Blog

In addition to selling automated solutions, software-as-a-service (SaaS) companies often provide a variety of related services, including configuration, implementation, training, testing, bug fixes, technical support, and software enhancements. Each of these services could have sales tax consequences different from those applicable to the underlying software. Even more challenging, the rules can sometimes vary based on […]

The U.S. software industry is no stranger to evolving technology. But what about sales tax compliance? Can this segment keep pace with ever-changing regulations, while still meeting customer needs? Sovos and SG Analytics conducted a survey to better understand how software organizations are planning to improve sales tax management. Overall, 43% of respondents said they […]

While the wave of litigation to remove legal barriers to retailer direct-to-consumer (DtC) keeps crashing against the breakwaters of district courts, a recent ripple in the courts may signal a potential shift in rules around self-distribution, which could have deep effects on the industry in the years to come. First, the Oregon Liquor and Cannabis […]

Organizations that access IRS systems to file information returns, including Form 1099, Affordable Care Act returns and more, need to understand how technological updates could impact their filing processes. As part of its multi-year business systems modernization plan, the IRS has implemented new systems and processes that must be followed for accessing their systems for […]

In today’s complicated world of tax compliance, it can be nearly impossible for teams to keep up with their 1099 and unclaimed property reporting obligations. From ensuring tax identity management for 1099 recipients to executing on the due diligence requirements needed to report unclaimed property, the time your accounts payable (AP) teams spend on compliance […]

Online wine marketplaces are a way for consumers to purchase many of their favorite brands with a few clicks, and often enjoy discounted or included shipping to boot. But state regulators are starting to take note of their shipping practices. States like Ohio are arguing that these web shops are not only depriving the state […]

The District Court for Arizona recently ruled against a Florida retail shop in the latest in an ongoing series of lawsuits that seek to address the right of alcohol retailers to engage in interstate direct-to-consumer (DtC) shipping. The Florida retailer in this case, which was joined by two Arizona wine collectors, argued against an Arizona […]

Do you work on your company’s statutory annual statement? If so, a committee of the National Association of Insurance Commissions (NAIC) you should track is the Blanks Working Group (BWG). One of the primary responsibilities of the BWG is to adopt improvements and revisions to the various statutory annual and quarterly statements. Yes, the BWG […]

Sovos’ recent observations of audits by EU Tax Authorities are that Tax Officers are paying more attention to the contents of One Stop Shop (OSS) VAT Returns. They have challenged, and even excluded, companies from this optional scheme. OSS VAT returns must contain details of supplies made to customers in each Member State of consumption […]

The EU’s VAT in the Digital Age (ViDA) Package contains a wide range of proposals with far-reaching impacts. One of the areas impacted by these proposals is the VAT treatment of call-off stock. What is call-off stock? Call-Off stock is used to describe an arrangement where a seller ships goods to a customer’s warehouse (stock) […]

The Chilean Internal Revenue Service (SII) recently published version 4.00 of the document describing the format of electronic tickets for Sales and Services. The electronic ticket (or Boleta Electrónica) is an electronic receipt issued for the sale of goods or services to individuals, consumers or end users. The document includes basic information about the transaction, […]

The European Commission, as part of its VAT in the Digital Age project (ViDA), is proposing to modify reverse charge rules for non-established suppliers. These rules are currently optional for Member States, which has resulted in patchwork application across the EU. The modifications are intended to harmonize these rules across member states. Although the intent […]

Back in 1959, Barbie took her first plastic steps to become the cultural icon that she is today. Living in that Barbie world meant driving to your local toy store and physically purchasing the doll and accessories. Physical products like this were and still are subject to sales tax, meaning the consumer pays tax at […]

All types of businesses are subject to reporting earnings on the 1099 form series. Tax information reporting 1099s can be a complex process, especially when you must report more than one type of 1099 form. There are also many different parts of the reporting process that can be confusing, including knowing what 1099s to report, […]

Businesses use software for everything, and for many companies, the aggregate cost of all their software licenses represents an enormous expense. When purchasers of business software acquire or renew their license, negotiations around the total price of the solution are often rigorous and sometimes even contentious. This is understandable as cost containment is a key […]

Extension of the implementation dates of the B2B e-invoicing Mandate. Update: 9 December 2024 On September 15th, 2024, the French Tax Authorities published a Press Release announcing a profound change in the upcoming French Mandate for electronic e-invoicing & e-reporting. Indeed, the Public Portal (aka PPF) will no longer provide e-Invoicing Services, making it compulsory […]

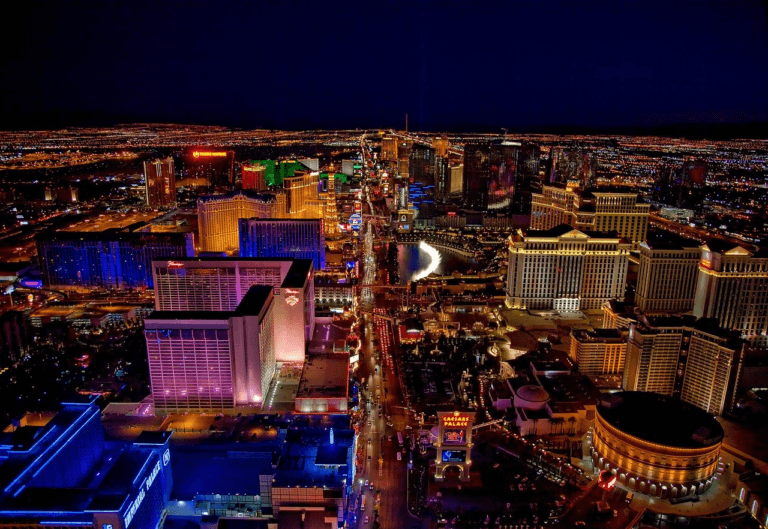

For the third time in four years, Nevada has amended its unclaimed property law. Indeed, Assembly Bill 55 was enacted in Nevada on June 2, 2023, and became effective July 1, 2023. The new law impacts the analysis of when certain property types are presumed abandoned. Further, a new certified mailing requirement is added for […]

Congratulations, your winery has grown to a point where shipping under someone else’s license has become too great of a risk, and you’ve decided to search for a direct-to-consumer (DtC) shipping compliance partner. There are choices in the marketplace, so how do you know which company to work with? As you conduct your due diligence […]