This blog was last updated on March 11, 2019

The Supreme Court’s decision in South Dakota v Wayfair no longer limits states to the “physical presence” standard previously required to impose tax collection and remittance responsibility on a business. The new state nexus standards now look to criteria other than physical presence in evaluating a seller’s connection to that state. For example, South Dakota’s standard looks at revenue earned by sales to in-state customers ($100,000) or the total number of in-state transactions (200).

This is not only impacting many tax and finance teams but also has significant impact on IT teams, who often have just as much skin in the game to ensure their businesses are keeping up with sales and use tax compliance obligations.

Understanding which states have enacted (or are about to enact) economic nexus standards, how those standards are articulated in each state, and having the systems and processes in place to keep up with changes is the key to maintaining tax compliance.

Survey reveals top IT tax compliance burdens

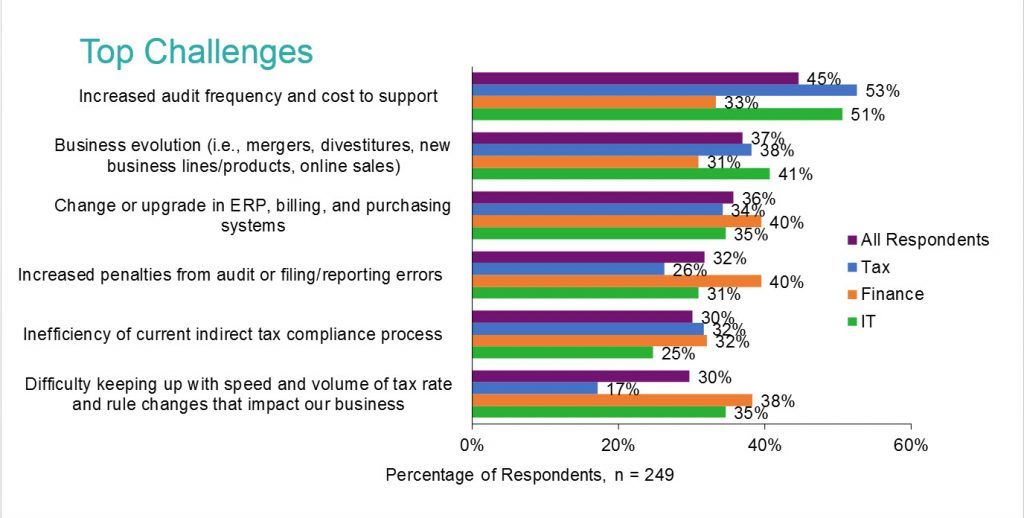

Recent surveys conducted by the Aberdeen Group show that, before Wayfair was even decided, IT teams were already inundated with an increase in audit frequency and the time spent responding to tax auditor requests and notices. Survey respondents indicated each as their top challenge and biggest drain on resources in the sales and use tax process. According to the results, IT typically spends 49.6 hours per month, per employee, dedicated to supporting the sales and use tax process. This includes software updates, maintenance, data reconciliation, filing and audit support.

What are your top two biggest challenges in sales and use tax compliance?

WayFair economic nexus impacts on IT teams

Business innovation and evolution through mergers and acquisitions, the introduction of new products and services, and moving to an ecommerce or more omnichannel business model are just a few of the challenges IT teams continue to face when managing sales and use tax initiatives.

How current and acquired financial systems manage the aggregation of tax information from multiple data sources, including ERP, POS, ecommerce, purchasing and customer relationship management software, will factor heavily into how much time and money is spent with data reconciliation between IT and tax and finance teams. For businesses with new international affiliations selling into the United States, the implications of Wayfair economic nexus thresholds may be significant depending on the number of transactions from each relevant state and jurisdiction. What was once a task that required 50 hours a month may multiply exponentially.

Businesses face challenges on the accounts payable side of the house as well, regardless of how well their own employees, internal controls, systems and workflows are set up to manage supplier invoices. Consider a situation where a business purchases new laptops and software for its newly acquired employees and contractors across the United States. Suppliers can often incorrectly assess use tax on businesses purchases that go unnoticed for lack of resources to review every single invoice. Wayfair rules and regulations may have changed in a particular state in the span of a few weeks or months, causing additional errors and delay in completing a customer order, or impacting cash flow in the ensuing months.

Reducing IT’s burden from Wayfair with sales tax software

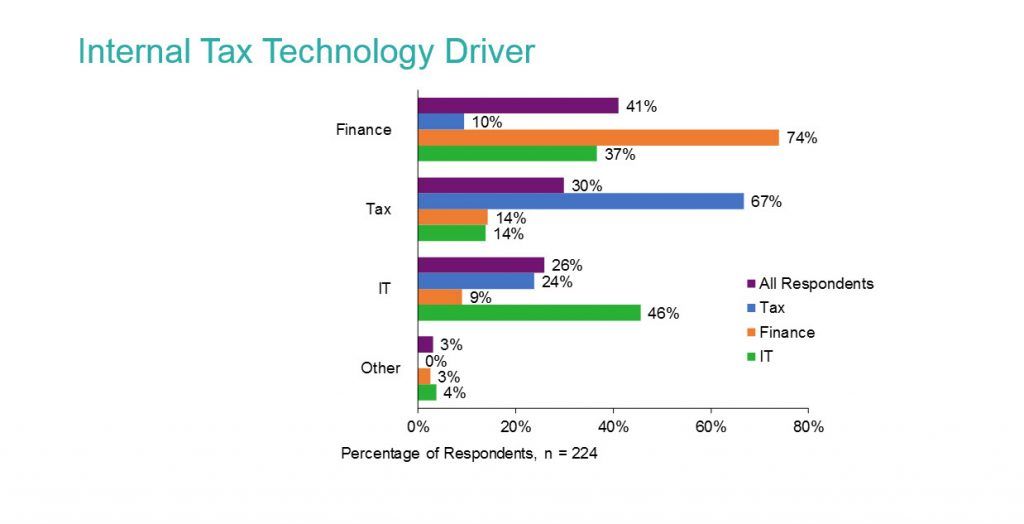

While nearly half of IT teams surveyed agree to have equal responsibility driving tax technology purchasing decisions within their organization, none would agree that they want to be directing more time and resources at manual sales and use tax efforts. Helping tax and finance teams aggregate data from multiple systems only distracts from those digital transformation projects that improve customers’ user experience or improve operational excellence. As businesses move to the cloud and upgrade legacy ERP systems, an opportunity exists for IT to make tax a part of the digital financial core and automate processes to reduce a tax team’s reliance on IT.

Who typically drives the tax technology purchase decision in your organization?

Take Action

Download the IDC MarketScape brief to learn about South Dakota v. Wayfair and other drivers of sales and use tax compliance software and how Sovos brings value to those looking to Solve Tax for Good.