This blog was last updated on February 28, 2024

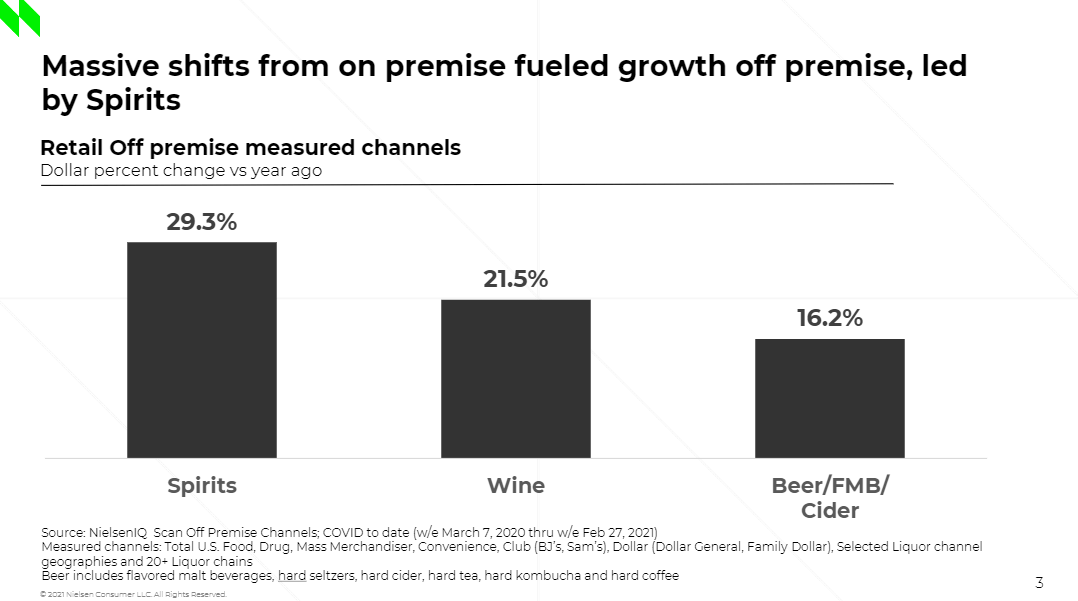

The wine market continues to be in flux as producers, retailers and consumers navigate the impacts of a global pandemic. Keeping a pulse on marketplace data has never been so important given these shifting dynamics.

Nielsen is collaborating with Wines Vines Analytics and Sovos ShipCompliant to provide a much more comprehensive view of the U.S. off-premise wine category than ever previously available, with a data product that enables both separate and combined views of retail off-premise sales and direct-to-consumer (DtC) shipments.

Here are some highlights from the most recent data, along with commentary from Nielsen consultant Danny Brager.

