Blog

Norway has an indirect tax that applies to elements of coverage under a motor insurance policy. This blog details everything you need to know about it. As with our dedicated Spain IPT overview, this blog will focus on the specifics in Norway. We also have a blog covering the taxation of motor insurance policies across […]

Managing compliance with unclaimed property has become challenging due to the constantly changing legislative environment. A recent obligation gaining traction among states, which companies must be mindful of, is the requirement to conduct outreach to owners before their property is considered abandoned. This obligation, referred to as “pre-presumption outreach,” stems from the enactment of the […]

By Andrew Adams, Editor, Wine Analytics Report With another year of winery direct-to-consumer shipments tallied and analyzed, the state of Washington was the only major region tracked by Sovos ShipCompliant and WineBusiness Analytics to enjoy growth over the previous year. Compared to 2022, shipment value by Washington’s wineries grew 11% to $187 million while volume […]

In a recurring theme, the IRS released communication this week that exempts the requirement to e-file Form 1042 Annual Withholding Tax Return for U.S. Source Income (Form 1042) information for 2023 transactions. Form 1042 for 2023 transactions must be filed with the IRS by March 15, 2024. Notice 2024-26 delays the new requirement to electronically […]

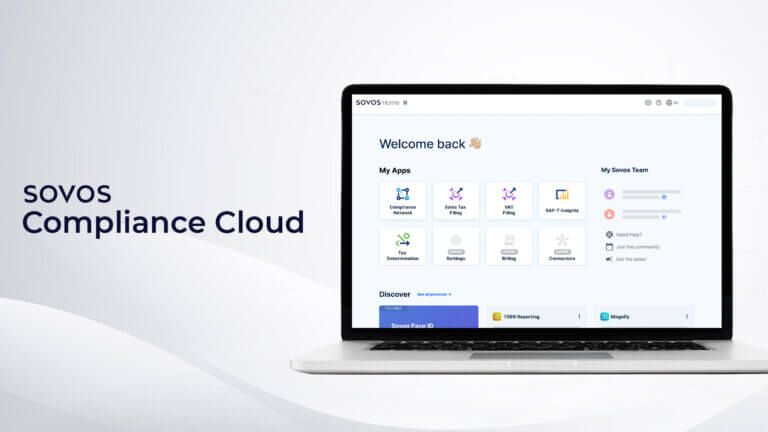

Last week, we introduced the Sovos Compliance Cloud. The industry’s first and only solution that unifies tax compliance and regulatory reporting software in one platform, providing a holistic data system of record for global compliance. Accompanying this launch, our CEO Kevin Akeroyd wrote about the global landscape of tax compliance, how we got to this […]

A number of recent lawsuits filed by beverage alcohol producers have raised new interest in self-distribution rights, an often-overlooked area of the industry. Self-distribution is when a supplier of alcohol, such as an importer or domestic manufacturer, is authorized to sell directly to retailers without having to work with a wholesaler to get their products […]

The emergence of digital transformation fundamentally changed how many governments and tax authorities around the world handle modern tax and compliance. What is unique about this process is that each individual government operates under its own set of rules, and global businesses are expected to keep up. In their efforts to address compliance, ironically, many […]

Affordable Care Act (ACA) reporting has started for tax year 2023. ACA reporting can quickly become complicated and costly with IRS penalties if your business does not have an efficient process in place. Although regulations have generally stayed the same for this reporting season, there are some important updates all businesses should be aware of […]

Building and maintaining a program to ensure compliance with the ever-changing unclaimed property laws is challenging, costly and time consuming. As a result, many companies put off or delay coming into compliance or do not put enough resources into creating a robust program. Those delays, erratic reporting and even ignorance that unclaimed property laws exist […]

Last month, Sovos ShipCompliant and WineBusiness Analytics released the 2024 Direct-to-Consumer Wine Shipping Report, marking the fourteenth consecutive collaboration between the two companies. Alex Koral and Andrew Adams presented an overview of the data and analysis from the report, highlighting key trends and statistics. Here, we summarize some of the noteworthy findings starting with the […]

Liechtenstein is one of many countries with Insurance Premium Tax (IPT) requirements, specifically the Swiss Stamp Duty and Liechtenstein Insurance Levy. This blog provides an overview of IPT in Liechtenstein to help insurance companies remain compliant. What kind of taxes are applicable in Liechtenstein on insurance premium amounts? In Liechtenstein, there are two types of […]

The unclaimed property (UP) community will convene in Las Vegas starting Sunday, March 10 for the 2024 Unclaimed Property Professionals Organization (UPPO) Annual Conference. Running until Wednesday, March 13, approximately 600 people will descend upon the Planet Hollywood hotel for three and a half days of learning, networking and sharing of ideas. According to UPPO, […]

Sovos ShipCompliant recently released the 2024 Direct-to-Consumer (DtC) Wine Shipping Report with our partner, WineBusiness Analytics. This look-back at 2023 is the most comprehensive, complete and exclusive collection of data and insights on the state of the DtC channel. While DtC wine shipments saw a decline in volume for the second year in a row, […]

I had the pleasure and privilege of attending the 2024 Direct to Consumer (DTC) Wine Symposium (DTCWS) to speak on the past and future of the direct-to-consumer (DtC) shipping market. As an annual event, DTCWS provides our industry with a regular opportunity to reflect on market conditions and connect on ways we can all help build […]

In the dynamic landscape of finance, Chief Financial Officers (CFOs) play a pivotal role in steering their companies towards success. One crucial aspect of their responsibilities is tax compliance, and in a recent survey, we delved into how CFOs perceive and leverage tax technology. The survey revealed valuable insights into how companies manage tax compliance, […]

Delaware’s Secretary of State (SOS) recently advised that they plan to send invitations to companies to participate in the Delaware Voluntary Disclosure Agreement (VDA) program November 15, 2024. This is the second wave of invitations for 2024. In the event that a company receives an invitation to participate in the VDA program and is interested […]

Last year, Sovos and Comply Exchange held a customer roundtable discussion on recent Form W-8 and Form W-9 changes. Here are some of the top points that participants brought up during the roundtable. Decentralized organization challenges In the realm of decentralized organizations, a recurring issue emerged – tax reporting departments often unearth problems with Form […]

Sovos often faces the question: “What triggers an audit from the States regarding unclaimed property compliance?” While each case is unique, there are common situations that can increase the likelihood of an audit. In this blog, we explore these triggers and provide insights on how companies can navigate the complexities of unclaimed property compliance. Here […]