Blog

The Government Accountability Office (GAO) will speak about gig economy tax issues at Sovos’ virtual GCS Intelligent Reporting conference. Jessica Nierenberg from the U.S Government Accountability Office (GAO) and Caroline Bruckner from American University’s Kogod Tax Policy Center will host a session discussing details from the office’s report recently released to the U.S. Senate Finance […]

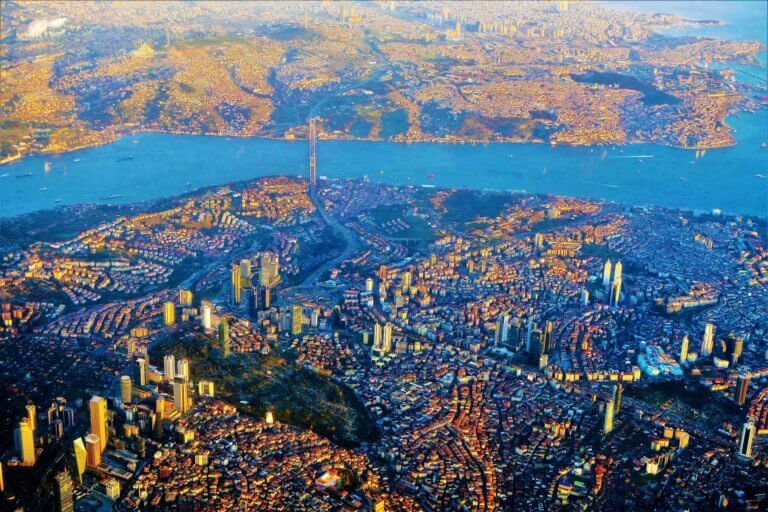

The Turkish government continues to minimize the effects of the COVID-19 pandemic on companies. A Presidential decree has extended the deadline for the Ban on Layoffs and Cash Wage Support from 17 July 2020 until 17 August 2020. This measure, which protects both employees and employers, is extended until 30 June 2021 and will be […]

The European Commission recently opened a public consultation on a carbon border adjustment mechanism (CBAM) to maximise the impact of tax in meeting the EU’s climate goals. A CBAM would reduce the risk of carbon leakage, which occurs when production is moved to countries with less robust climate policies, by ensuring that import prices better […]

A couple of weeks ago, the Government Accountability Office (GAO) released a report to the Senate Finance Committee describing the issues the IRS faces in enforcing income tax compliance for gig economy workers. The report highlighted long-standing issues the government has been grappling with in receiving tax information necessary to enforce compliance along with specific […]

VAT gaps can generally be found in countries that collect indirect taxes. This hiatus has led many tax administrations to implement Continuous Transaction Controls (CTCs), through which transactional and accounting data are monitored in real-time or near real-time. However, even countries with sophisticated CTCs may encounter fraud involving missing traders and non-existent supplies. This creates […]

For rules to carry any real weight, the rule-maker must combine compliance with that rule with either a carrot or a stick. In the field of tax legislation, the rule-maker, in this case, the legislator or the tax authority, almost always goes down the route of the stick in situations of noncompliance. And the penalties […]

Finding relevant insurance accounting education has always been a challenge for insurance professionals. Insurance is a global industry. But, the financial reporting and tax rules for insurance transactions represent only a small niche within the extensive realm of statutory and GAAP guidance. Captive insurance companies are yet another niche within that, which only narrows the […]

On 18 June 2020 European officials announced that an EU-wide digital services tax (DST) will be introduced if the US’s recent withdrawal from global tax negotiations stops international agreement. The US’s withdrawal follows the United States Trade Representative’s (USTR) initiation of Section 301 investigations into DSTs adopted or proposed in the EU and nine countries. […]

A touch of CLASS: simplifying access to customs tariff data CLASS – short for Classification Information System – is the new single point access search facility from the European Commission. It provides access to tariff classification data of goods entering or leaving the EU and is the latest step in developing an integrated approach to […]

For the first time in history, international business and governments have come together. Their aim was to define and agree a guiding set of principles for tax compliance in a world where continuous tax controls (CTCs) are becoming the norm. The International Chamber of Commerce‘s (ICC) executive board has now formally approved the first set […]

The General Communiqué no. 509 (communiqué) established the date of transition to the e-delivery note application and the full scope of the mandate. Whilst the communiqué addressed the general use of the application and the basic practices, it didn’t contain all the information businesses require and although the FAQ and information from the Turkish Revenue […]

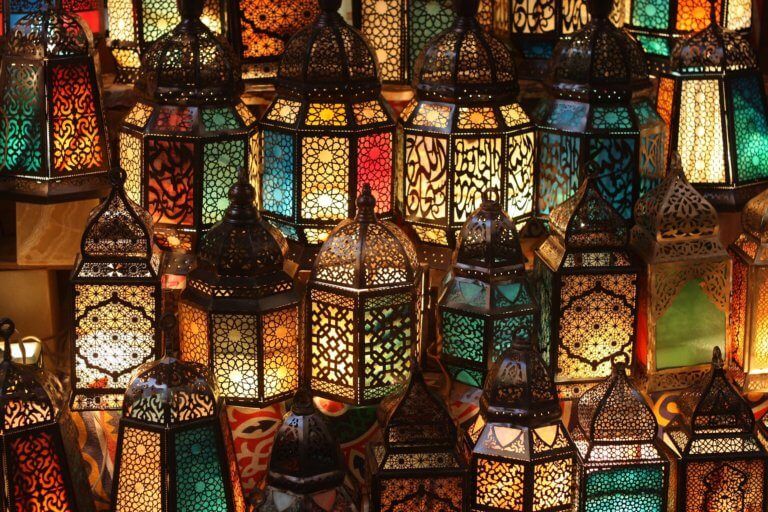

Update: 20 November 2023 by Dilara İnal E-invoicing systems in the Middle East and North Africa are undergoing significant transformations, aiming to modernise the financial landscape and improve fiscal transparency. Recent updates have seen numerous countries implementing electronic invoicing solutions designed to streamline tax collection and reduce VAT fraud. E-invoicing Trends in the Middle East […]

