North Macedonia E-invoicing

North Macedonia E-invoicing North Macedonia is poised to advance in its digital transformation journey with the launch of its e-invoicing pilot program on 1 January

Keep up on what’s happening in the digital transformation of tax worldwide.

North Macedonia E-invoicing North Macedonia is poised to advance in its digital transformation journey with the launch of its e-invoicing pilot program on 1 January

Moldova E-invoicing Moldova is currently in a transition period regarding its adoption of mandatory e-invoicing. The nation plans to fully implement obligatory e-invoicing for B2B

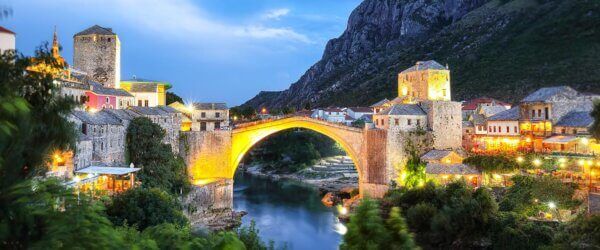

Bosnia and Herzegovina e-invoicing Bosnia and Herzegovina currently operates on a voluntary e-invoicing basis, but changes are coming. In the past two years, a draft

Albania E-invoicing Albania introduced a comprehensive fiscalisation model known as “Audit System” or “e-Fiskal” (fizkalizimi), a mandatory, real-time e-invoicing system in phases in 2021. This

Monaco E-invoicing Unlike its geographical neighbour, France, the sovereign city-state of Monaco has not introduced any regulation for the mandatory use of electronic invoices. The

Montenegro E-invoicing Montenegro is in the early stages of its e-invoicing journey. While the country’s Ministry of Finance signed an agreement with Serbia in 2023

Croatia E-invoicing Croatia is implementing a comprehensive e-invoicing and fiscal reporting system under the Fiscalization 2.0 framework. This system combines mandatory real-time reporting with e-invoicing

Liechtenstein E-invoicing While Liechtenstein has not introduced any mandates for electronic invoicing in the country, there are rules to be followed for voluntary e-invoicing. Liechtenstein

Chile VAT Compliance: An Overview for Businesses VAT compliance in Chile can be more resource-heavy than in other countries, largely because of the different tax

Lithuania E-invoicing While there is no B2B mandate in Lithuania, B2G e-invoicing has been implemented since 2017, and things have changed over recent years. Knowing

Latvia E-invoicing Latvia has been working towards implementing mandatory electronic invoicing for years. It has seen mixed success, with B2C e-invoicing being mandated while the

Cyprus E-invoicing Cyprus may not have mandated e-invoicing so far, but there are still rules and requirements you need to be aware of—especially given the

Malta e-invoicing While the Government of Malta supports and encourages the usage of electronic invoices, there is no mandate for e-invoicing in the country. The

Andorra E-invoicing Andorra is earlier in its e-invoicing journey than many other countries, but it still has some rules and requirements around electronic invoicing. In

Slovenia E-invoicing Slovenia is in the middle of its journey towards mandatory e-invoicing. It is already in place for B2G transactions, and the current plan

Belarus E-invoicing While B2B and B2G e-invoicing has been mandatory since 2016, Belarus is still working towards implementing electronic invoicing across a variety of transactions.

Estonia E-invoicing Estonia has been working on its electronic invoicing regulations for many years, mandating B2G e-invoicing since 2019. B2B is more complicated, however. This

Portugal E-invoicing Portugal, like every other country, is on a unique e-invoicing journey. While it was early in adopting digital reporting requirements, the country still

Luxembourg E-invoicing Luxembourg is on a typical trajectory regarding its e-invoicing adoption. It wasn’t an early mover, yet it already has a mandate in place—specifically

Austria E-invoicing While Austria does not have a full e-invoicing mandate in place for B2B and B2G transactions, it has systems and processes to encourage

