This blog was last updated on January 28, 2025

The direct-to-consumer (DtC) wine shipping channel faced a storm of challenges in 2024, navigating some of the toughest market conditions in over a decade. As inflation tightened wallets and consumer behaviors shifted, the industry recorded its steepest declines in shipment volume and value since the inception of the Direct-to-Consumer Wine Shipping Report in 2010.

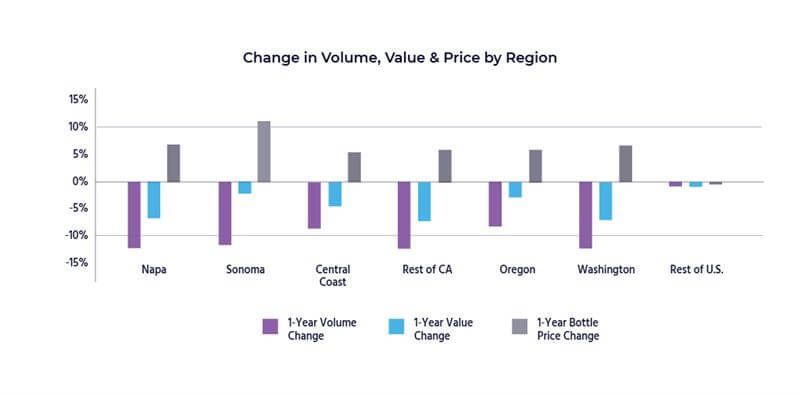

The DtC channel recorded double-digit declines in shipment volume, falling 10% year-over-year (YoY) to 6.4 million cases. Shipment value also took a hit, dropping 5% from 2023 to $3.94 billion. Additionally, the average bottle price (ABP) climbed 6% to a record $51.20.

These numbers reflect a market in flux—one where shifting consumer behaviors, economic pressures and evolving trends are rewriting the rules for wineries and consumers alike. But what’s really behind the challenges facing the DtC wine industry?

How the DtC wine market weathered industry shifts

The 2025 Direct-to-Consumer Wine Shipping report sheds light on how the market navigated significant challenges in 2024. While broader industry pressures like inflation, shifting health narratives, the rise of the no/low-alcohol trend and competition from cannabis created a turbulent environment, the data highlights three critical trends that shaped the DtC channel’s performance: a sharp decline in lower-priced wines, stagnation in the ultra-premium segment and disappointing outcomes for large wineries.

Lower-priced wines: $40-and-under

A striking trend was the rapid descent that continued across the lower-priced wine category. This $40-and-under per bottle segment experienced a 15% decrease in volume following an 11% drop in 2023. While DtC wines are often associated with premium pricing, lower-priced bottles still account for more than half of the channel’s total shipment volume, making these consecutive double-digit losses particularly challenging.

Ultra-premium wines: $80-and-above

On the other end of the spectrum, ultra-premium wines priced at $80 or more per bottle also struggled to maintain momentum. Historically, this category has demonstrated a certain level of resilience during economic downturns due to being supported by a consumer base that is less sensitive to price fluctuations. However, the narrative shifted as shipment volume grew by just 2%, a not-insignificant drop from the 5% growth seen in 2023.

Large wineries: 500,000+ cases annually

Large wineries—those that produce 500,000 or more cases annually—were another segment that struggled in 2024. After an ABP increase of 13% to $22.53, more than double the 6% average increase across the channel, these wineries experienced an 18% decline in shipment volume and a 7% decrease in value YoY. Though these wineries represent a smaller share compared to their small and medium-sized counterparts, this notably poor performance had a sizable impact on the overall channel.

The Price of Stability: Is it enough to sustain growth?

Amid widespread declines across the DtC shipping channel, the Rest of the U.S. stood out as an outlier. While the West Coast regions grappled with double-digit declines in shipment volume, this massively diverse category managed to limit its losses to just 1%.

Over the past five years, wineries in the Rest of U.S. have taken a notably conservative approach to pricing, raising ABP by 13% since 2020. This restrained approach contrasts with regions like Napa and the Central Coast, where price increases ranged from 23% to 47% for the same period. This pricing discipline persisted in 2024. While most regions continued to raise their ABP significantly, wineries in the Rest of U.S. held prices steady with a less-than-1% decrease YoY.

As stable pricing effectively minimized volume losses, the region also experienced a modest 1% decline in shipment value YoY. This minimal change in value underscores the delicate balance wineries must navigate to maintain affordability while ensuring enough revenue growth to offset production, labor and shipping costs.

A tough year for beverage alcohol: Where DtC wine shipping fits in

The challenges faced by the DtC wine market last year are just one chapter in a much larger story. Across the board, the numbers tell a sobering tale: U.S. total beverage alcohol (TBA) volumes continued their descent in 2024. According to International Wine and Spirits Research (ISWR), TBA volumes dropped by 2.8% in the first seven months of 2024, a sharper decline than the 1.9% originally forecasted.

While the numbers for 2024 are daunting, they are not the end of the story. The DtC wine shipping channel may be facing challenges, but with the right strategies, continued strength may lie ahead. Wineries that lean into innovation will be better positioned to weather the storm and thrive in the years to come.

Want to dive deeper? Download the full report for a comprehensive analysis and actionable insights to drive success in 2025 and beyond.