Blog

In the field of global e-invoicing and tax control, most eyes have been focused on trailblazing initiatives in Asia, as countries such as India, Vietnam and Thailand look set to introduce new reforms in this area. However, even in the home of mandatory digital tax controls – Latin America – where mandatory clearance of B2B […]

Premium tax and parafiscal compliance for insurers authorised to operate under the Italian regime can be challenging. For the experienced, it may seem that each year brings a different obligation to be met with new requirements often being introduced. There are almost always links between an upcoming year’s reporting requirements and declarations made in previous […]

With the acquisition of Eagle Technology Management (ETM) and Booke Seminars, Sovos has united the very best in statutory reporting solutions, technology and expertise. Below is an overview of our strategy following these acquisitions: Sovos’s SaaS and Security Strategy Sovos at its core is a Software as a Service (SaaS) and cloud-first company. This means […]

Accurately calculating insurance premium tax (IPT) for reporting can be complex. And the ramifications of getting it wrong can be far reaching from impacting profit margins to unwelcome audits, fines and damage to your company’s reputation in the market and with customers. Calculation methods When I speak to customers about how they calculate insurance premium […]

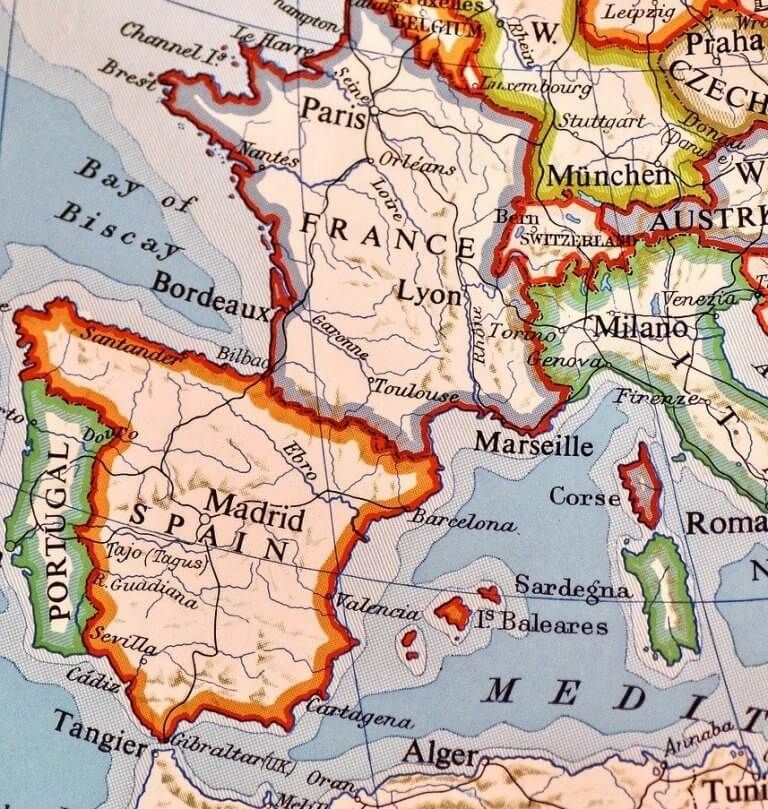

As negotiations to determine the future relationship between the EU and UK beyond the end of the transition period resume, after a COVID-19 initiated pause, it’s worth taking a moment to review some of the anticipated VAT implications of Brexit, and in particular the impact on Northern Ireland. Prior to the UK leaving the EU, […]