The era of paper invoices is coming to an end. With the e-arşiv invoice system, you can issue an electronic invoice, even to non-registered e-invoice taxpayers. This regulation enables companies to send invoices directly to the end-user via e-mail removing the need for paper invoices. Due to the official statement from the Turkish Revenue Administration […]

After a period of solid work around the myDATA framework, with little documentation left to implement the entire scheme in Greece, the IAPR has shifted its attention to e-invoicing. Last week the IAPR and the Ministry of Finance signed the long-awaited myDATA bill, which once turned into law will enforce the myDATA system within Greece. […]

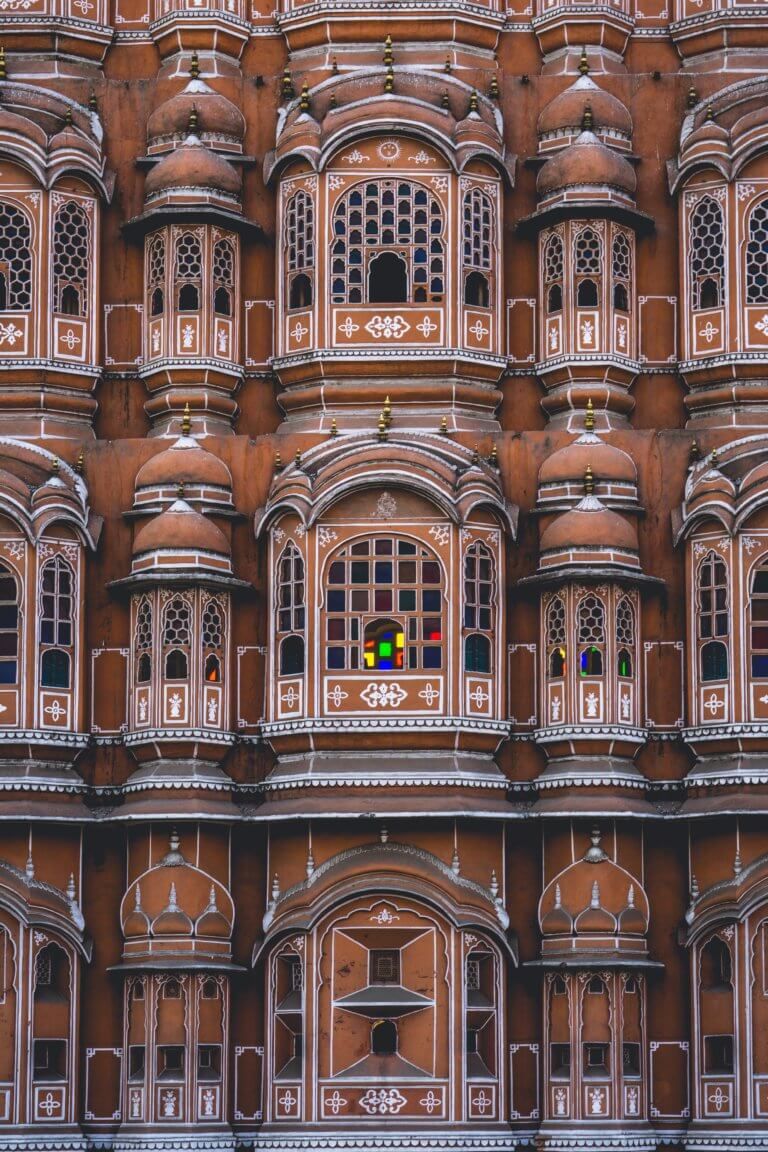

Renowned for its diversity, India is taking the same approach to its e-invoicing framework. There have been several changes and new possibilities included in the required processes and technical (“JSON”) invoice schema since e-invoicing was introduced. Such changes are unsurprising as many of the existing Continuous Transaction Controls (CTC) systems regularly bring new elements to […]

From 1 July 2020, all taxpayers with revenue above 25 million TL in 2018 or subsequent years must switch to the e-delivery note system. E-invoice instead of e-delivery note With the deadline fast approaching, one of the questions on taxpayers’ minds is whether e-invoices can be used to replace e-delivery notes as paper invoices can […]

The coronavirus pandemic’s full effect on insurance is yet to be revealed, however one thing is for certain, the shockwaves will be felt for years to come. Looking at the numbers, Lloyds of London have recently forecast that COVID-19 will cost the insurance industry £167bn globally this year resulting from claims related to the pandemic […]

In the midst of ongoing negotiations following the UK’s exit from the European Union (EU), the Court of Justice of the European Union (CJEU) has ruled that the UK has impermissibly expanded the scope of its 0% VAT rate on futures trading. And, that this has been occurring over a period spanning more than forty […]