Blog

Non-fungible tokens (NFTs) are the latest crypto craze to dominate the headlines; although these tokens are nothing new to the blockchain industry. In 2015, CryptoKitties took the industry by storm when people spent millions purchasing digital images of cartoon cats. Whether it’s digital art, music, videos, or items created in video games, NFTs offer a […]

Given the complexity of international VAT and the potential risk, pitfalls and associated costs, finance directors face a predicament. Unlike direct taxes, which tend to be retrospectively determined, VAT is effectively calculated in real-time. It’s linked to various aspects of the supply chain. If the related transaction has incorrect VAT calculations or erroneous codes, these […]

Although insurance companies do their best to settle their tax liabilities in the most compliant manner, historical liabilities may still occur. Here is an overview of the different types of historical declarations with some insurance premium tax (IPT) examples. When a tax liability becomes a historical liability Let’s start with a simple chart: Are we […]

Mexico introduced changes to the Miscellaneous Fiscal Resolution (MFR) this year. The Miscellaneous Fiscal Resolution is a group of regulations issued by the Mexican tax administration (SAT). The regulations contain the official interpretations of the rules enacted for the application of the taxes, levies and related obligations applicable to taxpayers in Mexico. The MFR is […]

On March 12, Kentucky Governor Andy Beshear signed HB 415 into effect, providing some very welcome updates to the state’s direct-to-consumer (DtC) alcohol shipping laws. The biggest reform provided by the recently signed bill is the removal of a provision that previously prohibited DtC alcohol shippers from using third-party fulfillment houses to help with their […]

As previously reported by my colleague, Erik Wallin, the Massachusetts Department of Revenue is set to start enforcing a new advance payment program applicable to sales, use and room occupancy tax. The requirements are detailed in a draft Technical Information Release and in an email sent to taxpayers on March 5. There are two critical changes […]

President Biden signed the American Rescue Plan Act of 2021 which included a variety of provisions aimed at helping Americans get through the aftermath of the COVID-19 pandemic. To help fund this most recent round of aid, Section 9674 of the Act includes a change to the Form 1099-K reporting threshold for Third-Party Settlement Organizations […]

By: Laurie Andrews, Gary Joseph and Brian McCarthy The unclaimed property audit landscape is forever changing. Just a few years ago there were only a handful of active third party contingent fee audit firms, whereas today there are currently 8+ audit firms contracted by the states to audit companies to ensure compliance with unclaimed property. […]

It’s good to see light at the end of the tunnel. Nonetheless, it’s too little, too late for many smaller – but also plenty of larger – companies. Thousands couldn’t weather the storm because they were particularly dependent on human contact. Others were affected disproportionally simply because COVID-19 hit them just as they traversed a […]

During the past few months, in the absence of formal clarification, there has been much speculation on whether the Indian authorities would move forward with the expansion of the mandatory e-invoicing scope. While some have raised concerns that the Indian mid-market to SME segment would not be ready for such a change, others, including government […]

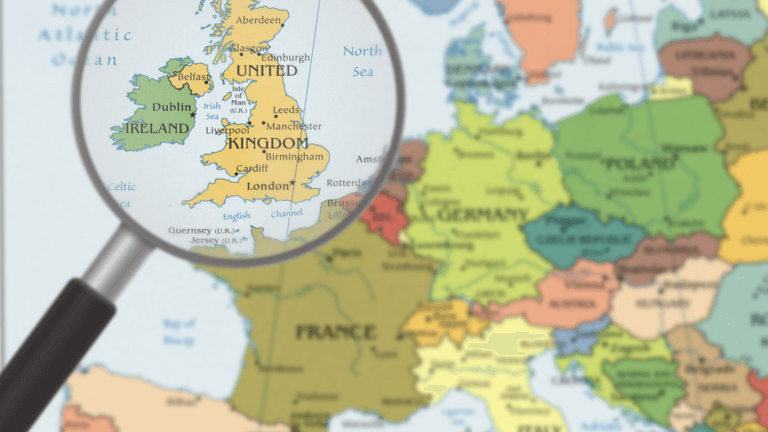

2021 sees several significant regulation changes for insurers when complying with insurance premium tax (IPT) across Europe. These include a new reporting system, an IPT increase, and new exemptions. To help insurers understand these changes, in this blog we’ll look at each of these changes. Spain – IPT increase Probably the most significant change this […]

As one of the more complicated administrative aspects of a retail business, sales and use tax filing processes are ripe for re-evaluation. Begin by asking yourself questions such as: Does my current solution do enough to make my life simpler? Do I get more out of it than I am putting in? Believe it or […]

Almost two decades ago when Bruce Respler joined Marjam Building Supply, one of the largest distributors of building materials on the East Coast, he was in charge of calculating and filing sales taxes manually. The company, which now owns 40 lumberyards, was only selling into a few states at the time. But even then, the […]

Since April 2019, the UK has required the submission of VAT returns and the storage of VAT records to be completed in accordance with the requirements of its Making Tax Digital (MTD) regulations. One of these requirements is that data transfer between software programs be achieved through ‘digital links.’ This requirement was initially waived during […]

For businesses headquartered or operating in Brazil, the constantly shifting Nota Fiscal compliance regulations are a well-known pain point. The Sistema Público de Escrituração Digital (SPED) reporting rules debuted in 2008 to digitize paper invoices and records, and the rules continue to change frequently, creating complexity and risk. These difficulties are deepened for businesses that […]

Following the introduction of ‘fiscalization’, Albania’s Continuous Transactions Controls scheme (CTC), in early 2020, the Albanian government published more information about the CTC system and in late 2020 updated the roll-out timeline. During 2020, the Albanian government published a series of secondary legislation about different elements of the CTC scheme. The Albanian CTC scheme is […]

The EU introduces the E-Commerce VAT Package and OSS on 1 July 2021. The previous delay from 1 January 2021 was due to the COVID-19 pandemic. COVID-19 is far from resolved with many Member States still suffering significantly with wide-ranging restrictions in place in many countries. Regardless, the European Commission’s current plan is to press ahead […]

As reported here, a few weeks ago the Maryland Legislature enacted two bills impacting the state’s approach to tax in the digital economy. The first bill was a first-in-the-nation tax on digital advertising that is already being challenged in the courts on Constitutional grounds. The second, HB 932, while far less controversial, should not be […]