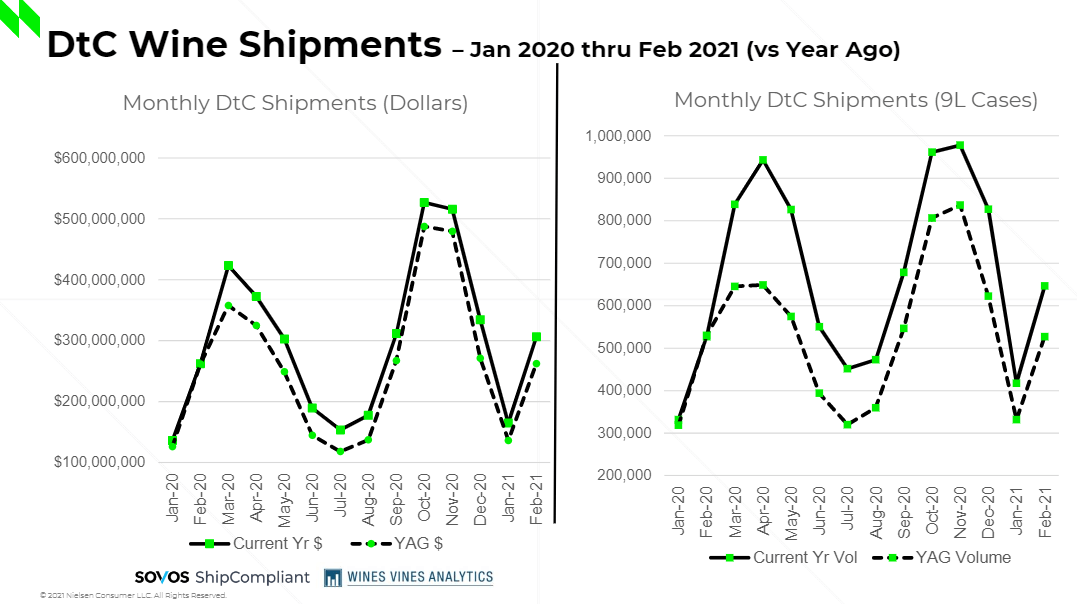

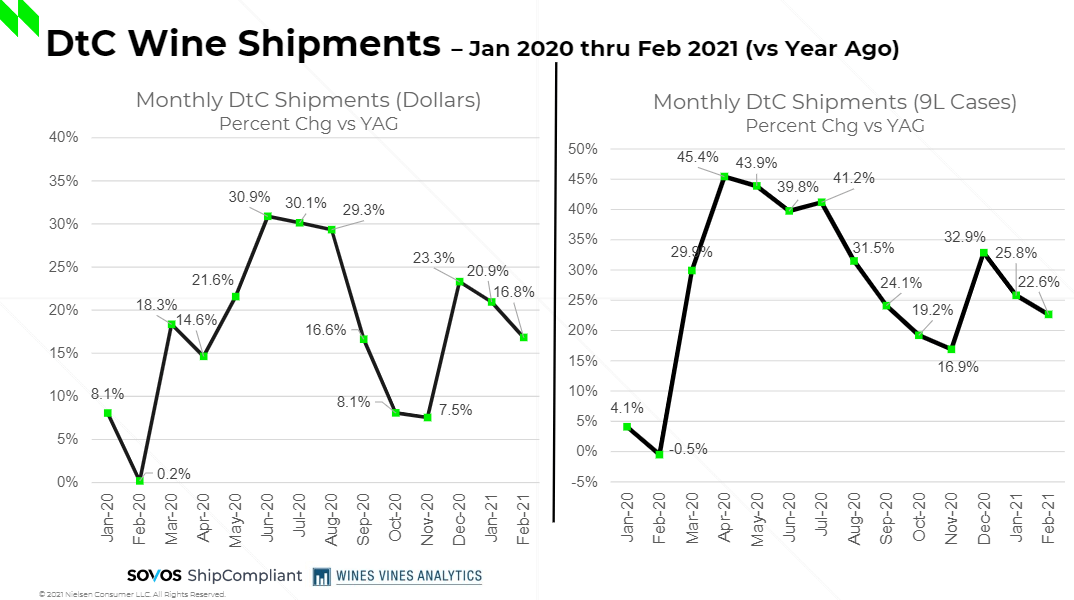

DtC Shipments

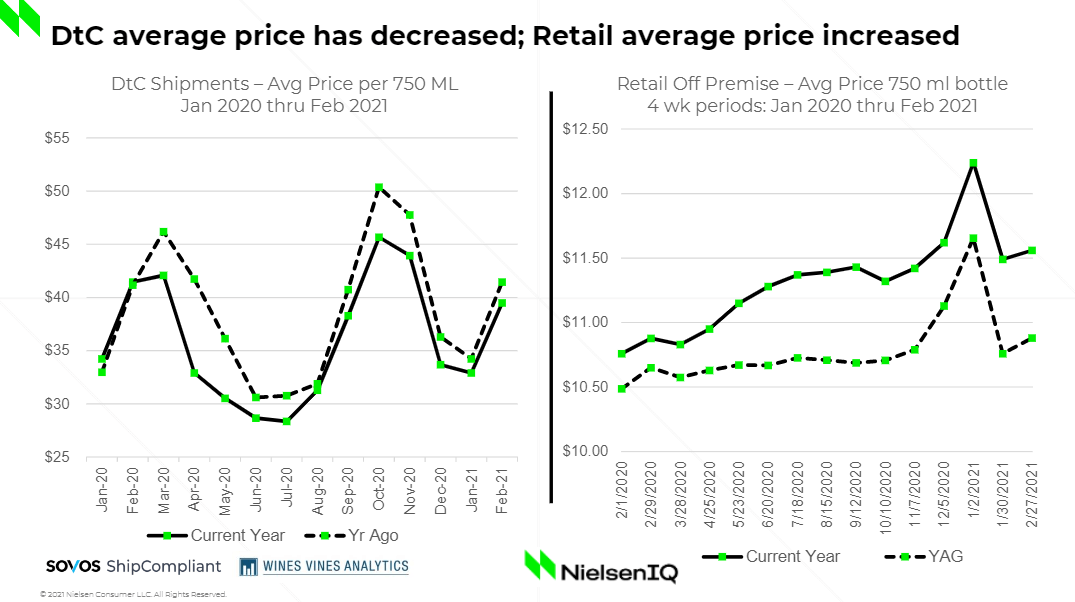

- In February DtC shipments reached $3.7B and 8.4M cases shipped.

- Year-over-year growth continued to be strong in February with a 16.8% increase in value and 2.6% increase in volume.

- Average price per bottle shipped DtC was $39.49, almost $2 less than last year.

- Almost all price tiers reported double-digital growth, except for the $50-$100 price tier which only experienced single-digit growth.

