Blog

Regardless of where the event, conference or exhibition is held, there will be VAT obligations to be met. For event organisers, understanding these VAT requirements is key as failure to do so will not only impact profit margins but may also result in late payments and possible penalties. VAT on conferences and events If your […]

The global e-commerce market continues to transform in today’s digital world. E-commerce transactions consist of a variety of digital services and products such as software, applications, streaming media, web hosting, online advertising, e-books, online newspapers, and various others. From an indirect tax perspective, nations across the globe apply destination-based VAT and GST legislation to these […]

In our previous blog, we focused on VAT registration and the steps a business needs to go through to determine where it needs to be registered. Once the registration is in place, there are a wide range of obligations that need to be met on an ongoing basis. The first step is fully understanding these […]

Registering for VAT in the EU remains an overly complicated task, with each Member State having its own processes and procedures to obtain a VAT number. The various One Stop Shop schemes that were introduced on 1 July 2021 show what the future could look like, with online application and a similar registration process in […]

Korea’s National Tax Service recently shared an investigation in which it discovered several foreign companies were evading tens of billions of dollars in taxes to be reported in Korea using international transactions. A few examples of the tactics used by these companies included stealing sales through offshore companies located in tax havens, and unfairly transferring […]

In Insurance Premium Tax (IPT) compliance, the Aviation Hull and Aviation Liability policy is defined under Annex 1, Classes of Non-Life Insurance, as described in DIRECTIVE 138/2009/EC (SOLVENCY II DIRECTIVE). But there are variations and identifying which class the policy is covering can be a challenge. This article will cover what insurers need to know […]

In the “Statement on a Two-Pillar Solution to Address the Tax Challenges Arising From the Digitalization of the Economy” issued on 1 July 2021, members of the G20 Inclusive Framework on Base Erosion and Profit Shifting (“BEPS”) have agreed upon a framework to move forward with a global tax reform deal. This will address the […]

Turkey’s e-transformation journey, which started in 2010, became more systematic in 2012. This process first launched with the introduction of e-ledgers on 1 Jan 2012 and has since reached a much wider scope for e-documents. The Turkish Revenue Administration (TRA), the leader of the e-transformation process, has played an important role in encouraging companies to […]

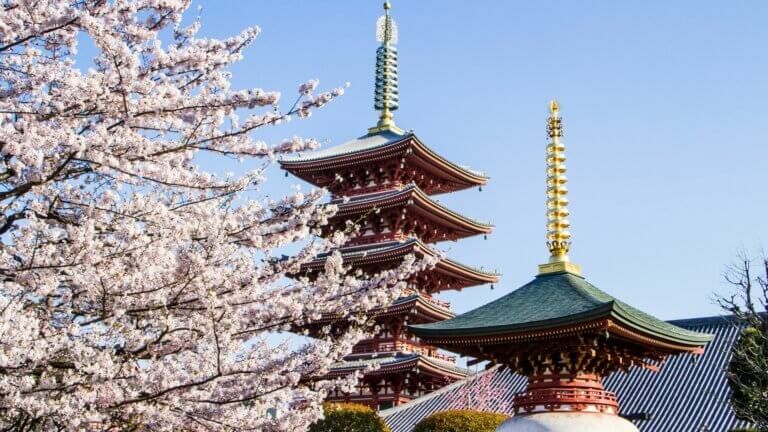

Update: 23 March 2023 by Dilara İnal Japan’s Qualified Invoice System Roll-out Approaches Japan is moving closer to the roll-out of its Qualified Invoice System (QIS), which will happen in October 2023. Under QIS rules, taxpayers will only be eligible for input tax credit after being issued a qualified invoice. However, exceptions exist where taxpayers […]

In the digital age we live in, speed is essential. For companies wanting to compete on a global scale, acting fast is just as important as having the digital solutions to advance. Taking into consideration the effect of digitalization on globalization, businesses are outsourcing processes to specialists to keep pace and focusing on their core […]

Norway announced its intentions to introduce a new digital VAT return in late 2020, with an intended launch date of 1 January 2022. Since then, businesses have wondered what this change would mean for them and how IT teams would need to prepare systems to meet this new requirement. Norway has since provided ample guidance […]

This blog was updated on December 12, 2023 Sovos recently sponsored a benchmark report with SAP Insider to better understand how SAP customers are adapting their strategies and technology investments to evolve their finance and accounting organizations by utilizing SAP S/4HANA Finance. This blog hits on some of the key points covered in the report […]

Six months after Brexit there’s still plenty of confusion. Our VAT Managed Services and Consultancy teams continue to get lots of questions. So here are answers to some of the more common VAT compliance concerns post-Brexit. How does postponed VAT accounting work? Since Brexit, the UK has changed the way import VAT is accounted for. […]

In Poland, the Ministry of Finance proposed several changes to the country’s mandatory JPK_V7M/V7K reports. These will take effect on 1 July 2021. The amendments offer administrative relief to taxpayers in some areas but create potential new hurdles elsewhere. Poland JPK_V7M and V7K Reports The JPK_V7M/V7K reports – Poland’s attempt to merge the summary reporting […]

The Turkish Revenue Administration (TRA) has published updated guidelines on the cancellation and objection of e-fatura and e-arsiv invoice. Two different guidelines are updated: guidelines on the notification of cancellation and objection of e-fatura and guidelines on the notification of cancellation and objection of e-arsiv. The updated guidelines inform taxable persons about the new procedures […]

An amendment in the General Communiqué No. 509 has announced healthcare service providers and taxpayers providing medical supplies and medicines or active substances must use the e-invoice application from 1 July 2021. The mandated scope for transition to e-invoice and e-arşiv invoice applications in the healthcare industry Published in the Official Gazette the implementation will […]

It’s difficult to pinpoint exactly when new taxes or tax rate increases will happen. Covid-19 has impacted almost everything, including a massive deficit in the economy. Many banks have applied negative interest and governments have put funding in place to aid recovery. It’s highly likely that tax authorities will be looking at ways to bring […]

Digitization has become more prevalent, especially because of COVID-19. Companies looking to improve efficiency via digital transformation are taking advantage of the benefits tax technologies can provide their business processes. Although they’re not within Turkey’s e-invoicing mandate scope, companies have been using e-document applications as part of their operational processes to save time, costs and […]