Understanding European VAT Compliance

Your guide to making VAT compliance simple

There are many elements to understanding European VAT compliance; our tax experts continually review regulations, compliance rules and tax authority updates to understand VAT requirements across Europe and beyond. This e-book is the result of their research and is ready for you to download. It’s ideal for anyone involved in VAT compliance who is keen to learn more.

- Helps you to understand VAT

- Covers over 40 jurisdictions within and outside the EU

- Download for free

Navigating cross-border and understanding European VAT compliance can be complicated. With requirements varying from country to country it’s important to be prepared for any upcoming changes to ensure continued compliance. The digitization of VAT continues, and our guide will help you understand and be ready for changes including SAF-T, e-invoicing and continuous transaction controls (CTCs).

Quick Links

Minimise compliance risks

Essential VAT Guide

Including latest VAT trends

What this guide to understanding European VAT compliance covers

The guide provides information on understanding European VAT compliance including some of the biggest trends in VAT – CTCs and e-invoicing. We also look at some of the more complex VAT requirements including Intrastat, supply chain management, the EU e-commerce VAT package and VAT for events – all in one easy to understand e-book:

- What is VAT?

- The global tax landscape

- VAT reporting

- What is SAF-T?

- What are CTCs?

- Optimising supply chain management

- The EU E-Commerce VAT Package

- What is Intrastat?

- VAT for events

- Global and Europe VAT reporting requirements

- How Sovos can help

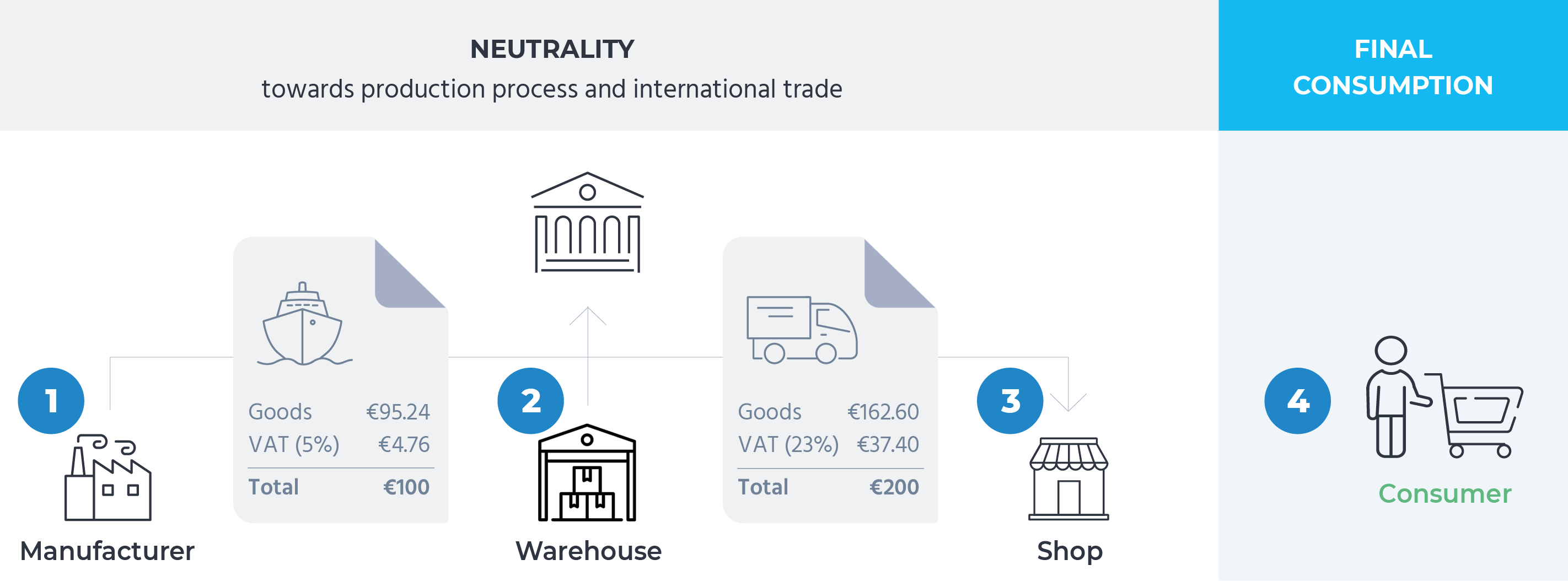

What is VAT compliance?

VAT compliance means ensuring that VAT is applied and submitted in the correct format and by the relevant deadline to the relevant tax authority.

Each Member State has its own VAT invoicing and reporting requirements. Member States have been introducing e-invoicing, continuous transaction controls and SAF-T, all requiring specific data and formats to submit to the tax authority.

VAT requirements continue to change so it’s important to be aware of upcoming regulations and prepare in advance to remain compliant with the latest requirements.

What is a VAT number in Europe?

To obtain a VAT number a company must register for VAT in the EU. Registering for VAT in the EU remains a complicated task, with each Member State having bespoke processes and procedures to obtain a VAT number. VAT reporting includes many elements, from registration to fiscal representation and filing returns. This guide explains the VAT reporting process, as well as upcoming changes that organisations should be aware of to remain VAT compliant.

Need help with VAT compliance now? Get in touch

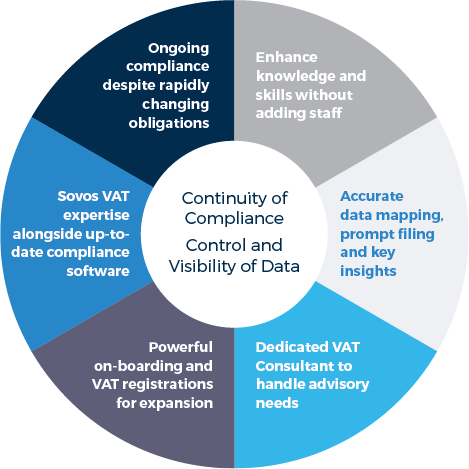

End-to-end, technology-enabled VAT Managed Services ease your compliance workload and mitigate risk wherever you operate today while ensuring you’re ready to handle the VAT requirements in the markets you intend to dominate tomorrow. Get in touch with our sales team now.

- Registration – guidance on country-specific registration requirements to avoid delays

- Audits – minimise management time, fees and exposure to penalties or interest

- Filing VAT returns – ensure VAT returns are in the correct format and include information required by tax authorities

- Managing VAT changes – navigate changes to minimise risk and ensure continued compliance with the latest regulations and updates

- Consultancy services – always on-hand to advise and help with queries of any complexity

Give yourself VAT compliance peace of mind.

Ease your VAT compliance workload and mitigate risk wherever you trade with Sovos’ complete end-to-end offering, enabled by our comprehensive software, helping you stay up to date and reducing the burden on your team.