Among the main changes and regulations established by the resolution are:

Technical Annex 1.9 of the electronic sales invoice

• It incorporates new fields and validations for generation and transmission, as well as for registration as a security in the RADIAN.

• It establishes that the subjects obliged to invoice must adopt this version within 3 months of its publication.

Electronic Equivalent Document (EED) and its Technical Annex 1.0

• The electronic equivalent document is defined as a document that contains the information of a commercial operation carried out by a subject not obliged to issue an electronic sales invoice, that complies with the legal requirements and that is generated and transmitted electronically through a technology provider authorized by the DIAN.

• It must be implemented by the obligated subjects in accordance with the dates indicated in the calendar:

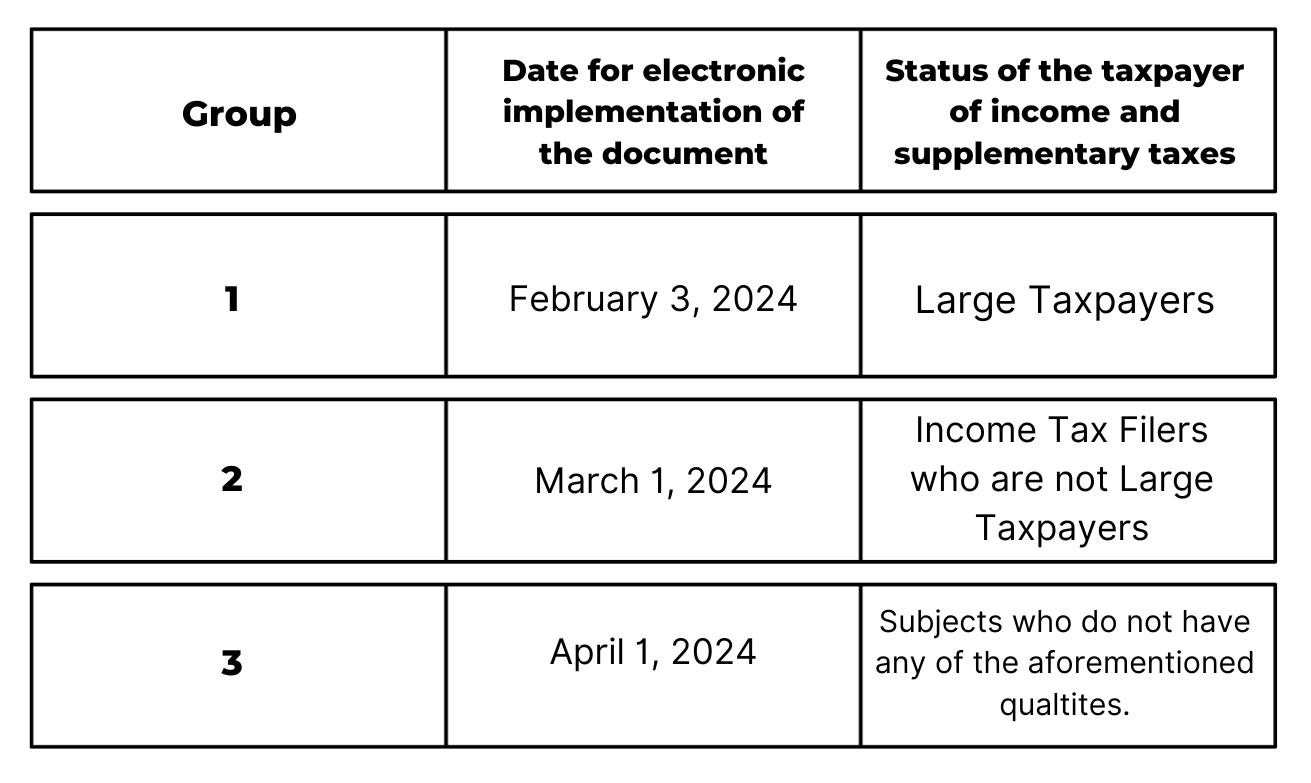

Implementation schedule for the equivalent electronic document cash register ticket with P.O.S. system, according to the status of taxpayer in relation to income tax and complementary taxes:

