VAT Digitization in Eastern Europe

A Quick Guide to E-invoicing and Real-Time Reporting

Tax regulations in Eastern European countries are complex but that shouldn’t be a reason not to do business there. If you’re responsible for VAT compliance, this ebook provides key details of the varying VAT digitisation mandates and business requirements across the region:

A Quick Guide to E-invoicing and Real-Time Reporting

Tax regulations in Eastern European countries are complex but that shouldn’t be a reason not to do business there. If you’re responsible for VAT compliance, this ebook provides key details of the varying VAT digitisation mandates and business requirements across the region:

- Understand how to comply with the e-invoicing and reporting in Eastern Europe

- Deep dives into Hungary, Poland, Romania, Serbia and Slovakia

- Must-read for tax professionals and consultants

Get the ebook

Who should read this ebook?

Tax professional

- Need to be up to date with Eastern European regulations

- Understand system requirements for real-time reporting and e-invoicing

- Prepare and future-proof for upcoming tax digitization

Consultancy

- Ensure best practices for clients

- Keep up to date with latest regulations and developments

- Confidently navigate the tax landscape to help clients with planning

Written by tax experts and regulatory specialists

Tax administrations continue to insert themselves into the invoicing process or demand detailed records within a matter of hours or days of transactions. Many have introduced continuous transaction controls (CTCs)and are seeing the benefits of closing their country’s VAT gap and gaining granular, real-time or near real-time insight. Eastern Europe is part of this trend, moving forward rapidly with real-time reporting and e-invoicing initiatives.

The challenge of VAT digitization in Eastern Europe

Each Eastern European country has a different approach to CTCs. These differences could extend further as mandates evolve and businesses have to deal with new filing formats like SAF-T and real-time reporting to stay tax compliant. Understanding the varying demands of VAT compliance is key for any business operating in or looking to expand into the region. With this guide you’ll gain a greater understanding of the requirements across the region. Our deep dive into key countries will help you comply with VAT regulations now and prepare for upcoming mandates.

What this guide to Eastern Europe e-invoicing and reporting compliance covers

Get our guide for a comprehensive picture of CTCs in Eastern Europe and the many requirements that vary country to country. This includes invoice format, connectivity, data requirements, how to submit, archiving, legacy systems, technologies and business processes-all of which need to be reconsidered and rewired to be compliant. We also conduct extensive reviews of key Eastern European economies as well as uncover what’s on the horizon in one of the most important countries in the region, Slovakia:

The CTC landscape in Eastern Europe is constantly evolving, with countries at different stages of their journeys.

The Czech Republic, Austria, Croatia and Montenegro all currently allow post-audit invoicing.

Countries that have already implemented CTC regimes (either e-reporting or e-invoicing) where paper invoicing is still possible include Hungary, Albania and Greece.

In some cases, such as in Slovenia and Bulgaria, there are CTC schemes planned but details have yet to be specified.

Others have outlined their specifications and implemented voluntary schemes. Our guide covers some of these countries, providing details about the scope, document flows, key requirements and timelines of their regimes.

Romania –A sneak peak

There are three requirements for taxpayers in Romania:

- Mandatory e-invoicing for B2G transactions

- Mandatory e-invoicing for high-risk products

- Electronic transport mandate

Taxpayers are required to use the Romania e-transport system to issue an e-transport document regarding the transport of high fiscal risk products before transportation of goods begins. This includes data regarding the sender, recipient, goods, places of loading and unloading and details of the means of transport and carrier.

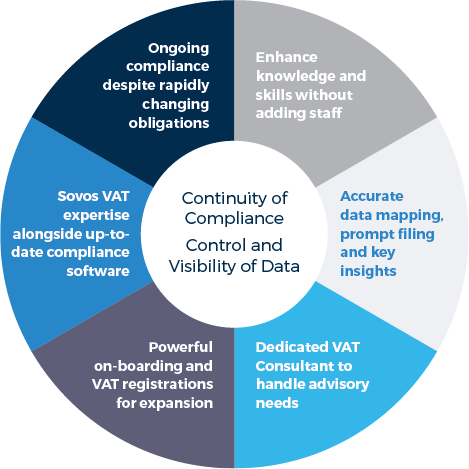

Sovos provides a cost-effective, secure, global solution capable of withstanding disruption prompted by the worldwide CTC trend.

Our unique cloud solutions keep you compliant in 60+ countries and our tax experts ensure your business complies with the latest regulations and their requirements.

Market-leading 40+ year history in global regulatory monitoring and analysis

One vendor, one technical interface

Embedded in 60+ partners (SAP, Ariba, Coupa, IBM and more)

Simple API for plug-and-play interoperability

Evolves with your technology and process choices

Sovos’ VAT Compliance Solution Suite includes both CTC reporting and CTC e-invoicing as integral components of a fully scalable solution suite and includes Sovos Periodic Reporting, VAT Determination, SAF-T and Sovos eArchive.