Treatment of Space Insurance

Update: 25 January 2024 by James Brown Judgment in the Netherlands and Lloyd’s Position on Space Insurance There have been a couple of key developments

Update: 25 January 2024 by James Brown Judgment in the Netherlands and Lloyd’s Position on Space Insurance There have been a couple of key developments

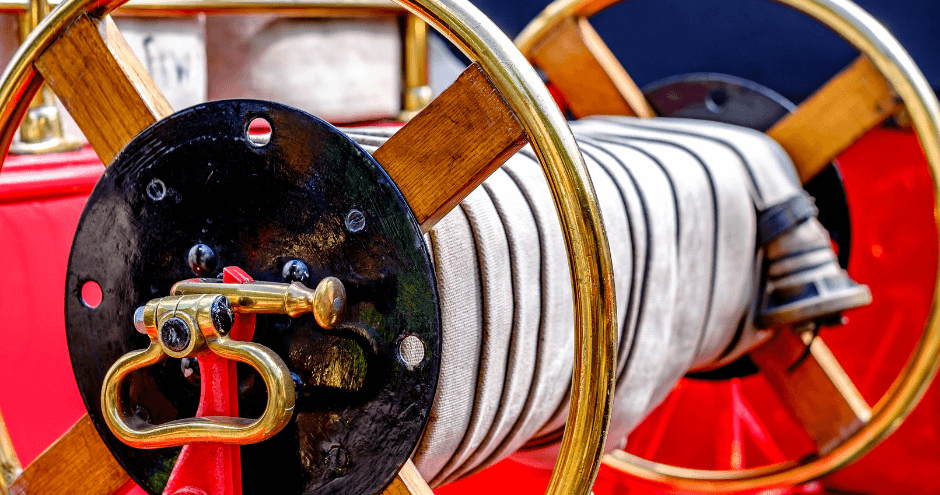

There are several countries within the European Union (EU) and European Economic Area (EEA) that have introduced a Fire Brigade Tax (FBT). Fire Brigade Tax

For Insurance Premium Tax, Location of Risk is vital in determining the correct tax. In this episode of the Sovos Expert Series, Anita Blanusic

The world of Insurance Premium Tax (IPT) is ever changing, with countries updating rates and thresholds whenever the need arises, introducing new taxes regularly and

Update: 27 July 2023 by Edit Buliczka Changes to IPT registration requirements in Austria The registration requirements for settling taxes in a country are similar

Continuing our IPT prepayment series, we take a look at Italy’s requirements. In previous articles we have looked at Belgium, Austria, and Hungary. All insurers

Update: 17 April 2025 by Edit Buliczka New IPT Prepayment Rules in Hungary Starting in 2025, new prepayment rules will apply to the Extra Profit

In the next edition of our series of blogs in Insurance Premium Tax (IPT) prepayments, we look at a less familiar regime to many, the

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and insurance premium tax (IPT) compliance services.

It’s time to return to Insurance Premium Tax (IPT) prepayments – a continuation of our blog series on the important IPT topic. You can find

The Dutch government issued an updated Policy Statement for Insurance Premium Tax (IPT) on 12 May 2022. The first of its kind since February 2017,

There are some countries across Europe where declaring and settling insurance premium tax (IPT) and parafiscal charges on time is not enough to prevent late

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global organisation

An increasing insurance premium tax (IPT) trend is using transactional level information in various returns and reports. Preparation and education are key to ensuring details

A parafiscal tax is a levy on a service or a product which a government charges for a specific purpose. It can be used to

Update 7 October 2024 by Edit Buliczka Hungarian Tax Office Updates IPT Declaration Form for 2023 The procedure necessary to correct an underdeclared premium figure

Identifying the location of risk for Insurance Premium Tax (IPT) purposes is the first step to ensuring IPT compliance in a given territory. This area

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global