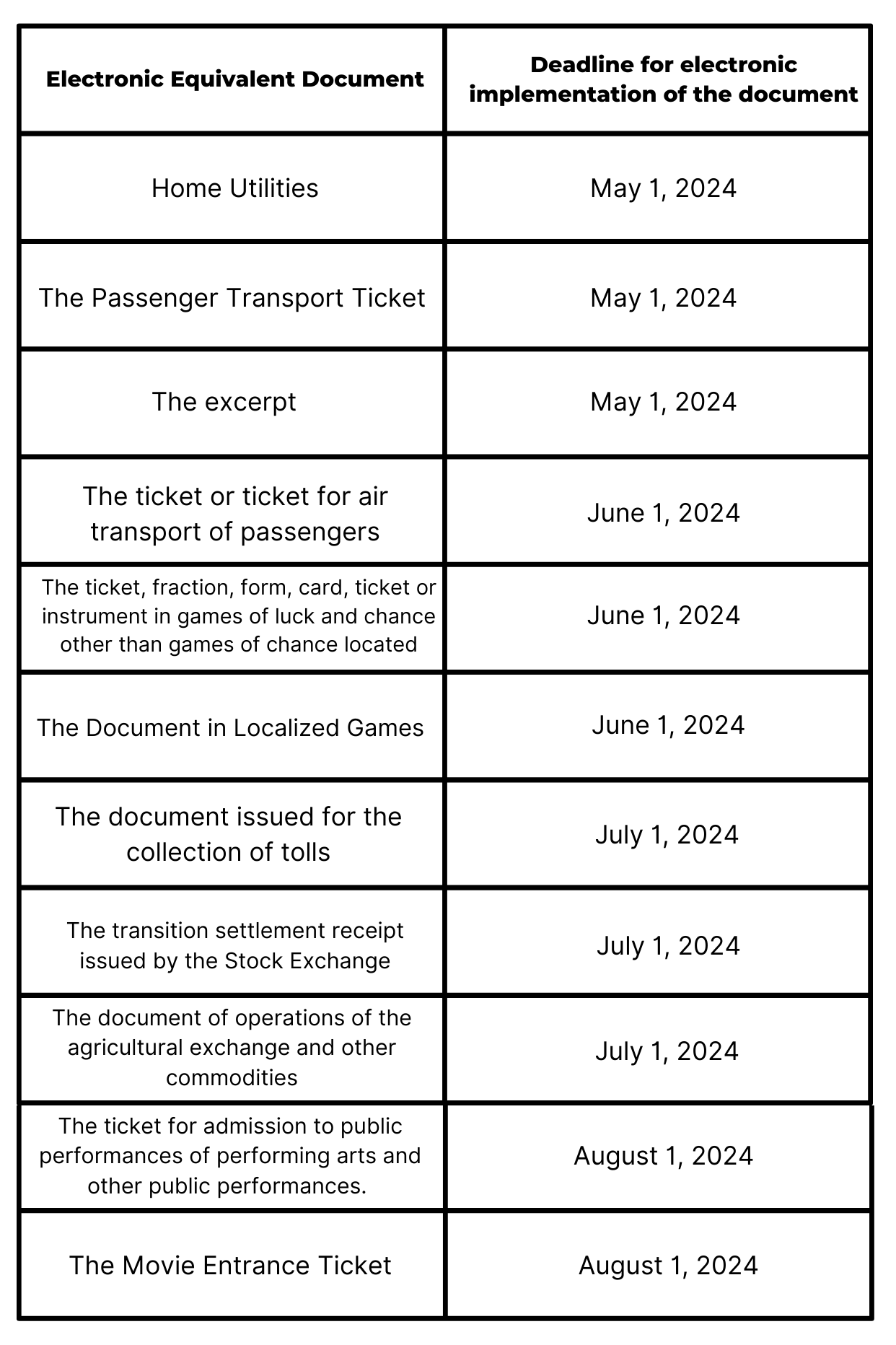

Other equivalent documents:

Adjustment notes are included for the electronic equivalent document, which are created as a mechanism for cancelling or correcting it.

Electronic sales invoices issued on a contingency basis.

• The deadline for issuing them is extended until December 31, 2023.

• Obligated subjects must report to the DIAN within two business days following the issuance of this type of invoice.

Electronic sales invoice related to the discrimination of taxes on ultra-processed sugary beverages and the tax on industrially ultra-processed food products, among others.

• The discrimination of the taxes on ultra-processed sugary beverages and the tax on industrially ultra-processed food products AND/OR with a high content of added sugars, sodiums or saturated fats may be discriminated against in terms of the electronic sales invoice annex version 1.8 until November 30, 2023. As of December 1, 2023, the discrimination of this tax must be carried out under the terms contemplated in the technical annex of electronic sales invoice version 1.9.