Blog

What is the AIR system? Why do you need to know what this is? How does it relate to tax information reporting? These are common questions human resource (HR) professionals, employers and many other people are asking themselves as they prepare for the first year of mandatory Affordable Care Act (ACA) reporting. The AIR system […]

Recently, we’ve been examining the tidal wave of business-to-government regulations in emerging markets and their impact on business operations, including sales and procurement. Heavily involving both the accounts receivable and accounts payable teams, it’s clear that these mandates have significant implications on financial processes. However, recent legislation is adding a new operational unit to those […]

Sovos Compliance has been closely watching recent developments in the City of Chicago as it relates to the issuance of new guidance defining the proper scope of both their Personal Property Lease Transaction Tax as well as their Amusement Tax. Key rulings interpreting both taxes were scheduled to take effect on September 1, 2015. However, […]

Enterprise Resource Planning (ERP) driven business insight is critical for an effective finance operation, yet IT processes are not owned by finance, making it a necessity to align both functions. With important but very different specialized expertise between IT and finance, it can become a challenge to maintain common controls and provide accurate data to […]

Announcing the appointment of Andy Zupsic as COO and Jack Walsh as CFO Boston, MA. August 12, 2015 Sovos Compliance is proud to announce the additions of Andy Zupsic as Chief Operating Officer and Jack Walsh as Chief Financial Officer. Mr. Zupsic and Mr. Walsh bring additional depth to an already experienced and seasoned leadership […]

This summit will be held at the Kensington Close Hotel from 25th – 27th November. If you are involved in the indirect tax compliance process in SAP, we would like to extend to you an exclusive Invitation to join us at the conference at a 25% discounted rate. Some of the key learnings that you might […]

European Union: Applicability of VAT to Bitcoin Exchange Transactions On July 16, 2015, the Advocate General (“AG”) of the Court of Justice of the European Union (“ECJ”) delivered a recommendation regarding the applicability of VAT to foreign exchange of the virtual currency “Bitcoin” against conventional currencies. The AG concluded that the activity of exchange of […]

There has been a recent development in the evolution of global information reporting and the Common Reporting Standard (CRS) reporting requirements. On August 7, 2015, the OECD (Organization for Economic Co-operation and Development) released the first version of a CRS Implementation Handbook, which is meant to provide practical guidance to assist government officials and financial institutions […]

Peru published new legislation on August 3, 2015 that mandates electronic invoicing as the standard starting in 2016. Over the last few years, the SUNAT (Peru’s Tax Authority) has announced a number of e-invoicing waves; however, this latest legislation focuses exclusively on large and medium organizations classified as PRICOS (principal contribuyentes nacionales). Below is the […]

Offering another detailed webinar and supporting educational materials to help businesses with tax compliance and to mitigate new penalty increase exposure. MINNEAPOLIS, MN. AUGUST 12, 2015 On June 29, an update was passed to the Trade Preferences Extension Act. H.R. 1295 (now PL 114-27). This legislative change more than doubles the penalty per record from […]

Compliance with strict e-invoicing, finance and tax reporting legislation throughout Latin America is not a one-time, set-it-and-forget-it process. The pace of legislative change in this region is faster than ever as governments aim to expand the tax base and collect every penny, peso or reais they can. New mandates commonly move from initial legislation through […]

Most people are probably not aware that the taxability of a cruise ticket in New York depends on whether or not food or drink is included in the ticket price. For instance, many cruises offer “all-inclusive” tickets that include all of your meals and drinks in the ticket price. Some cruises offer tickets that simply […]

1099 filing penalties have recently doubled. On July 27, Law360 contributor Eric Kroh published an article featuring Sovos Compliance CMO Troy Thibodeau. The article focuses on the increased need for the government to raise revenue through stricter compliance enforcement of compliance rules, including the Trade Preferences Extension Act of 2015. This update affects not only all 1099 filers, but also […]

As business-to-government compliance mandates spread throughout Latin America and into the global economy, these countries are regularly introducing new ways to standardize and automate financial reporting and tax collections. New regulations often go well-beyond traditional e-invoicing, affecting even more business processes. Recently, we examined how these mandates add complexity to the sales process; this week, […]

As result of the passage of Law 72-2015, the indirect tax system of the Commonwealth of Puerto Rico is undergoing a remarkable transformation which is taking place over three distinct stages, culminating with a new Value Added Tax scheduled which will go into effect on April 1, 2016. Last week, our Tax Experts, Ramon […]

EU Court Rules E-Books Are Services, Not Goods – Update to previous post. Update 8/4/2015 Sovos Compliance has continued to monitor the repercussions of the ECJ’s decision in March and would like to report on some major developments since our last blog posting. In response to the decision of the European Court of Justice (ECJ) […]

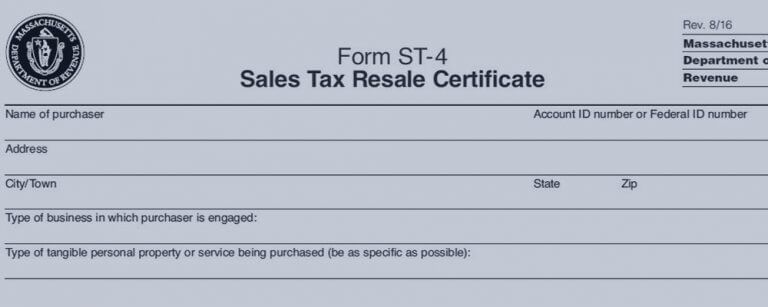

Managing your company’s exemption certificates can be a difficult process that many organizations find difficult to stay on top of. Exemption certificate management, or ECM, can be a large burden for companies who do not have an integrated solution, as employees frequently find themselves struggling to acquire, organize and manage these types of certificates. Exemption […]

Oftentimes organizations are unsure where to begin when it comes to unclaimed property processes and procedures. Check out this free eBook that provides a solid base to get your company on track when it comes to unclaimed property compliance. Download your copy today!