This blog was last updated on June 27, 2021

The Hybrid Cloud Compliance Model Eliminates Failure Points and the Need for Constant Monitors

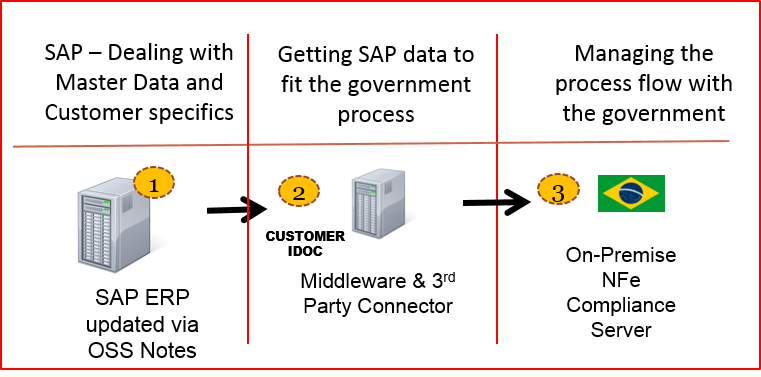

As we continue to examine the benefits of leveraging a hybrid cloud model for Latin American e-invoicing compliance in preparation for the transition to Nota Fiscal (NFe) Version 3.1, let’s take a look at the traditional failure points that can be found in the typical NFe architecture.

Typical corporate compliance architectures were developed as IT teams faced three distinct realities:

- Corporate IT desired to centralize all financial processes on a common SAP ERP platform and replace local ERP solutions for consistency and controls.

- Because many multinationals achieved growth by acquiring companies in Brazil, there were legacy systems already in place. With the centralized SAP transition, the standard operating procedure was to integrate the existing local compliance system. This created an integration project that was often outsourced to local consultants.

- Many companies use a common SAP maintenance strategy known as (N-1), meaning they stay one support pack back from the latest release. Often multinationals are many service packs behind because applying OSS notes to a highly customized and configured SAP systems is a significant undertaking.

With these three factors in play, companies are usually left with three distinct silos of support and change management, equating to three (or more) potential failure points each with their own support teams:

Layer the day-to-day support and constant change management that Latin American compliance requires on top of these silos, and you’ve got a complex, expensive and time-consuming compliance infrastructure.

Problems can occur in any functional area, requiring a “search and rescue” mission as teams first have to find the problem and then have to identify the functional area that needs to fix it, which may involve:

- The SAP support team

- The middleware support team or the 3rd party system integrator that built the connector

- The local e-invoicing solution support

As this “search and rescue” mission takes place, shipping is delayed, or worse, shut down. Many companies experience shut downs for 3-7 days a year when on-premise solutions stop working due to technical issues or government changes.

Luckily, there is a better way. When you consider the potential issues and the overall cost to support these three components, it’s apparent why the constant changes in 2015 represent a good time to consider managed service providers that implement, monitor and maintain all three components as a complete end-to-end solution. Wouldn’t it be nice to pick up the phone and call one expert, rather than going on “search & rescue” missions to find and fix the problem every time there is an error?

Sovos’ hybrid cloud model lets your company benefit from significant local expertise, lessons learned and economies of scale. After all, why try to manage something individually that is the same for all companies operating in Brazil?