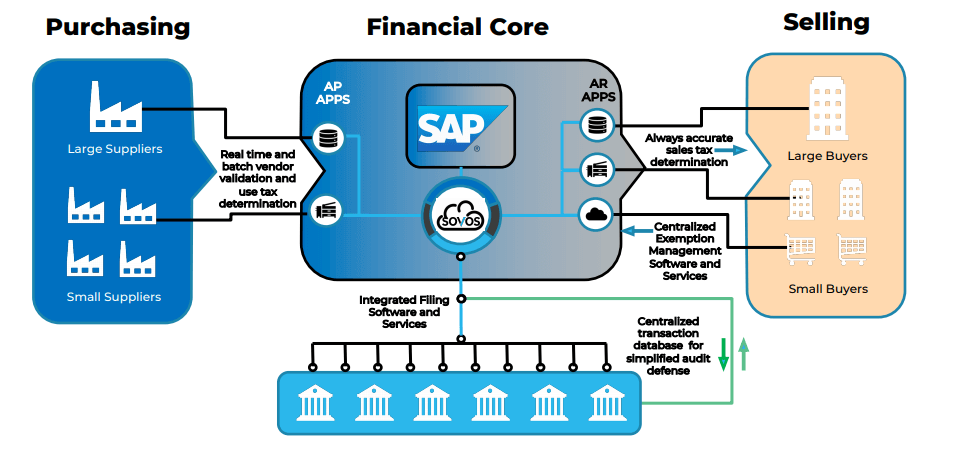

An integrated SAP partner like Sovos can help minimize the challenges for buyers and sellers alongside exemption and global challenges.

With a cloud-powered tax engine, tax determination and obligation information can be consolidated into one system. With an integrated filling software in your financial core, your determination and reporting processes will be in one central location.

Take Action

Watch the full webinar on-demand here.