Blog

Marketplace sales tax laws are being used by states as an additional means to collect more sales tax revenue from remote sellers on marketplaces like Amazon, eBay, Etsy, and WalMart. These online marketplaces and the rules being introduced to compel marketplace tax compliance have introduced new sales tax collection and remittance questions and complexity. According […]

With more companies focusing on global integration, cross-border supply chains and expanding ecommerce, governments across the globe are introducing new ways to enforce tax rules and close their tax gaps. The evolving global regulatory environment produces unique tax determination and reporting challenges in the United States and additional VAT and e-invoicing compliance challenges around the […]

In December 2018, the state of Colorado made substantial changes impacting the sales tax collection and remittance requirements imposed on both in-state and remote sellers. The state extended a grace period for companies to comply with these requirements through May 31, 2019. Beginning June 1, 2019, under the new rules, most companies will be required […]

Pawel Smolarkiewicz, chief product office at Sovos, will speak on the digital transformation of tax and its effect on SAP S/4HANA at next week’s SAPPHIRE conference in Orlando. As countries make continuous tax compliance the new normal, businesses are finding that they have to respond by putting tax compliance functionality at the core of […]

SAP Central Finance is driving migration to SAP S/4HANA as companies look to deliver value to their finance and accounting organizations, as well as improve on the configuration of previous financial systems. And for most companies making the transition, tax compliance is a priority. In a recent survey by SAP Insider, 74 percent of SAP […]

SAP S/4HANA is the promised land for SAP customers: an entire suite of ERP functionality in one place with a single data store. The ability to run all ERP capabilities, both from SAP and non-SAP systems, from a single source represents delivery of a model IT professionals and SAP administrators have sought for years. Getting […]

Sovos has been named a ‘2019 Provider to Know’ by Spend Matters for innovation in procurement. Spend Matters released its 6th annual “50 Providers to Know/50 Providers to Watch” lists today in conjunction with the annual ISM conference, naming Sovos as one of its 50 Providers to Know for 2019. The recognition highlights Sovos’ Intelligent […]

On March 21, Sovos and Deloitte Tax LLP teamed up on a webinar, “The Speed of Sales Tax – How to Stay Ahead of Changing Regulations in 2019,” discussing trends in sales tax compliance that will impact tax professionals’ day-to-day processes and work. Below is a brief recap of the major trends that were discussed […]

The digital transformation of tax around the globe is putting enormous pressure on NetSuite-driven businesses large and small looking to confidently expand into new markets, launch new products and services and adapt as global regulatory compliance demands become more complex and real-time. This new business complexity puts an additional onus on tax and IT teams, […]

Marketplace facilitators and payment processors find themselves in the global tax compliance crosshairs. While approaches may differ across the globe, one of the defining trends in indirect tax over the last few years has been the effort to expand the number of types of businesses responsible for collecting tax. However, one of the challenges associated […]

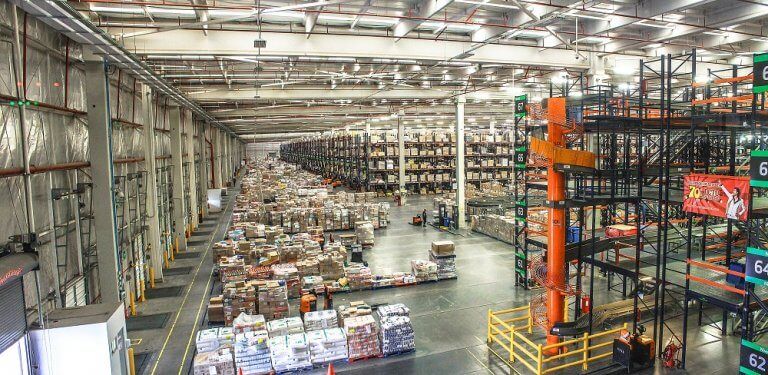

Launched at SAP Ariba in March of 2018, Sovos Use Tax Manager, a cloud-based solution that automates use tax determination reconciliation on purchases to accurately self-assess and accrue tax for proper filing, is one of the few innovations in sales and use tax compliance that is focused on improving your procurement process by eliminating invoice […]

Sovos recently announced that its solution for real-time and batch tax determination, Global Tax Determination, has achieved SAP certification as integrated with SAP S/4HANA®, meaning it integrates with SAP S/4HANA using standard integration technologies. The integration helps organizations provide appropriate tax calculation in both purchasing and sales processes, keeping businesses ahead of increased disparity in […]

The Chief Procurement Officer may not be the first employee that comes to mind when the acronym CPO is used, yet over 100 of them joined Ardent Partners in Boston a few months ago at the CPO Rising 2018 Summit to exchange and improve the procurement function through innovation and thoughts around P2P, accounts payable […]

The Supreme Court’s decision in South Dakota v Wayfair no longer limits states to the “physical presence” standard previously required to impose tax collection and remittance responsibility on a business. The new state nexus standards now look to criteria other than physical presence in evaluating a seller’s connection to that state. For example, South Dakota’s […]

Sovos being named a “Leader” in the IDC MarketScape: Worldwide Sales Tax and VAT Automation Applications 2019 Vendor Assessment is a validation of its current and future product and business strategy. For those who are less familiar with IDC and its vendor evaluation process, or who are more familiar with the Gartner Magic Quadrant or […]

It is the “other” tax, the one that doesn’t generally get the attention that income tax gets. But use tax can be full of nasty surprises for financial institutions (FIs) that don’t have it under control. With jurisdictions cracking down with audits, developing processes to handle use tax is becoming a significant concern for financial […]

Earlier this week, IDC released its first-ever MarketScape Report, “IDC MarketScape: Worldwide SaaS and Cloud-Enabled Sales Tax and VAT Automation Applications 2019 Vendor Assessment,” focused on global tax compliance software, signaling two things at a crucial moment in the digital transformation of tax: Modern tax technology is an important part of the digital financial core […]

As global enterprises further their digital transformation initiatives to move financial applications to the cloud, many are at a crossroads with how they choose a deployment strategy that consolidates disparate financial and other departmental solutions and processes. Many organizations that consolidated under the auspice of a single enterprise resource planning (ERP) solution to combine administrative […]