Blog

As far back as the 1940s, Coca-Cola used the tagline “It’s the Real Thing” to advertise its famous beverage. The company could just as easily been talking about e-archiving or, at least, answering the question electronic archiving systems have to answer about electronic invoices. E-archiving is not just storage. Storage is part of what a […]

Scope and timeline Croatia is one of the few countries in Europe to have chosen to mandate the use of e-invoicing in public procurement processes as outlined in Directive 2014/55/EU and within the transposition deadline of April 2019. The Croatian mandate covers both the issuance and receipt of e-invoices in B2G transactions. Other countries – […]

On 15 February 2019, Portugal published Decree-Law 28/2019 regarding the processing, archiving and dematerialization of invoices and other tax related documents including: The mandatory use of certified invoicing software General requirements for paper and electronic invoices Dematerialization of tax documentation Archiving of tax documentation (including ledgers, etc) Adjacent tax rules and obligations The decree aims […]

What is Esterometro? The Italian government’s e-invoicing mandate became effective on 1 January 2019. While cross-border invoices are exempt, all domestic B2B and B2C invoices must be cleared through the SDI platform. This means that the Italian government and tax authority now have real-time access to the data of all B2B and B2C VAT transactions […]

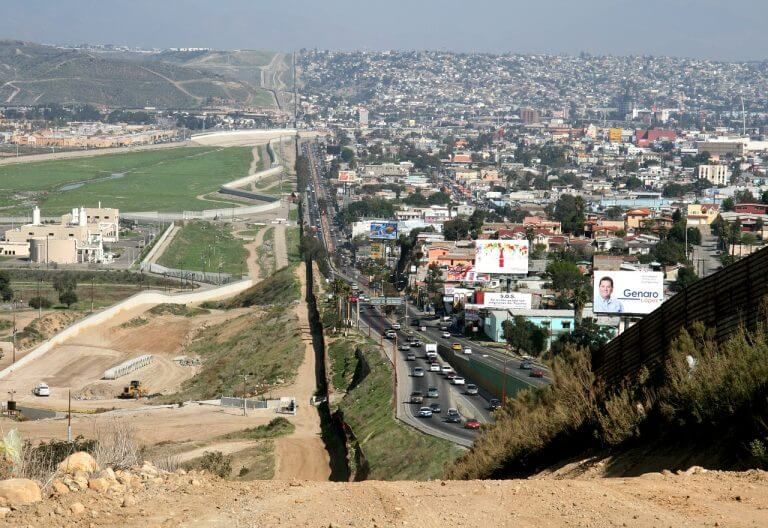

Mexico has overhauled its e-invoicing requirements in recent years, and while businesses of all kinds have had to adapt, keeping up with changes is particularly important for maquiladoras. Maquiladoras are manufacturers, often with factories near the border with the US, which have a special designation from the Mexican government that allows them to import materials […]

Most enterprises already have one or several solutions for storing electronic data and documents. However, those systems might not meet compliance requirements for storing original electronic invoices and similar legally critical documents. Here is a brief guide to some of the prominent international requirements for acquiring a compliant e-archiving system. Compliance maintenance Regulatory monitoring and […]

There is no doubt that the roll out of the Italian clearance e-invoicing mandate has kept the e-invoicing market and local taxpayers on their toes. Compliance with the mandate’s legal and technical requirements is not an easy task to fulfil. Consequently, taxpayers of different sectors of the economy, as well as different stakeholders of the […]

No global e-invoicing strategy is complete without functionality for e-archiving. In fact, far from being an afterthought or add-on, e-archiving should be at the core of any organization’s e-invoicing plans. There are a few reasons why: E-archiving makes up a large percentage of a global e-invoicing strategy If a government wants to audit an organization’s […]

As global enterprises further their digital transformation initiatives to move financial applications to the cloud, many are at a crossroads with how they choose a deployment strategy that consolidates disparate financial and other departmental solutions and processes. Many organizations that consolidated under the auspice of a single enterprise resource planning (ERP) solution to combine administrative […]

2018 was a volatile year in indirect tax compliance for tax, finance and IT professionals worldwide. With an increase in globalization and tax gaps surpassing tens of billions in some countries, it’s not surprising that one of the biggest challenges governments are addressing is revenue collection. Like enterprises, governments are creating new, technology-driven processes to […]

The Decree 119/2018, first published in draft in late October of this year in Italy, has now been converted into law, but with a number of changes to its content. The main changes to the previously published version of the e-invoicing rules of this decree are: Extension to the grace period for delays in the […]

With electronic invoicing sweeping Europe and much of the rest of the globe just as it did Latin America, organizations need to be prepared to meet the challenges of new mandates. The 2018 Sovos TrustWeaver global e-invoicing eBook leaves absolutely no stone unturned in offering the most comprehensive information and analysis available regarding e-invoicing compliance. […]

Los cambios relacionados con el nuevo proceso que permite anular facturas electrónicas en México no son triviales, ya que repercuten de manera importante tanto en las operaciones de las AP (cuentas por pagar), como en las AR (cuentas por cobrar). El nuevo mandato, que pretende llenar el gran vacío que hasta ahora existía en la […]

More than six months ago the Greek authorities announced their intention to introduce mandatory e-invoicing and e-bookkeeping rules, and enough information is now available to assess what the proposed rules will mean for Greece. Although formal legislation has yet to be published, it’s expected the new e-invoicing measures by the Independent Public Revenue Authority, the […]

Mandated e-invoicing and tax reporting requirements in Latin America make SAP implementations in this region more complex than anywhere else in the world. Here, we examine the Top 10 Hurdles to Implementing SAP in Latin America: 1. Consistency Consistency between transactional invoices and accounting reports is essential. Any slight discrepancy triggers audits and fines, which […]

SAP Central Finance delivers on the promise of pulling data from multiple sources into a single view for reporting and analysis. Channeling disparate data sources into a single source of truth can be massively valuable to organizations, especially those that have a sprawling number of billing, accounts payable and general ledger components, or even multiple […]

La autoridad fiscal de Colombia, DIAN (Dirección de Impuestos y Aduanas Nacionales), anunció esta semana el retraso a su mandato de facturación electrónica para todas las empresas, exceptuando a los mayores contribuyentes que operan en el país. La DIAN había declarado previamente que todas las compañías que pagan IVA en Colombia tendrían que adaptar el […]

Colombia’s tax authority, the DIAN, announced this week that it is delaying its e-invoicing mandate for all but the largest taxpayers operating in the country. The DIAN had previously said that all companies that pay VAT in Colombia would have to adopt mandatory e-invoicing by Jan. 1, 2019. However, the DIAN this week said that […]