Blog

Each year there are hundreds of tax rules and rates changes and 2015 was no different. All over the US, changes are made every year about everything from rate changes to what is taxable and of course, sales tax holidays. Was your company able to keep up? The problem of having an incorrect rate active in […]

On September 18, 2015 and September 30, 2015, House Bill 97 and House Bill 117, respectively, were signed into law by North Carolina Governor, Pat McCrory. Together, these bills expand the sales tax base in North Carolina. This new expansion of the sales tax base will impact retailers who provide repair, maintenance, and installation services. […]

Alabama will be holding its fifth annual Severe Weather Preparedness Sales Tax Holiday at the end of this month, offering tax exemptions on qualifying items purchased between 12:01am (CST) on Friday, February 26, 2016 and midnight on Sunday February 28, 2016. During this time, purchases of items such as batteries, radios, flashlights, ropes, duct tape, […]

Are sales and use taxes making life difficult for your retail business? Do you know the full scope of your company’s sales and use tax obligations? There are a number of unique tax laws that retailers must know, stay up-to-date on, and abide by. Join Erik Wallin, Senior Tax Counsel at Sovos Compliance, to learn […]

If you buy a 50” flat screen TV in California, you might notice California Sales Tax is not the only additional charge on your invoice; there is also a $5 “eWaste” fee. Consumers can sometimes be caught off-guard by additional fees when checking out at the register, however retailers should always be aware of such […]

In mid-January the National Retail Federation held their 105th convention & expo at the Jacob K. Javits Convention Center in the heart of Manhattan. The event boasted over 33,000 attendees, 500 exhibitors, and at least one child-sized robot. Omnichannel, the New Philosophy The definitive unifying idea of the show was centered on the move to […]

The beginning of a new year signals a fresh opportunity to assess your sales and use tax purchase side process and Sovos is here to help ensure you are staying compliant. Consider the points below and ask yourself, what needs to change to be efficient, prepared, and compliant for this year. Do You Know Where […]

Sales and use tax compliance is complicated for all businesses, but this can be especially problematic when an organization is in the process of trying to grow. When expanding business into new and unfamiliar products and taxing jurisdictions, it is easy for important details on the tax compliance end to slip through the cracks. This […]

When the demands of retailers were highest, this Black Friday and Cyber Monday weekend Sovos delivered fast, accurate sales tax calculations so clients could reach their revenue goals. The last weekend of November can be a trying time for retailers. Every year there seems to be a bigger push for more extreme and extended sales […]

At the end of October, members of the Sovos Compliance Sales and Marketing teams attended Oracle OpenWorld in San Francisco, California. The conference, that consumed the Moscone Center both inside and out, was spread out over four days and included a wide variety of educational sessions, numerous high profile keynote speakers, and two exhibit halls […]

Collecting sales tax is not the focus of most companies. Even for businesses, people who learn the financial side of running a business, sales taxes can seem to be more of a nuisance than anything else. However, remember the old adage what you don’t know can hurt you. These are five sales tax gottchas that […]

Alabama Responds to Justice Kennedy’s Concurrence in Brohl: Voluntary Compliance Leading the Way to Economic Nexus in the Sales Tax World Alabama has enacted new rules to define when out-of-state sellers are required to charge sales tax and when they have the option to voluntarily opt to charge use tax on out-of-state sales. Both of […]

The Puerto Rican indirect tax system has gone through a remarkable number of changes during the last 10 years. Back in 2004, the expansion of the fiscal deficit of the Commonwealth and the cities of Puerto Rico started to become unbearable for the government and a serious source of concern for the international bond market. […]

End-of-summer sales tax holidays may be fun, helpful and welcome to consumers, but they are no picnic for the tax departments of retailers. For different periods in July and August of this year, consumers in 19 states saved money by not having to pay sales tax on certain items. It is also not a coincidence […]

For those of you responsible for sales tax compliance in the retail industry, the month of August can be somewhat challenging. As detailed in previous blogs and in our Sales Tax Holiday infographic, the complexity associated with making sure your stores process transactions correctly during all applicable sales tax holidays requires retailers to expend significant […]

Louisiana has a sales tax at both the state and the parish (county) level. The state rate is 4%, while the parish rates vary. In most states, the locals mirror the exemptions provided by the state, which makes compliance a bit easier. Louisiana is not one of these states. The parishes in Louisiana follow the […]

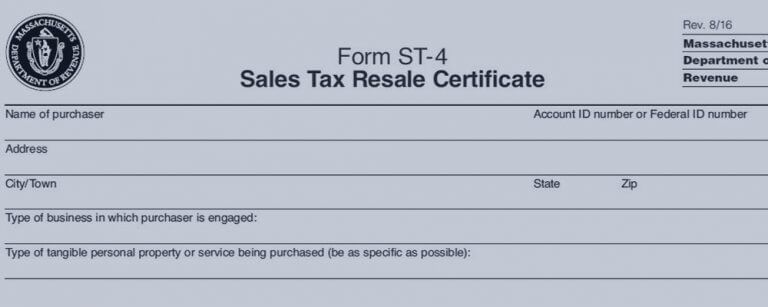

Managing your company’s exemption certificates can be a difficult process that many organizations find difficult to stay on top of. Exemption certificate management, or ECM, can be a large burden for companies who do not have an integrated solution, as employees frequently find themselves struggling to acquire, organize and manage these types of certificates. Exemption […]

If you live in a state with a Sales Tax Holiday, you know how exciting it can be. Stores beef up inventory of the affected items, shoppers get their mega-shopping lists ready, and it’s a race to the register. All this is in an effort to save an average of a few dollars per transaction. […]