This blog was last updated on February 1, 2022

As a result of the 2020 Finance Law implementation, which transfers the management and collection of import VAT from customs to the Public Finances Directorate General (DGFIP), France has implemented mandatory reporting of import VAT in the VAT return instead of having the option to pay through customs as is typically the process. This change came into effect on 1 January 2022, with additional VAT reporting changes in France, including the Declaration of Exchange Goods (DEB) split where the Intrastat dispatch and EC sales list are now separate reports.

This new import procedure is mandatory for all taxpayers identified for VAT purposes in France. Registered taxpayers may no longer opt to pay import VAT to customs and must report all import VAT via the VAT return. This is a departure from the prior process, where taxpayers needed to receive prior authorisation to implement a reverse charge mechanism to pay import VAT through the VAT return. Now, this process is automatic and mandatory, and no authorisation is required.

Consequently, taxpayers with import transactions into France must now register for VAT purposes with the French tax authorities. Additionally, the French intra-community VAT number of the person liable for payment of import VAT must be listed on all customs declarations.

Changes to the VAT return

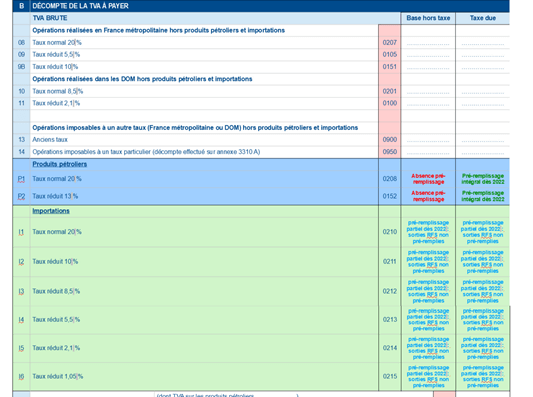

Changes to the French VAT return include (see Figure 1):

- New fields to report import VAT and petroleum products

- New numbering system for most of the return

- Pre-filled information on imports – lists the amount of import VAT collected from customs items previously declared to the Directorate-General of Customs and Indirect Taxes (DGDDI). Taxpayers will have the ability to edit the pre-filled import amounts before submission

- Pre-filled information will be populated from the 14th of the month following the due date

- VAT returns containing import VAT will be due the 24th day of the month following the filing period

Impact on Taxpayers

From 31 December 2021, “foreign traders” who imported goods and then made local sales under the domestic reverse charge are now required to register as a result of the import portion of the transaction and will still apply the reverse charge to their sales. This will now require a new VAT declaration to be submitted.

Additionally, until 31 December 2021, a foreign company that imported goods into France and made local sales under the reverse charge had to recover the import VAT paid under the Refund Directive (EU companies) or the 13th Directive (non-EU companies). For Refund Directive claims, there would have been a cash advantage for France because either companies did not submit claims (small value) or because claims were rejected for non-compliance. For claims under the 13th Directive and the two previous considerations, there was also the issue of “reciprocity” which prevented claims from some counties such as the US, for example. Under the new regime, all import VAT is reclaimed, leading to a potential budget shortfall.