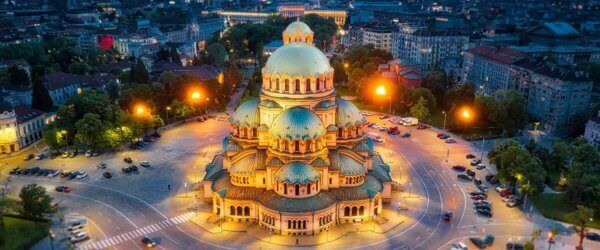

Bulgaria E-invoicing Based on the European Directive 2014/55/EU, Bulgaria has legislated the use of e-invoicing in public administrations to receive and process electronic invoices. However,

Ecuador VAT Compliance Ecuador has multiple tax mandates you need to be aware of, including its VAT regime. Your obligations may span multiple regulations, and

Czech Republic E-invoicing Like many countries, the Czech Republic has experience with e-invoices for the purposes of reducing administrative strain, reducing associated costs and greater

Hungary E-invoicing While Hungary does not explicitly mandate the issuance of electronic invoices for most transactions, the country’s real-time invoice reporting (RTIR) scheme applies to

Finland E-invoicing Finland has long worked to implement the electronic transmission of invoices, with the country’s digitisation journey beginning in 2008. Fast-forward to today, Finland

Indonesia VAT Compliance Value Added Tax (VAT) is a significant source of revenue for the Indonesian government. It applies to most goods and services at

Russia E-invoicing Russia regulates electronic invoicing nationwide, but its usage remains mainly optional. Only transactions involving certain traceable goods require buyers to issue e-invoices. Russia

Electronic invoicing in Ecuador Electronic invoicing in Ecuador, also known as Facturación electrónica, is mandated for established taxpayers. Like many Latin American countries, Ecuador was

Denmark E-invoicing Denmark has mandated the use of electronic invoices, though not in all contexts, since 2005 – making it an early adopter of the

Norway E-invoicing Norway is widely regarded as one of the more forward-thinking European countries when it comes to e-invoicing. Serving as one of the original

Ireland E-invoicing Ireland gave electronic invoicing the same legal weight as paper invoices in 2013. Since then, there have been no major developments regarding mandating

UAE E-invoicing The United Arab Emirates (UAE) introduced comprehensive e-invoicing legislation in 2025, with mandatory implementation set to begin in phases starting in January 2027.

Bulgaria SAF-T: Everything You Need To Know Bulgaria is on its way to introducing mandatory SAF-T reporting requirements for businesses, with implementation starting in January

Sweden E-invoicing As a pioneer in tax digitization, Sweden is one of the early adopters of electronic information exchange, with its journey starting in 2003.

Netherlands E-invoicing The Netherlands’ e-invoicing journey started in 2019 when all public authorities were obligated to receive electronic invoices from their suppliers. It is estimated

Switzerland E-invoicing Switzerland is on its e-invoicing journey, having mandated its use for transactions between suppliers and federal government entities since 2016. That said, electronic

Mexico VAT Compliance: An Overview for Businesses VAT compliance in Mexico requires in-depth knowledge of the country’s rules and future plans. It can take a

Belgium e-invoicing Belgium is gearing up to mandate e-invoicing for B2B transactions, having already introduced it for governmental transactions in 2024. It’s important to stay

New Zealand E-invoicing New Zealand began its e-invoicing journey in 2018 through a joint venture with Australia. While it’s far behind many other countries in

Australia E-invoicing Australia is on its e-invoicing journey. It has slowly been rolling out electronic invoicing rules and requirements since 2018, when it launched a

Colombia VAT Compliance: An Overview for Businesses Meeting your VAT obligations in Colombia is crucial to avoiding penalties and reputational harm. Each country has its

Peru VAT Compliance: An Overview for Businesses You may think complying with Peru’s VAT obligation is simple, but there is plenty to consider. Peru has

Electronic invoicing in Chile Chile has long been a leader in adopting electronic invoicing, starting in 2001 with voluntary adoption for taxpayers. Its status as

Brazil VAT Compliance: An Overview for Businesses Brazil has plenty of tax rules and mandates to consider, but compliance doesn’t have to be strenuous. Knowing

Argentina VAT Compliance: An Overview for Businesses Doing business in Argentina means meeting your tax compliance obligations. Adhering to requirements from multiple mandates, including both

Singapore E-invoicing While electronic invoicing is not mandated yet on any level in Singapore, the country’s tax authority is working on implementing a continuous transaction