Blog

The Cayman Islands has opened its AEOI Portal for CRS and FATCA notification and reporting. In addition, a new portal user guide has been released. The guide provides assistance with both the notification and reporting requirements. Reporting Financial Institutions should keep in mind that there will be no CDOT functionality on the portal for this […]

The State of Washington has passed new legislation which provides an exemption for materials incorporated into and services rendered in respect to adapted housing for disabled veterans from retail sales tax. The exemption only applies to construction projects for disabled veterans approved by the United States Department of Veteran Affairs. The exemption will be in […]

On May 15, Costa Rica released additional documentation for reporting under FATCA 2.0. The documentation include Client Configuration Guide v 2.0, a user guide for the FATCA reporting site, and example XML files according to the 2.0 standard. These documents provide essential guidance for parties needing to file FATCA returns with Costa Rica. To review […]

Guernsey recently published Bulletin 2017/3, detailing how Trustee Documented Trusts (“TDT”) must report under the Common Reporting Standard (“CRS”). This bulletin provides guidance on the format for electronic reporting through the Information Gateway Online Reporter (IGOR), the Guernsey electronic reporting portal. While trusts would ordinarily be considered Reporting Financial Institutions (RFIs) under Schedule 2 of […]

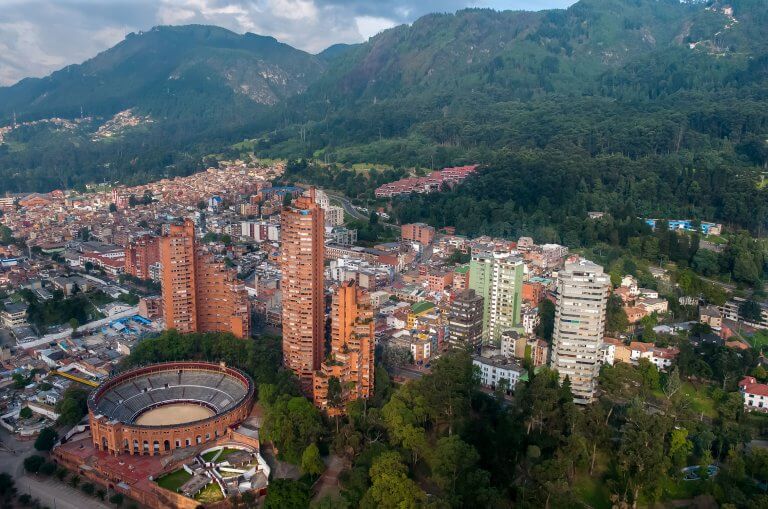

In line with other countries in Latin America, Colombia opted to roll out e-invoicing on a voluntary basis, coupled with individual mandates to join the e-invoicing framework to specific taxpayers (often within strategic industry sectors or upon exceeding certain annual turnover threshold). At the end of 2015, Colombia issued Decree 2242 updating their e-invoicing framework. […]

As Mexico attempts to better track the money flowing through its economy – and the taxes owed on said transactions – it recently introduced a new process requiring companies to submit payment receipts. This new mandate, which goes into effect on December 1, 2017, will affect both IT and business teams, yet is not supported […]

During 2016, Mexico started the process of updating the legally established e-invoicing format. More specifically, the xml version of the CFDI document is being updated from v3.2 to v3.3. The process had a deadline for full migration from CFDI v3.2 to CFDI v3.3 by 1 July this year. However, the Mexican Tax Administration has postponed […]

North Dakota’s sales and use tax exemption for tangible personal property used to construct or expand telecommunications service infrastructure is set to expire on June 30, 2017. This exemption covers cell towers, switching equipment, cable, and other infrastructure items used directly in delivering telecommunication services and owned by a telecommunications company. In order to receive […]

Effective July 1, 2017, North Dakota will expand the definition of “Farm Machinery” to include machinery, equipment and materials used exclusively in a milking operation of a dairy farm. In North Dakota, sales of new farm machinery sold exclusively for agricultural purposes are taxed at a lower tax rate of 3% compared to the general […]

Effective July 1, 2017, North Dakota will begin to provide an exemption from sales tax for sales of “internet access services.” Since 1998, the Internet Tax Freedom Act has prohibited federal, state and local governments from levying a tax on internet access however, seven states which previously had imposed taxes on internet access, including North Dakota, were […]

North Dakota recently enacted legislation which will increase the Prepaid Wireless Emergency 911 Fee from 2.0% to 2.5% effective July 1, 2017. Retailers are required to collect this fee on all sales of prepaid wireless services and minutes. Retailers must remit the collection of such fees to the State Tax Commissioner. Revenue generated from this increase […]

Monaco recently published an updated publication on the implementation of the automatic exchange of information. This publication relates to how financial institutions must report under the OECD’s Common Reporting Standard (CRS). This most recent update includes a few updates to existing language surrounding trusts, specifically with regard to controlling persons. The settlor, trustee, protector, or beneficiary […]

Costa Rica recently published a communique on FATCA reporting. The document sets the reporting dates for 2016 information to be reporting in 2017. Reporting dates will run from May 12 to August 11, 2017. The document also provides links to the portals available for reporting, as well instructions for registration of reporters and, validation, testing, […]

Bahrain, a late adopter jurisdiction, has recently posted legislation (CRS Directive) concerning the Common Reporting Standard. The legislation, though brief, does provide some important information for Financial Institutions. Of note, Bahrain will require CRS returns to be furnished by May 2, and that FIs submit nil reports. In addition, there is a list of Participating Jurisdictions […]

Bermuda has published Guidance for Financial Institutions to follow with respect to the Common Reporting Standard. Financial Institutions and their advisors should pay particular attention to the information as it covers many facets of the due diligence and reporting requirements. In particular, the Guidance provides that the due date for this year’s reporting will be […]

Jersey has posted guidance for next month’s CRS reporting. Jersey had previously released guidance in April for FATCA. This publication contains information on single or multi-jurisdictional reporting, trustee and third party reporting, and nil returns, amongst others. Jersey’s due date is June 30. As such, this publication should be reviewed by Reporting Financial Institutions to […]

The Spanish Tax Administration has published additional answers to Frequently Asked Questions regarding FATCA and CRS reporting. The questions address specific circumstances – under both FATCA and CRS – in which a Financial Institution is obligated to carry out blocking of a financial account for both entities and natural persons: A Financial Institution must block […]

The Spanish Tax Administration has updated its XML guidance for submitting FATCA returns. There is only one significant revision of which filers should take note. It provides a web address for the consultation of presentations made in the preproduction test environment. In order to access this page, the filer will need to have a digital […]