Blog

By Marc Sorini Marc Sorini is General Counsel for the Brewers Association. Prior to joining the BA, he represented small and independent craft brewers for over two decades as a partner with McDermott Will & Emery law firm, representing the BA and its predecessor organization, the Brewers Association of America (BAA). Sorini’s accolades include Go-To […]

EESPA, the European E-invoicing Service Providers Association, recently published EESPA Standard Definitions for Legally Compliant Electronic Invoicing and their usage. This document aims to provide a basis for e-invoicing service providers and their customers to agree on allocation of responsibility of the legal compliance of processes supported by the services. These standard definitions will contribute […]

Sales tax is a necessary evil for all businesses but you don’t want to spend more time thinking about it than you have to. Implementing the right sales tax technology solution can help your business continue to grow while ensuring you meet all sales tax obligations. Choosing an efficient, reliable, always-up-to-date solution will help you […]

Florida Governor Ron DeSantis signed SB 50 into law on April 19, which makes Florida the latest state to adopt economic nexus rules to impose a sales tax liability on remote sellers, including direct-to-consumer (DtC) shippers of wine. Unlike most other states, Florida does not currently require DtC wine shippers to assume a sales tax […]

Historically, the healthcare industry has experienced challenges in identifying and reporting unclaimed property. This is due to several reasons including a lack of clear statutory guidance, limited understanding of the potential unclaimed property liabilities which they are truly subject, and conflicting laws (i.e., refund recoupment, prompt payment, HIPAA, etc.). The fundamental understanding that healthcare entities […]

When are unclaimed property reports due? This is a fairly common question asked by holders that are new to the escheat reporting process, or not as well versed in the intricacies of escheatment reporting. Fortunately, Sovos has provided answers to some of the most frequently asked escheat reporting questions to help your organization survive unclaimed […]

Most unclaimed property professionals are familiar with the story of Verus Analytics, LLC’s (“Verus”)[1] appearance on the contract audit “field of play” some ten years ago, as it cut a swath across the life insurance industry with audits focused on the industry’s failure to report and remit unclaimed life insurance proceeds based on the insurers […]

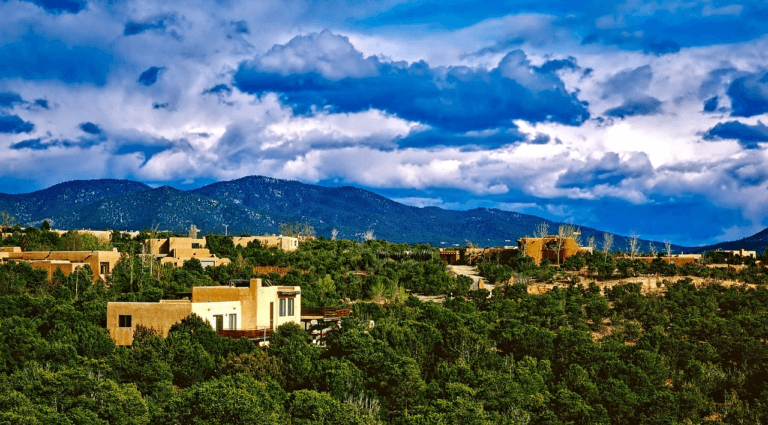

New Mexico is one of many states that updated its economic nexus following the South Dakota v. Wayfair, Inc. decision. With the passing of New Mexico House Bill (H.B.) 6, the Land of Enchantment adopted a sales tax collection requirement for out-of-state sellers and marketplace facilitators. The below outlines several of the major points in […]

There has been an interesting development from the Commonwealth of Massachusetts State Treasurer’s Office as they introduce a new wave of unclaimed property self-review invitations. Recipients of these self-review invitations have 30 days from the receipt of the letter to log into the state website to provide updated contact information. This timeline is shorter than […]

For the past 70 years, unclaimed property reporting requirements have been challenging for US businesses. Understanding the nuances of individual state statutes and how to comply effectively and efficiently has caused many sleepless nights for unclaimed property professionals. Well, that may be a bit extreme, however, state regulations are difficult to master. When the first […]

Taxpayers worried about complying with the new Massachusetts “Advance Payment” requirement, applicable to sales/use and room occupancy tax taking effect on April 1, 2021, should take note of a temporary safe harbor added to the final version of Technical Information Release TIR 21-4 published by the Department of Revenue on March 31, 2021. As previously […]

“Regulation always follows innovation, and sometimes, in democracies, it follows a little further behind other jurisdictions.” – Chris Giancarlo, CFTC Chairman Regulators at the IRS, SEC and CFTC have been playing catch-up for years, and in their defense, it’s not easy to hit a moving target. The digital asset ecosystem continues to grow exponentially and […]

North Carolina Sales Tax Nexus Following the South Dakota v. Wayfair, Inc. Supreme Court decision, North Carolina issued a policy directive (SD-18-6) indicating that it would be enforcing the imposition of tax on remote sellers under N.C. Gen. Stat. § 105-164.8(b). This directive was later codified in Session Law 2019-6. However, effective July 1, 2024, […]

As previously reported by my colleague, Erik Wallin, the Massachusetts Department of Revenue is set to start enforcing a new advance payment program applicable to sales, use and room occupancy tax. The requirements are detailed in a draft Technical Information Release and in an email sent to taxpayers on March 5. There are two critical changes […]

President Biden signed the American Rescue Plan Act of 2021 which included a variety of provisions aimed at helping Americans get through the aftermath of the COVID-19 pandemic. To help fund this most recent round of aid, Section 9674 of the Act includes a change to the Form 1099-K reporting threshold for Third-Party Settlement Organizations […]

As one of the more complicated administrative aspects of a retail business, sales and use tax filing processes are ripe for re-evaluation. Begin by asking yourself questions such as: Does my current solution do enough to make my life simpler? Do I get more out of it than I am putting in? Believe it or […]

Almost two decades ago when Bruce Respler joined Marjam Building Supply, one of the largest distributors of building materials on the East Coast, he was in charge of calculating and filing sales taxes manually. The company, which now owns 40 lumberyards, was only selling into a few states at the time. But even then, the […]

As reported here, a few weeks ago the Maryland Legislature enacted two bills impacting the state’s approach to tax in the digital economy. The first bill was a first-in-the-nation tax on digital advertising that is already being challenged in the courts on Constitutional grounds. The second, HB 932, while far less controversial, should not be […]