This blog was last updated on October 1, 2019

On September 26, Sovos held a webinar, “How a Modern Approach to Sales and Use Tax Safeguards Your SAP S/4HANA Transition.” You may now view a recording and download the slides.

VP of Regulatory Analysis & Design Chuck Maniace and Sales Engineering Manager Tim Roden shared reasons why tax compliance needs to play a role in your IT modernization project and best practices for a transition to SAP S/4HANA given the dynamic tax regulatory landscape.

Chuck provided a brief overview of the current state of the tax compliance regulatory environment due to the South Dakota v. Wayfair decision and how:

- The rate and pace of change in the U.S. (the main focus for this webinar) and global regulatory environment impact local and offshore manufacturing and retailers using SAP as their backend moving and/or consolidating to S/4HANA;

- Streamlined sales tax (SST) may benefit sellers;

- AR and AP automation needs have actually increased due to Wayfair.

Centralizing finances and compliance – protecting SAP S/4HANA from global tax mandates

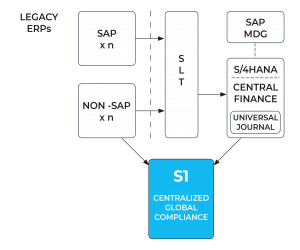

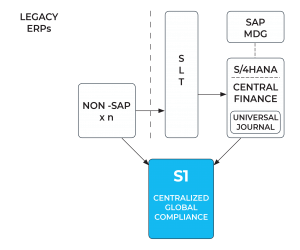

Tim then provided insights into how companies are using SAP Central Finance, SAP Landscape Transformation Replication Server (SLT), and the Universal Journal as a stepping stone for S/4HANA migration. He also explored the challenges that can remain from a tax perspective when summarized transactions are rolled up into Central Finance for financial reporting for profit and loss positions. How does one preserve the necessary tax data when it comes time to file or defend an audit? That’s one of the reasons SAP recommends tax calculations happen outside of the Central Finance system.

Protecting your migration path to SAP S/4HANA – whether greenfield, brownfield or landscape transformation

Tim discussed multiple migration paths companies are using to move to SAP S/4HANA and how Sovos S1, the underlying architecture of its tax compliance solutions (such as Sales and Use Tax Filing, CertManager and Use Tax Manager), including the Global Tax Determination engine, helps eliminate some of the customizations related to tax coded into SAP during your process. This can be particularly important when determining tax exemptions for manufacturing material groups mapped to goods and services codes, handling tax on drop shipments, or making a correct tax determination for unique remote seller state requirements or intra-state sales. This removes the burden from IT or expensive software developers since they no longer have to account for tax changes within SAP and legacy ERPs during the migration.

To learn more about how Sovos protects SAP shops from global tax compliance regulatory change, visit Sovos for SAP.

Take Action

View the on-demand webinar recording, “How a Modern Approach to Sales and Use Tax Safeguards Your SAP S/4HANA Transition,” and learn how a proactive approach to end-to-end sales and use tax compliance can streamline your SAP S/4HANA transition.