Blog

InsurTech companies are really getting their claws into the insurance industry. New products are coming to market, processes are being overhauled and end customers are benefiting from the positive disruption. From Zego’s flexible policies to By Miles pay-per-mile car insurance, new solutions are rewriting the rules of insurance to better serve customers. But are these […]

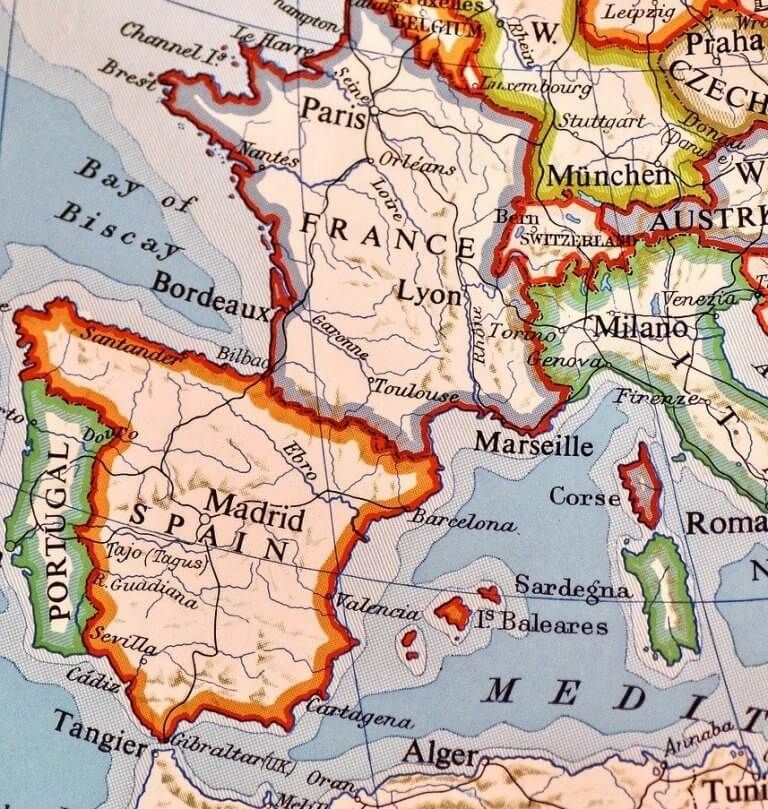

France is usually known for the complexity of its insurance premium tax filing system with many parafiscal charges potentially applying to insurance premiums and with many overseas territories where IPT should be filed directly. Over the last decade, France has either introduced new taxes and contributions on insurance premiums or increased rates. Now, as for […]

The coronavirus pandemic’s full effect on insurance is yet to be revealed, however one thing is for certain, the shockwaves will be felt for years to come. Looking at the numbers, Lloyds of London have recently forecast that COVID-19 will cost the insurance industry £167bn globally this year resulting from claims related to the pandemic […]

Premium tax and parafiscal compliance for insurers authorised to operate under the Italian regime can be challenging. For the experienced, it may seem that each year brings a different obligation to be met with new requirements often being introduced. There are almost always links between an upcoming year’s reporting requirements and declarations made in previous […]

Accurately calculating insurance premium tax (IPT) for reporting can be complex. And the ramifications of getting it wrong can be far reaching from impacting profit margins to unwelcome audits, fines and damage to your company’s reputation in the market and with customers. Calculation methods When I speak to customers about how they calculate insurance premium […]

Coronavirus has already immeasurably changed how we live, work, travel and socialise, and the insurance industry is certainly no exception. Looking back, policies agreed at the beginning of this year could never have reasonably taken into account the scale of this pandemic because nothing like this situation has graced the world in living memory. Furthermore, […]

Anyone involved in insurance premium tax (IPT) compliance will be only too aware of negatives. Sadly, they almost always cause a headache and not only for financial reasons but also from a tax compliance perspective as well. What are negatives? Negatives for IPT purposes mean negative policy lines in documentation created to support the premium […]

As we all know, insurance premium tax (IPT) differs country to country and if your company writes insurance cross border, tracking every jurisdiction’s IPT rate can be challenging. We’re often asked by insurers about IPT regimes in overseas France because they vary island to island. Not only does each territory maintain its own IPT regime, […]

The global tax landscape is rapidly changing as more tax jurisdictions require detailed electronic transactional reporting. This trend also applies to premium taxes, with Spain leading the way having introduced a new digitised reporting system and requesting Consorcio surcharges be declared on a transactional line-by-line basis. Greece shortly followed with detailed IPT reporting and most […]

Spain’s tax system is one of the most complex in Europe. For this reason, it presents a unique challenge for insurers when it comes to insurance premium tax (IPT) compliance. It has various taxes on insurance premiums with varying rates and several reports which must be declared. There are four provinces in Spain, each requiring […]

When operating across multiple regions, it’s challenging to stay abreast with every jurisdictions’ insurance premium tax (IPT) rates, particularities and exemptions. Country-specific filing and audit processes vary country to country too. If you operate in Portugal, France or Spain, or are looking to expand your business into these European territories, we’ve compiled a quick guide […]

We are in unprecedented times where hour-by-hour change has become the new norm. This is particularly true across our industry as governments evaluate and assess every direct and indirect tax at their disposal as part of broader economic stimulus measure. Tax authorities across the world – national, regional and overseas territories – have acted decisively […]

The UK officially left the European Union at 11pm BST on Friday 31 January 2020, 10 months later than originally planned due to two negotiation period extensions. Both are now in a transition period due to end on 31 December 2020. During this period, the conditions of the new relationship will be redefined and agreed. […]

The insurance market for 2019 was marked by two key trends: insurers implementing post-Brexit strategies, and the continuous rise of insurtech companies. But classic and more traditional insurance companies and captives have not surrendered. A hard Brexit has been anticipated by UK insurers British insurance companies have carefully planned for the different flavours of Brexit […]

Insurance Premium Tax (IPT) doesn’t represent a significant share of the total revenue generated by tax authorities. In the UK for instance, it only accounts for 1% of the total revenue while the share rises to just 4% in Germany. However, over the past five years there has been a regular increase in the amount […]

The insurance world is often seen as slow and reluctant to fully embrace technology. However, new competition from the growing number of insurtech companies and the digitisation of reporting to local authorities are forcing insurers to wake up to the wave of technology transformation the sector is experiencing. Still, people behind technology remain key. Perhaps […]

In the increasingly complex world of IPT, understanding, assessing and applying the right taxes to new insurance products can be a challenge for insurers when complying with fragmented regulations. As new risks continue to emerge, so do new insurance products. But how can insurers ensure insurance premium tax (IPT) is correctly applied? The three questions […]

EU and local legislation Location of risk is one of the key criteria an insurer must identify and consider before thinking about insurance premium taxes. It’s important to understand the location of risk rules and apply them correctly to be able to settle insurance premium taxes compliantly and to the correct tax authority. Whilst location […]