Blog

Love it or loathe it, social media can be an essential component of any business’ marketing strategy. Both organic and paid social media can be used to increase brand awareness and expand your customer base; in fact 52% of all online brand discovery still happens in public social feeds. This tool can be especially useful […]

Part 1: Main Aspects of the 2nd Modification of the Miscellaneous Fiscal Resolution for 2020 The Mexican Tax Administration (SAT) released the second modification of the Miscellaneous Fiscal Resolution for 2020 (RMF2020). This is the first of two blogs, where we address some of the main changes in compliance obligations for suppliers of digital services […]

Since 31 January 2020, the UK is officially no longer part of the EU but is considered a third country to the union although EU legislation will still apply to the country until the end of 2020. Although Northern Ireland is part of the UK, the region will remain under EU VAT legislation when it […]

The Spanish tax system is one of the most complex in Europe. If the tax system and surcharges are not fully understood it can be a real challenge for insurance companies writing business in Spain or for those that want to start their business in this country. Spain has different taxes and reports that must […]

Under the latest Streamlined Sales Tax™ Agreement, direct-to-consumer shippers of alcoholic beverages can soon get increased support, including compensation and audit protections, for using approved sales tax technology services like Sovos ShipCompliant. This should prove to be extremely welcome news for the DtC shipping market as managing sales tax obligations is consistently one of the […]

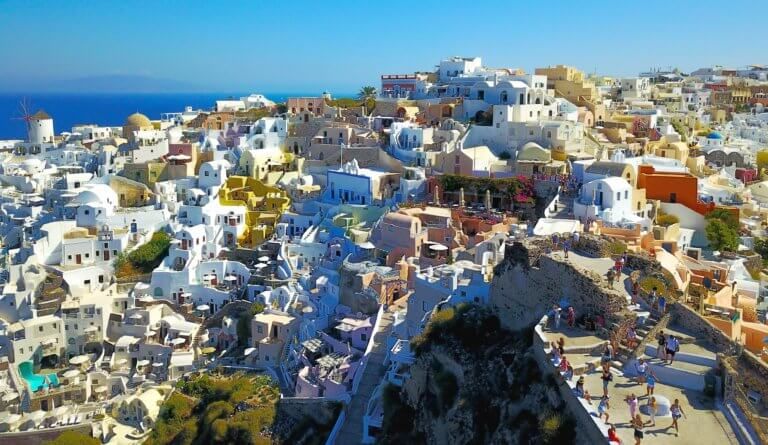

With the 1 October go-live date for myDATA, the first Greek implementation of Continuous Transaction Controls (CTC), fast approaching, legal clarity around the broader tax reform should ideally be close to completion. Greece’s tax reform is expected to not only cover CTC reporting but also e-invoicing. So far, however, we have only seen fragmented documentation […]

Last week, the IRS released an updated draft of the Form 1040 to be used by individual taxpayers when reporting income taxes for the 2020 calendar year. The new version contains the question about whether a taxpayer held an interest in virtual currency assets on the front page of the form. Crypto investors and the […]

Direct-to-consumer (DtC) is a phrase that can encompass many things: tasting room sales, retailers sales, sampling and festival sales. But, DtC shipping is the shipping of alcohol directly to the purchaser through delivery by a third-party carrier (e.g., UPS or FedEx). In DtC shipping the customer gets the product indirectly, but the sale is made […]

The Government Accountability Office (GAO) will speak about gig economy tax issues at Sovos’ virtual GCS Intelligent Reporting conference. Jessica Nierenberg from the U.S Government Accountability Office (GAO) and Caroline Bruckner from American University’s Kogod Tax Policy Center will host a session discussing details from the office’s report recently released to the U.S. Senate Finance […]

The Turkish government continues to minimize the effects of the COVID-19 pandemic on companies. A Presidential decree has extended the deadline for the Ban on Layoffs and Cash Wage Support from 17 July 2020 until 17 August 2020. This measure, which protects both employees and employers, is extended until 30 June 2021 and will be […]

Whilst M&A activity may have slowed down slightly, deals are still taking place and the future of many insurers could depend on a buy-out. Continued volatility in share prices could make a once expensive acquisition target more appealing than it once was. For sectors such as travel and events insurance, now could be the time […]

SAP recently announced the launch of an initiative that will plant one tree for every online purchase made on SAP Store and SAP App Center. This program is part of a larger project with a goal of planting 5 million trees by 2025. This is not the first initiative of its kind for SAP. The […]

The European Commission recently opened a public consultation on a carbon border adjustment mechanism (CBAM) to maximise the impact of tax in meeting the EU’s climate goals. A CBAM would reduce the risk of carbon leakage, which occurs when production is moved to countries with less robust climate policies, by ensuring that import prices better […]

As anticipated, further information has been published by the Portuguese tax authorities about the regulation of invoices. Last weeks’ news about the postponement of requirements established during the country’s mini e-invoice reform, and the withdrawal of a company’s obligation to communicate a set of information to the tax authority, culminated in the long-waited regulation about […]

With the fast pace of change happening on the global tax landscape, where tax authorities require more granular information with electronic tax submissions, it’s not surprising to see another country embarking on their digital journey. Portugal is now following in the footsteps of other nations by changing the way in which stamp duty is declared. […]

Issuing e-delivery and printed delivery notes together The article (Article 15.5), which was quite confusing in the initial version of the guideline, is now much clearer. If an e-delivery note can’t be issued in the location where the shipment is initiated e.g. the delivery truck, it may be issued within the company. However, a printed […]

Unprecedented times. It’s a phrase that’s been used so much of late but the pandemic is certainly not the first incident that has adversely affected society on a global scale. Before coronavirus, there had been a strong focus on environmental issues and initiatives. With an increase in extreme weather incidents over the last decade, governments […]

In February last year, the Portuguese government published the Law Decree 28/2019 rolling out changes affecting e-invoices. The goal of the Law Decree is to simplify and consolidate pieces of law that are scattered around the Portuguese legal framework. However, the effectiveness of many of those rules is still dependent on further regulation, such as […]