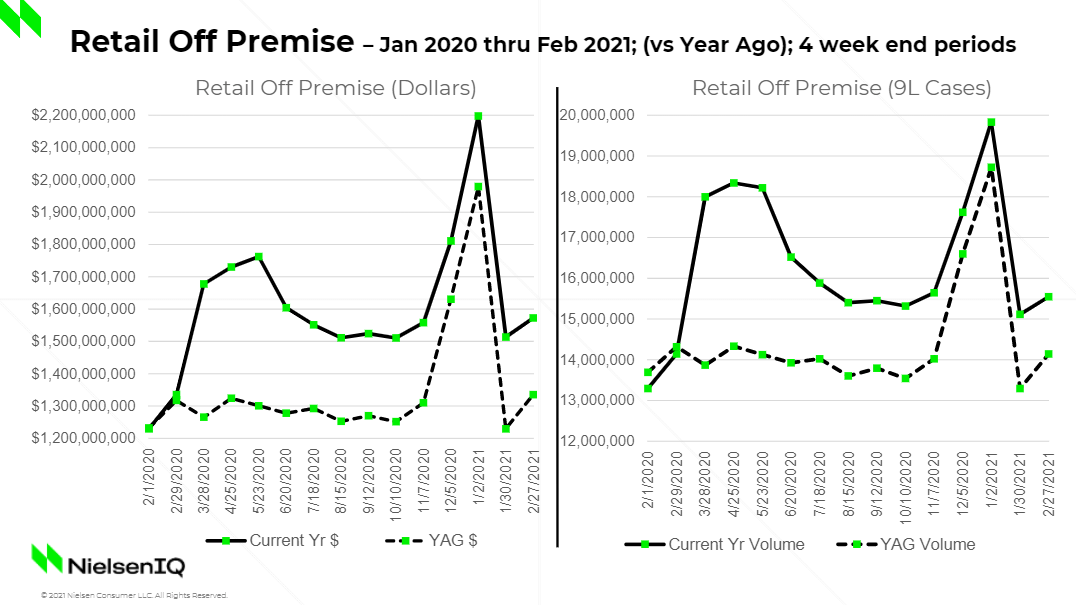

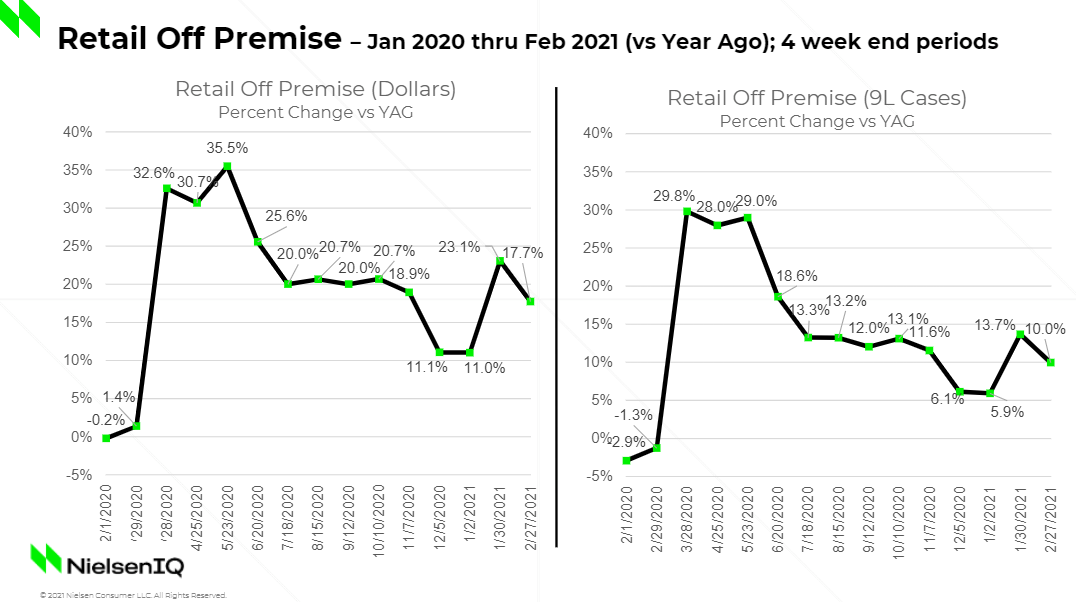

Retail Off-premise

- In February retail off-premise sales reached $21B and 212M cases.

- All price tiers above $11 continued to grow rapidly in February, with dollar growth exceeding volume growth, continuing the trend of premiumization.

- The Sparkling category continues to have high growth, with both value and volume increasing +20% in February.

Interested in knowing more (e.g., by price tiers, varietals, origin, winery size, geography)? Contact Danny Brager at danny.brager@nielseniq.com.

Take Action

Download the Direct-to-Consumer Wine Shipping Reporting for an in-depth look at the 2020 DtC wine shipping market.