Blog

Goods in transit insurance is defined in the Solvency II Directive 2009/138/EC (25 November 2009) within Annex I Classes of Non-Life Insurance under class 7. It includes merchandise, baggage, and all other goods and the insurance relates to all damage to or loss of goods in transit or baggage, irrespective of the form of transport. […]

On 26 November, Black Friday presents another opportunity for retailers to drive e-commerce sales and boost revenue. It has become one of the biggest global retail events of the year, with shoppers increasingly turning to online retailers for the best deals. Retailers will be working hard to prepare the best deals to entice shoppers but […]

Direct-to-consumer (DtC) alcohol shipping laws vary from state to state, and that fact holds true for importers looking to enter the DtC business. While importers can be treated similarly to other members of the “supplier” tier (e.g., wineries, breweries), they are often treated differently in federal and state regulations. Because of how DtC shipping laws […]

Sovos’ consultants have noticed a growing trend in 2021 as states across the country increase their unclaimed property pre-audit activity or voluntary compliance programs. Due to the negative economic impact resulting from COVID-19, Sovos’ consulting, reporting and regulatory teams have been preparing for increased unclaimed property compliance enforcement efforts to shore up struggling state budgets. […]

The Commonwealth of Massachusetts is squarely in the midst of modernizing its sales tax filing and remittance requirements, and in so doing, creating new, novel and likely challenging requirements for taxpayers. The most recent incarnation of this modernization was announced in its September 2021 DOR News, which hints at new requirements for restaurants and ecommerce […]

By Tom Wark, Executive Director, National Association of Wine Retailers The effort to open more states for interstate wine retailer-to-consumer shipments is multi-pronged. One prong—perhaps the most important—is the effort to overturn discriminatory state laws by using the federal courts to challenge state laws that violate the U.S. Constitution’s dormant commerce clause as well as the […]

The EU E-Commerce VAT Package is here. The new schemes, One Stop Shop (OSS) and Import One Stop Shop (IOSS), bring significant changes to VAT treatment and reporting mechanisms for sales to private individuals in the EU. Our recent webinar, Back to Basics: The EU E-Commerce VAT Package, discussed the basic principles of the three […]

The proper supporting documentation of a tax return has always been required by the local tax offices. In this blog we will focus on the supporting documentation of Insurance Premium Tax (IPT) returns, especially the Italian requirements. Although the requirements for the preparation of IPT supporting documentation differs from country to country, the details of […]

The EU E-Commerce VAT Package is here. The new schemes, One Stop Shop (OSS) and Import One Stop Shop (IOSS) bring significant changes to VAT treatment and reporting mechanisms for sales to private individuals in the EU. Our recent webinar, Back to Basics: The EU E-Commerce VAT Package, discussed the basic principles of the three […]

As the digitization of tax continues, many organizations are looking to reduce the complexity and cost of tax compliance. In our latest spotlight report, created in partnership with Americas’ SAP Users’ Group (ASUG), “Boost Tax Compliance Capabilities and Visibility with SAP S/4HANA”, we discuss the most optimal time in the SAP S/4HANA migration process to […]

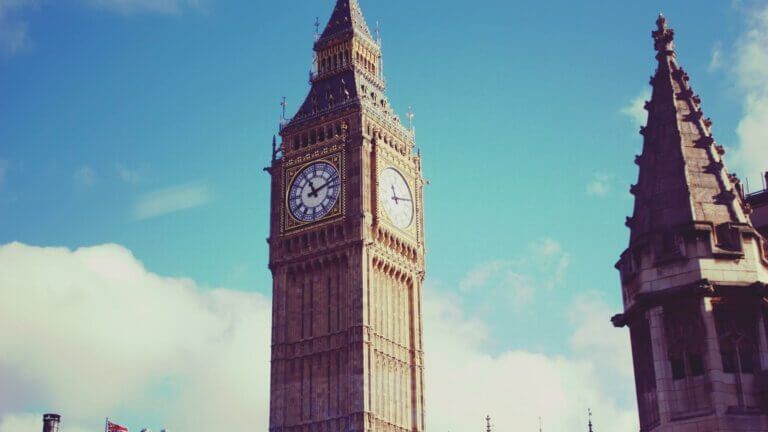

Non-EU companies are required to appoint a Fiscal Representative in order to be registered for VAT in many Member States. Following the end of the Brexit transition agreement on 31 December 2020, this was a consideration for UK companies who wanted to remain registered or had to register as a result of changes to supply […]

When the French Tax Authority published its report last fall, unveiling the continuous transaction control (CTC) plans for France, we questioned whether it would be possible to finalise all the details of this system in less than a year, to allow sufficient time for businesses to adapt. Although the French Treasury (DGFiP) has made good […]

The Zakat, Tax and Customs Authority (ZATCA) announced the finalized rules for the Saudi Arabia e-invoicing system earlier this year, announcing plans for two main phases for the new e-invoicing system. The first phase of the Saudi Arabia e-invoicing system is set to go live from 4 December 2021. With the mandate just around the […]

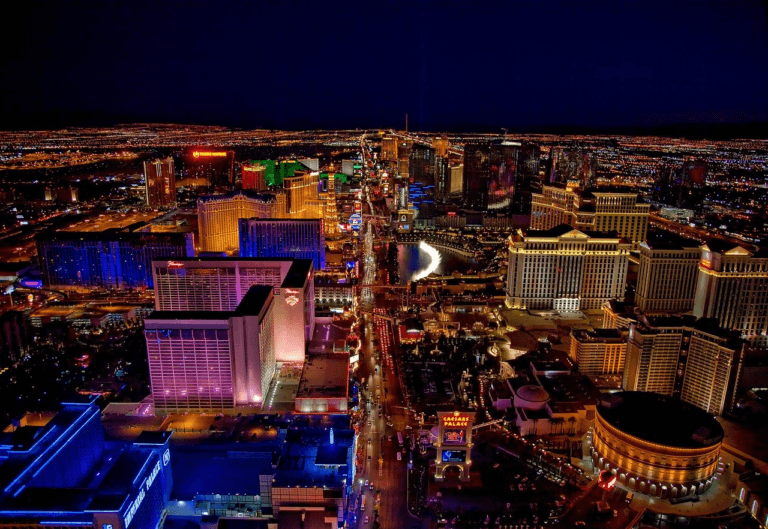

Earlier this year, SB 307 was enacted in Nevada, effectively eliminating the right for Nevada residents to receive direct-to-consumer (DtC) shipments of beer and spirits from producers, or any alcoholic beverage from out-of-state retailers. Previously, Nevada DtC alcohol shipping permissions were among the most open, with the state allowing breweries, distilleries and retailers to sell […]

Unclaimed property due dates are spread across the calendar year and differ by state and holder/company type. Complicating matters even further, each state’s own unclaimed property rules and regulations are updated frequently. We’ve gathered state-specific information on unclaimed property due dates to help you stay on top of this changing information. The Sovos regulatory analysis […]

This blog is an excerpt from Sovos’ annual VAT Trends report. Governments are increasingly putting liability for reporting and/or paying VAT on platforms that already process many taxable transactions and associated data flows, instead of putting such liability on each individual taxable person transacting on such platforms. Why is this happening? With the introduction of […]

Having originated in Latin America, the next region set to embrace continuous transaction controls is Asia. Several jurisdictions in the region have announced their intent to introduce a new invoicing system as soon as possible. In this episode of the Sovos Expert Series, Harri Vivian sits down with Victor Duarte, Senior Regulatory Counsel at Sovos […]