Blog

Sales tax nexus is not static. As your company grows, expands and evolves, your nexus footprint will likely change as well. All too often, companies will not realize the compliance impact of those changes until they receive an unfriendly inquiry from a sales tax auditor. As tax compliance professionals emerge from the barrage of requirements […]

Imagine this scenario. Your business partner changes the rules on you mid-stream and your ability to conduct business with them is now contingent on changing your entire reporting structure to meet their new demands. Oh yeah, I should also mention the time frame to meet these demands is extremely tight and if you don’t, you […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and insurance premium tax (IPT) compliance services. As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about regulatory changes and developments in global tax regimes to […]

Emblematic of a trend gaining momentum, Wisconsin becomes the fifth U.S. taxing jurisdiction to promulgate official guidance regarding the applicability of sales tax to non-fungible tokens (NFTs). Going as far back as 1976, Wisconsin published a periodic “Tax Bulletin” announcing new laws, letter rulings and status updates on tax-related litigation. In its most recent edition […]

States continue to enforce unclaimed property (UP) compliance. UP is broadly defined as any property held by companies in which the owner is lost and/or there has been no customer-generated activity for a statutorily mandated period of time, known as the dormancy period. Research conducted by Sovos found that there is nearly $77 billion in […]

While beer brand labels are a great way to set your product apart with clever marketing and design, there are rules brewers must follow while designing them. Beer labels, whether on a bottle, can or keg, have lots of information that is highly regulated, both at the federal level and by individual states. We’ve compiled […]

France is implementing a decentralised continuous transaction control (CTC) system where domestic B2B e-invoicing constitutes the foundation of the system, adding e-reporting requirements for data relating to B2C and cross-border B2B transactions (sales and purchases). Under this upcoming regime, data or invoices can be directly sent to the Invoicing Public Portal ‘PPF’ (Portail Public de […]

Part IV of V – Ryan Ostilly, vice president of product and GTM strategy EMEA & APAC, Sovos Click here to read part III of the series. Government-mandated e-invoicing laws are making their way across nearly every region of the globe, bringing more stringent mandates and expectations on businesses. Inserted into every aspect of your […]

Part V of V – Christiaan Van Der Valk, vice president, strategy and regulatory, Sovos Click here to read part IV of the series. Government-mandated e-invoicing laws are making their way across nearly every region of the globe, bringing more stringent mandates and expectations on businesses. Inserted into every aspect of your operation, governments are […]

Update: 25 January 2024 by James Brown Judgment in the Netherlands and Lloyd’s Position on Space Insurance There have been a couple of key developments in the space insurance landscape in recent months from an IPT perspective. The Netherlands’ judgment on space insurance In October 2023, a District Court in the Netherlands passed judgment […]

Part III of V – Eric Lefebvre, chief technology officer, Sovos Click here to read part II of the series. Government-mandated e-invoicing laws are making their way across nearly every region of the globe, bringing more stringent mandates and expectations on businesses. Inserted into every aspect of your operation, governments are now an omni-present influence […]

Part II of V – Oscar Caicedo, Vice president of product management for VAT Americas, Sovos Click here to read part I of the series. Government-mandated e-invoicing laws are making their way across nearly every region of the globe, bringing more stringent mandates and expectations on businesses. Inserted into every aspect of your operation, governments […]

Part I of V – Steve Sprague, chief commercial officer, Sovos Government-mandated e-invoicing laws are making their way across nearly every region of the globe, bringing more stringent mandates and expectations on businesses. Inserted into every aspect of your operation, governments are now an omni-present influence in your data stack reviewing every transaction in real […]

Wine has strong quarter, with 28% increase from Q2 and 8% year-over-year increase in registrations The temperatures may be starting to dip with the outset of autumn, but beverage alcohol new product registrations are seeing increases across spirits, wine and beer. Similar to this time last year, wine new product registrations had a strong showing. […]

On October 20, the Washington Department of Revenue hosted a public “listening session” to garner taxpayer feedback on the Interim Statement it published regarding the tax treatment of Non Fungible Tokens (NFTs), dated July 1, 2022. As written here, Washington is one of a small handful of states that has overtly addressed the sales tax […]

The Louisiana Office of Alcohol and Tobacco Control (ATC) recently adopted new regulations governing the use of fulfillment houses by licensed direct-to-consumer (DtC) shippers of wine. Fulfillment houses have become a central, and invaluable, part of the DtC wine shipping market by offering wineries with critical storage and logistical services. They provide climate-controlled warehouses to […]

By Brandon Harvie, Product Marketing Coordinator at WineDirect Just as the direct-to-consumer(DtC) wine industry is constantly evolving, so should the marketing strategies for your winery. Whether you are a small, family-owned winery or a massive multiple-brand enterprise, every winery needs to review how they are highlighting their business. Marketing can be an exciting part of […]

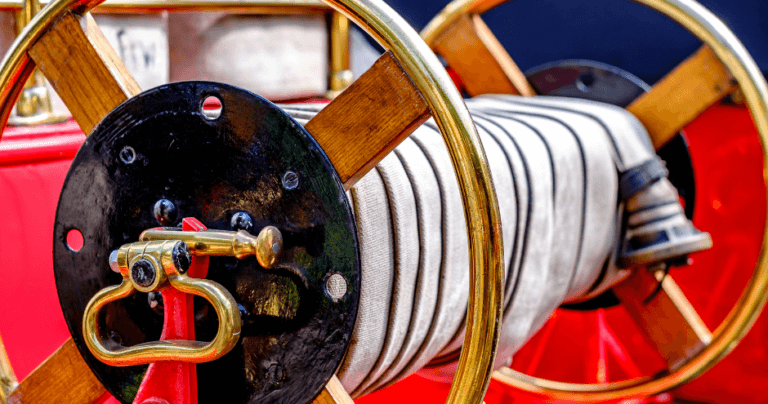

There are several countries within the European Union (EU) and European Economic Area (EEA) that have introduced a Fire Brigade Tax (FBT). Fire Brigade Tax is payable on certain premium amounts and usually in addition to Insurance Premium Tax (IPT). Fire Brigade Tax, or the Fire Brigade Charge (FBC) or Fire Protection Fee (FPF) as […]