Blog

Having a cloud-based sales tax solution can be greatly beneficial for businesses that are working to stay compliant in an ever-evolving industry. While user-centric solutions that operate on the most up-to-date regulatory requirements are key, organizations cannot ignore the indirect tax burden that can impact IT departments. Moving to SAP S/4HANA will help IT teams […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about new regulatory changes, ensuring you stay compliant. We spoke to Christina Wilcox, […]

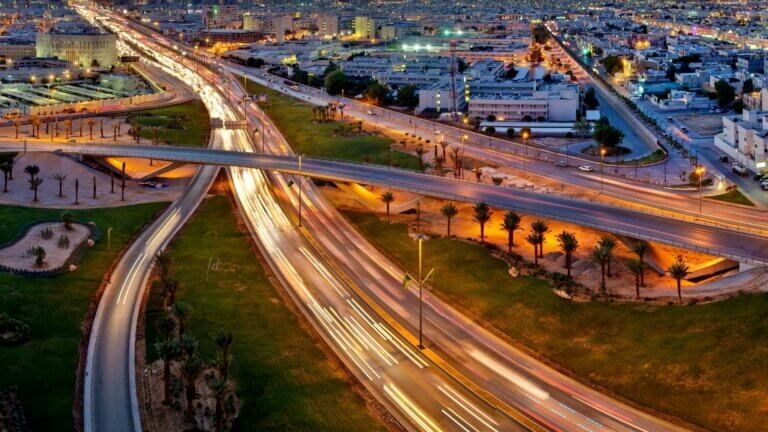

The General Authority of Zakat and Tax’s (GAZT) previously published draft rules on ‘Controls, Requirements, Technical Specifications and Procedural Rules for Implementing the Provisions of the E-Invoicing Regulation’ aimed to define technical and procedural requirements and controls for the upcoming e-invoicing mandate. GAZT recently finalized and published the draft e-invoicing rules in Saudi Arabia. Meanwhile, […]

The securities industry continues to be an area of focus from an unclaimed property standpoint. Individual issuers and transfer agents are being targeted for audits. The auditors are using traditional techniques to confirm that holders are in compliance with unclaimed property laws but they are also using nontraditional techniques to identify audit populations and shifting […]

On May 18, 2021, congressional bi-partisan co-sponsors introduced the USPS Shipping Equity Act, a bill that would allow the Postal Service to ship beverage alcohol directly to consumers over the age of 21. If passed, the bill would lift a Prohibition-era ban that currently prevents the USPS from shipping wine and other alcohol directly to […]

It’s been more than a few years since Romania first toyed with the idea of introducing a SAF-T obligation to combat its ever-growing VAT gap. Year after year, businesses wondered what the status of this new tax mandate was, with the ANAF continuously promising to give details soon. Well, the time is now. What is […]

The Turkish Revenue Administration (TRA) has published updated guidelines on the cancellation and objection of e-fatura and e-arsiv invoice. Two different guidelines are updated: guidelines on the notification of cancellation and objection of e-fatura and guidelines on the notification of cancellation and objection of e-arsiv. The updated guidelines inform taxable persons about the new procedures […]

Kansas Governor Laura Kelly signed HB 2137 into law on May 19, 2021, establishing new regulations affecting the direct-to-consumer (DtC) wine shipments in the state. These regulations became effective immediately. What is included in HB 2137? HB 2137 includes provisions that now require both in-state and out-of-state fulfillment houses to register and received a Fulfillment […]

There are a variety of different approaches to Insurance Premium Tax (IPT) treatment for marine insurance across Europe. Before looking at how individual countries treat marine insurance, it is worth noting the challenges in determining the country entitled to levy IPT and any associated charges. The location of risk relating to marine vessels falls within […]

In my previous blog, Unclaimed Property and Cryptocurrency: Regulation and the Impact on Digital Assets, we explored the impact of unclaimed property regulations in the virtual currency world. We determined that if you have a direct legal obligation to the owner, it is important that you review the requirements for unclaimed property reporting and partner […]

Last month, Sovos ShipCompliant hosted its 16th annual Wine Summit. The virtual event featured sessions and keynotes devoted to regulatory updates, education and how the industry has continued to make adjustments in the wake of the pandemic. We gathered some Summit highlights and fast facts from a few sessions. Industry & ShipCompliant Product Updates Larry […]

To understand why there is an ongoing evolution in the managing and administration of value added taxes (VAT), it is important to first understand the motivations of the governments behind the changes. The primary responsibility of any tax authority is to collect the revenue in which the government is legally owed. The difference between what […]

In Part I of our series on the VAT Evolution, we explored the motivations of tax authorities and governments around the world to embrace digitization and technology of a method of increasing revenue collection and shrinking tax gaps. More information on this topic can also be found by downloading your free copy of our IDC […]

In Part I of our series on the VAT Evolution, we explored the motivations of tax authorities and governments around the world to embrace digitization and technology of a method of increasing revenue collection and shrinking tax gaps. Then in Part II, Three Focus Areas for VAT we discussed some of the priority concerns for […]

There are many things to keep track of with unclaimed property so it’s understandable that certain items, such as unclaimed property pre-presumption outreach and electronic due diligence requirements, can be overlooked. However, they are part of unclaimed property law and therefore require compliance. Sovos tracks all nuances of unclaimed property law and ensures that our […]

Sovos ShipCompliant recently announced new Product Registration Online (PRO) renewal enhancements that will help suppliers and states ensure even more efficient workflows. With these changes, PRO users enjoy fast, easy electronic brand and label registrations for beer, wine, spirits and no-COLA products in participating states. Oklahoma was the pilot state for these enhancements, with their […]

Update: 9 March 2023 by Hector Fernandez IPT in Spain is complex. Navigating the country’s requirements and ensuring compliance can feel a difficult task. Sovos has developed this guide to answer prominent and pressing questions to help your understanding of Insurance Premium Tax in the country. Originally created following a Spain IPT webinar we hosted, […]