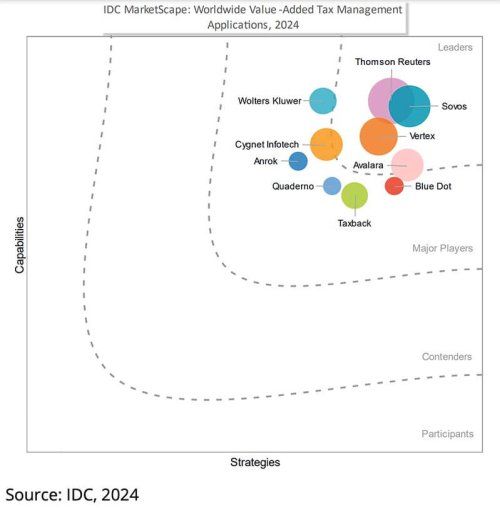

Regulatory mandates are accelerating across Europe, Latin America, Asia and emerging markets—tightening enforcement, shortening timelines, and increasing the penalties for non-compliance. Enterprises must choose between a fragmented solution on SAP Document & Reporting Compliance (DRC), or a complete, future-ready platform with Sovos.

This guide breaks down the critical differences between SAP DRC and Sovos and shows why leading global companies rely on Sovos to meet e-invoicing, VAT reporting and indirect tax requirements in 80+ countries.

Why Choose Sovos Over SAP DRC?

- Complete Indirect Tax Lifecycle Management. VAT determination, e-invoicing, reporting, SAF-T, analytics, government archiving and reconciliation all on one platform.

- Global Coverage That’s Ready Today. 80+ countries supported with certified, direct connections and regulatory teams who monitor global mandates in real time.

- Lower Total Cost of Ownership. Go live in weeks, not years. Avoid the hidden costs and delays of SAP DRC’s multi-year rollouts and fragmented integrations.