This blog was last updated on March 11, 2019

In my last post, “Accounts Payable Process Improvement with Use Tax Automation,” I looked at the challenges managing tax compliance on purchases and how some of your peers we’re dealing with the problem based on the live webinar polls.

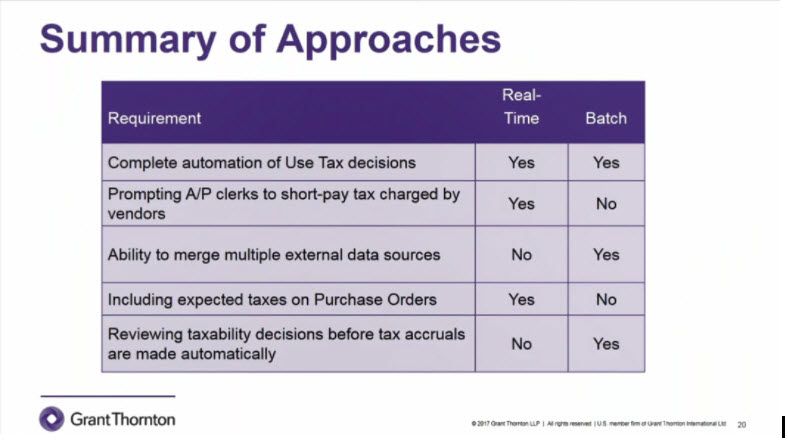

As promised, below is a recap of the two different approaches to sales tax validation and use tax accruals, real-time vs. batch automation, and the advantages and disadvantages of each, as discussed by Mark Rems, partner, Indirect Tax Automation, Grant Thornton.

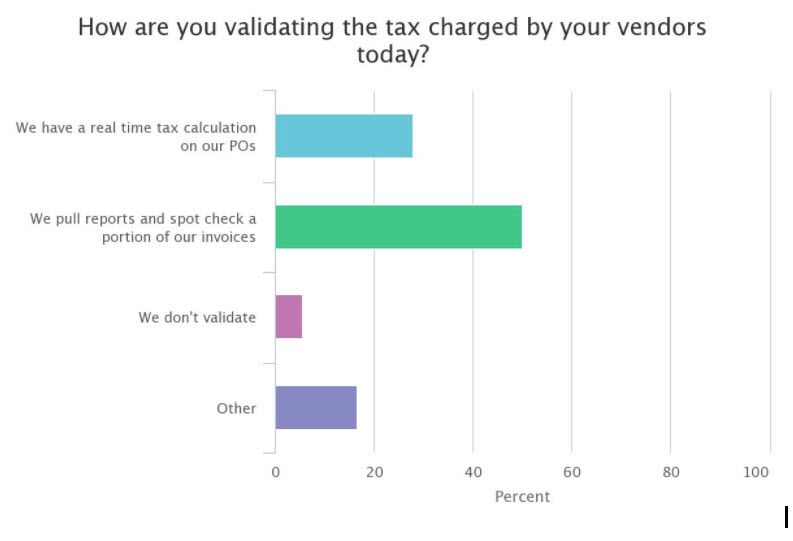

To start, when asked, “How are you validating the tax charged by your vendors today?,” 28 percent of attendees noted having a real-time calculation on their purchases, while 50 percent noted pulling reports and spot checking only a portion of invoices. (Poll result below):

Advantages and Disadvantages of a Real-Time Approach for Use Tax Automation

Advantages

Enabling Tax Calculations when PO Created

There are some pretty good workflows now in digital marketplaces and procurement systems around approving requisitions and approving POs. To fully understand the true cost of a purchase is to evaluate whether tax is due and include that total amount in the requisition for approval. Having the tax calculation initiated when the PO is created will enable the PO approval process to account for taxes, which can be important.

Short Pays

- From the vendor invoice entry side, this is the only way to give your AP clerks the power to short pay invoices. Say you’re a manufacturer or you do a lot of R&D and your vendors don’t know exactly how you’re using these products and they’re incorrectly billing you tax. If you don’t want the cash going out the door, you would need a real-time evaluation at that time.

Example:

The AP clerk enters an invoice for $1,000 and the vendor is charged $60.00 in tax. A call out to the tax engine recognizes this is as an exempt part going on the manufacturing line and no tax is due (learn more about our exemption certificate management solution). So a short pay on the invoice is made. Again, enabled by the real-time integration.

Use Tax Accruals Booked to General Ledger Immediately

- Conversely, to accrue use taxes immediately when posting that invoice, it’s the same process. AP clerk enters invoice with no tax. Tax engine determines there is a tax due. An immediate accrual would occur depending on the mechanics of the ERP system so that tax is accrued for that transaction.

Disadvantages

Limited ability to enhance data. Relies on user inputs.

- Real-time automation takes control out of the expert’s hands in the tax department

Unless you’re confident you have clean data and it’s accurately assessing the material groups in question, where and how it’s going to be used, you may be better off with a batch approach since you would be able to look at things like vendor names, line descriptions, components of line descriptions, etc. without disrupting the AP processing time as the invoice would already be paid.

- Requires IT and is likely more time intensive and expensive to implement

- Can slow the A/P process

Advantages and Disadvantages of a Batch Approach for Use Tax Automation

From a system flow perspective the batch approach is not much different from the real-time integration approach, you’re still dealing with the same core ERP system, however instead of making calls when a PO is created or an AP invoice is created, you would pull data either daily, weekly or monthly, batch it against a tax determination engine, use the same data elements, and potentially more data elements (now able to pull in data from SRMs, a fixed asset system or other systems that need accrual validation – like pulling parts out of inventory used to repair equipment – all that data can be combined into a central location before you kick off an automated process to see if your vendor is overcharging you and where do you need to accrue use tax.

Advantages

- You can pull in data from multiple systems

Many times the necessary data (such as market data that shows break out by user or cost center) isn’t available in the ERP or AP system. You may need to get that allocation data and combine it with a vendor invoice data to truly know which jurisdictions have the right to collect tax.

- Keeps control of the process with the tax department experts

Additionally, the only lean on from IT may be to get the report of all your purchase activity from multiple data sources outside your ERP or AP system, or loading a journal entry back into the system. Gives the tax team ultimate say in what they want to accrue or not accrue.

- Ability to review use tax postings before they are committed

As mentioned previously, If it’s important for you to look at things like vendor names, line descriptions, components of line descriptions and you generally need more control over the process, batch may be the way to go.

- Simpler approach for automating use tax

- Does not interrupt the AP process – enabling you to deal with the challenges as they are discovered

- Much lower cost to implement

Again, if you are utilizing multiple ERPs, digital marketplaces, SRMs and fixed asset systems and you require integrations to get the best possible information on each transaction, a batch approach will simplify your life.

Disadvantages

- Inability to short pay invoices and requiring you to request a refund from the vendor after the fact

- No ability to post correct tax accruals to the GL immediately

Check out the entire recorded webinar, embedded below.

Take Action

Learn how Sovos Use Tax Manager can safeguard your business against the burden and risks of procure-to-pay sales and use tax compliance, give your tax team the visibility and control needed over tax data on every purchase – without slowing down your Accounts Payable process.