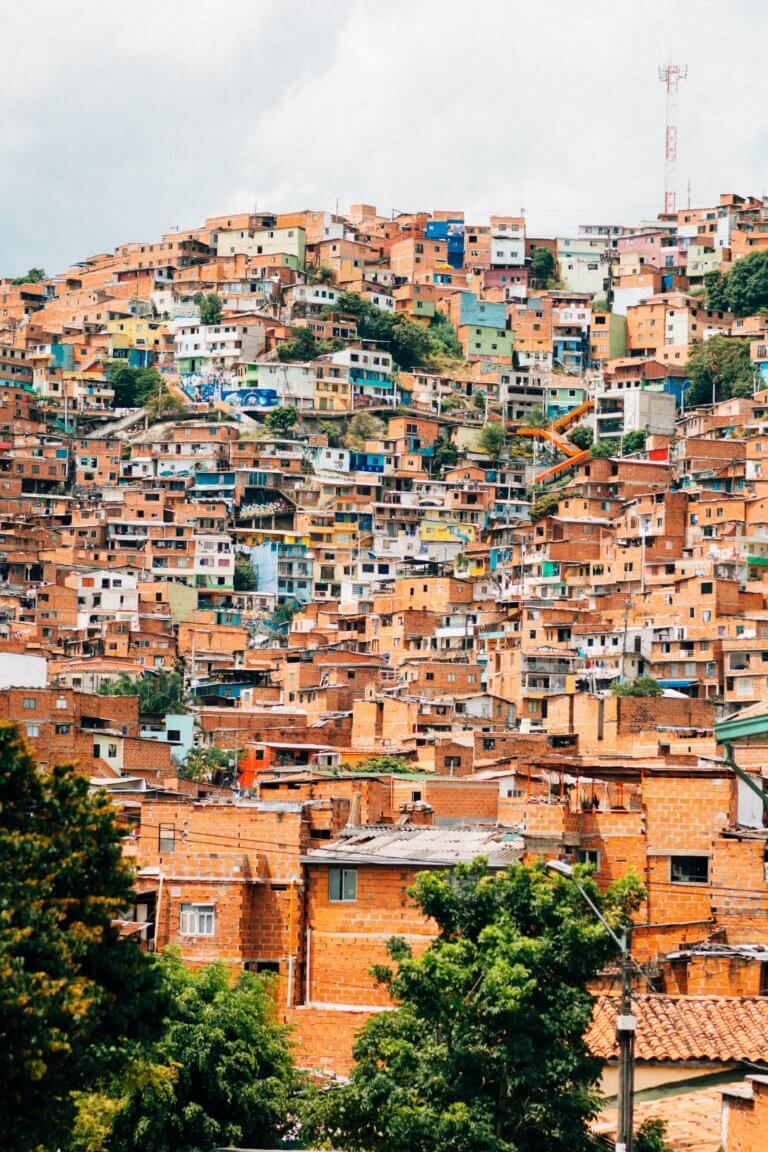

Following the trailblazing efforts by countries such as Italy, Hungary and Spain, this past year has seen an increase in European countries announcing digital tax control reforms. Earlier this year, Albania joined the ranks of France and Poland by announcing the introduction of a continuous transaction controls (CTC) system, called fiscalization. This scheme requires clearance […]

Coronavirus has already immeasurably changed how we live, work, travel and socialise, and the insurance industry is certainly no exception. Looking back, policies agreed at the beginning of this year could never have reasonably taken into account the scale of this pandemic because nothing like this situation has graced the world in living memory. Furthermore, […]

In February, some of the largest U.S. insurers came together for a Sovos-sponsored virtual forum. The forum focused on how these insurers managed their reporting obligations for the new IRS Forms 1099-LS and 1099-SB. Below you will find important background information on Forms 1099-LS and SB and four tips for issuing Form 1099-SB gathered from […]

A trend is emerging across the country. In the last year, Illinois, Virginia, Florida and Maryland changed their reporting requirements for the 1099-K. Below are the new requirements, by state: Illinois: Beginning with tax year (TY) 2019, issuers of Form 1099-K will be required to submit those reports to Illinois electronically if required by the […]

We recently reported the Polish government’s decision to delay introduction of the new JPK_VAT with a declaration structure until 1 July 2020. This move is part of the country’s Tarcza antykryzysowa (“Anti-Crisis Shield”) initiative to support business during the coronavirus pandemic and gives welcome extra preparation time especially as the Ministry of Finance only recently […]

The global tax landscape is rapidly changing as more tax jurisdictions require detailed electronic transactional reporting. This trend also applies to premium taxes, with Spain leading the way having introduced a new digitised reporting system and requesting Consorcio surcharges be declared on a transactional line-by-line basis. Greece shortly followed with detailed IPT reporting and most […]

Finland’s government already receives over 90% of invoices electronically. Aiming to expand the use of e-invoices in B2B transactions, the country has granted B2B buyers the right to receive a structured electronic invoice from their suppliers if requested. The scheme applies to all Finnish companies with a turnover above €10,000 and came into force on […]

Spain’s tax system is one of the most complex in Europe. For this reason, it presents a unique challenge for insurers when it comes to insurance premium tax (IPT) compliance. It has various taxes on insurance premiums with varying rates and several reports which must be declared. There are four provinces in Spain, each requiring […]

When operating across multiple regions, it’s challenging to stay abreast with every jurisdictions’ insurance premium tax (IPT) rates, particularities and exemptions. Country-specific filing and audit processes vary country to country too. If you operate in Portugal, France or Spain, or are looking to expand your business into these European territories, we’ve compiled a quick guide […]

Sovos recently published a blog regarding prospective measures EU member states are taking in response to the Covid-19 pandemic. Included below are additional actions introduced from countries across the EU: European Union The European Commission has approved requests from all EU Member States to temporarily suspend VAT and customs duties on imported medical equipment. This […]

The Coronavirus Aid, Relief and Economic Security (CARES) Act addresses the economic impacts of the COVID-19 outbreak. It authorizes emergency loans to distressed businesses, payouts of tax rebates to individuals and their children and provides paid family leave and paid sick leave benefits to employees by offsetting tax credits to employers. The bill provides for […]

Forms 1099-LS and 1099-SB were born out of the 2017 Tax Cuts and Jobs Act (TCJA) as part of the Life Settlement reporting section. They were first introduced for the 2019 tax season, and require reporting from both the purchaser and the life insurance carrier when a life insurance policy is sold to a new […]

The Ministry of Finance in Vietnam recently presented a draft decree to the Prime Minister for ratification, indicating that the go-live date for mandatory e-invoicing in the country will be delayed from 1 November 2020 to 1 July 2022. This proposed delay is in response to difficulties encountered by local companies to implement a compliant […]