Blog

The direct-to-consumer wine shipping channel continues to grow each year, with a 7.4 percent increase in value and 4.7 percent increase in volume in 2019. But starting mid-March 2020, as the pandemic progressed, and buying patterns shifted to rely heavily on ecommerce, we’ve seen a significant spike in growth over last year’s numbers. The DtC […]

Compliant archiving of original invoices and similar tax-relevant documents has long been overlooked. As companies gradually made the move to digitize existing paper processes, invoicing became a prime area for transformation into e-invoicing. However, requirements for long-term electronic archiving in traditional tax law were not always adapted in time to reflect the specific challenges of […]

We recently reported the Polish government’s decision to delay introduction of the new JPK_VAT with a declaration structure until 1 July 2020. This move is part of the country’s Tarcza antykryzysowa (“Anti-Crisis Shield”) initiative to support business during the coronavirus pandemic and gives welcome extra preparation time especially as the Ministry of Finance only recently […]

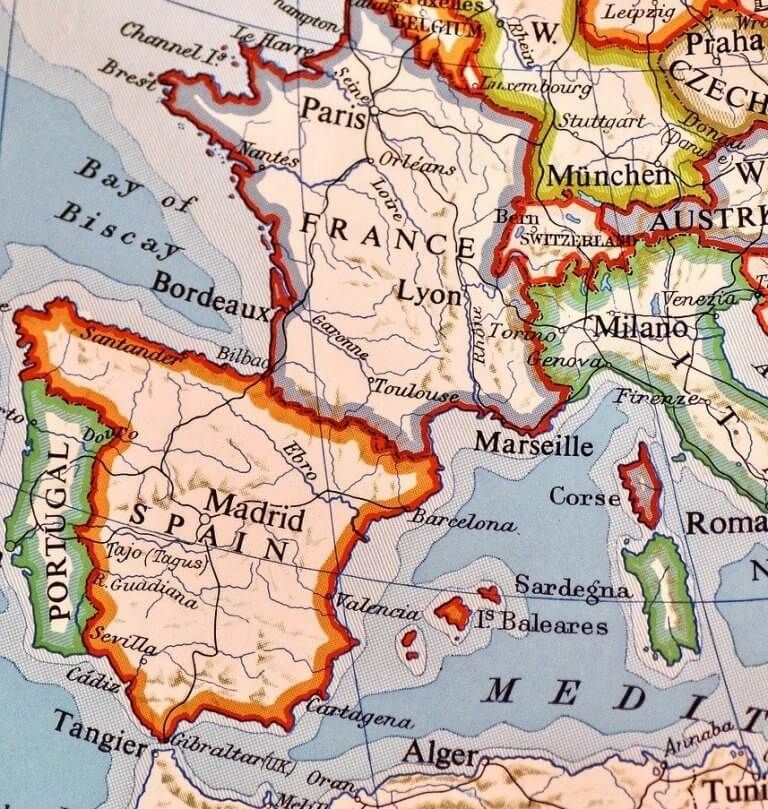

The global tax landscape is rapidly changing as more tax jurisdictions require detailed electronic transactional reporting. This trend also applies to premium taxes, with Spain leading the way having introduced a new digitised reporting system and requesting Consorcio surcharges be declared on a transactional line-by-line basis. Greece shortly followed with detailed IPT reporting and most […]

As of April 28, 2020 the state of New York and the alcohol suppliers within its borders will now be able to streamline the process of filing brand registrations and renewing licenses. With Sovos ShipCompliant’s Product Registration Online (PRO) tool, the process and cost of getting registrations approved for beer, wine and spirits will greatly […]

Unclaimed property compliance is a year-round job. Preparations must be made monthly in order to stay compliant. Below are the top 5 ways you can stay ahead of your unclaimed property obligations, before they turn into penalties. 1. Review procedures and document them: A lack of good audit trails and procedure documentation is commonplace in […]

Finland’s government already receives over 90% of invoices electronically. Aiming to expand the use of e-invoices in B2B transactions, the country has granted B2B buyers the right to receive a structured electronic invoice from their suppliers if requested. The scheme applies to all Finnish companies with a turnover above €10,000 and came into force on […]

Healthcare providers build up patient credit balances from collecting more coinsurance, copays, and deductibles than they earn. Unfortunately, because the fees are unearned, the healthcare provider has inadvertently accepted fiduciary responsibility for the funds. In addition to safeguarding the funds from potential loss, the healthcare provider is now facing penalties and interest from the states […]

Younger or less experienced wine consumers may find speaking with a wine expert at a tasting room or wine retailer intimidating. There is plenty of wine-specific terminology that consumers outside of the wine industry may find opaque or confusing. Don’t underestimate the role that even seemingly basic education can play in helping convert customers. At […]

Spain’s tax system is one of the most complex in Europe. For this reason, it presents a unique challenge for insurers when it comes to insurance premium tax (IPT) compliance. It has various taxes on insurance premiums with varying rates and several reports which must be declared. There are four provinces in Spain, each requiring […]

For those tax professionals responsible for keeping their company safe from audit risk, the time is coming (if it’s not already here) to think about how states may act to shore up budget shortfalls stemming from decrease in sales tax revenue as a result of the COVID-19 pandemic. While the US economy was (until recently) […]

According to Forrester Research, 65 percent of North American enterprises relied on public cloud platforms in 2019. This is five times the percentage that used cloud platforms 6 years ago. Leading businesses are flocking to cloud solutions because of the numerous benefits they provide. Below are the top 4 benefits of using a cloud-based unclaimed […]

When operating across multiple regions, it’s challenging to stay abreast with every jurisdictions’ insurance premium tax (IPT) rates, particularities and exemptions. Country-specific filing and audit processes vary country to country too. If you operate in Portugal, France or Spain, or are looking to expand your business into these European territories, we’ve compiled a quick guide […]

Sovos recently published a blog regarding prospective measures EU member states are taking in response to the Covid-19 pandemic. Included below are additional actions introduced from countries across the EU: European Union The European Commission has approved requests from all EU Member States to temporarily suspend VAT and customs duties on imported medical equipment. This […]

The Coronavirus Aid, Relief and Economic Security (CARES) Act addresses the economic impacts of the COVID-19 outbreak. It authorizes emergency loans to distressed businesses, payouts of tax rebates to individuals and their children and provides paid family leave and paid sick leave benefits to employees by offsetting tax credits to employers. The bill provides for […]

Forms 1099-LS and 1099-SB were born out of the 2017 Tax Cuts and Jobs Act (TCJA) as part of the Life Settlement reporting section. They were first introduced for the 2019 tax season, and require reporting from both the purchaser and the life insurance carrier when a life insurance policy is sold to a new […]

The Ministry of Finance in Vietnam recently presented a draft decree to the Prime Minister for ratification, indicating that the go-live date for mandatory e-invoicing in the country will be delayed from 1 November 2020 to 1 July 2022. This proposed delay is in response to difficulties encountered by local companies to implement a compliant […]

On 3 April 2020, storage guidelines for e-ledger were published by the Turkish Revenue Authority (TRA). The guidelines set out the requirements and standards for special integrators, and the requirements for supporting secondary storage services for e-ledgers, e-ledger summary report (Berat) files and other documents created through the e-ledger system. Background The Communique, first published […]