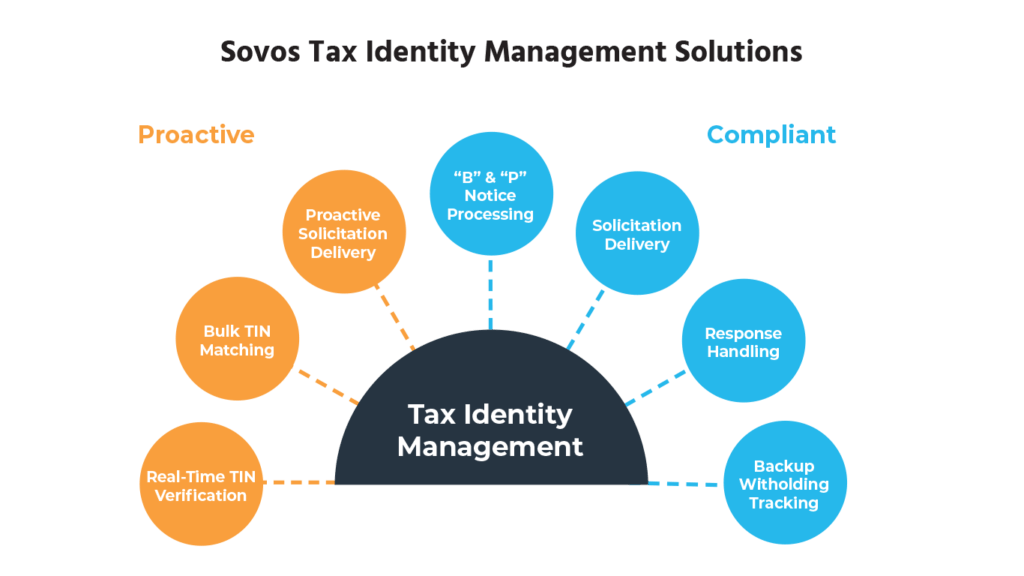

Why do governments care about Tax Identity Management?

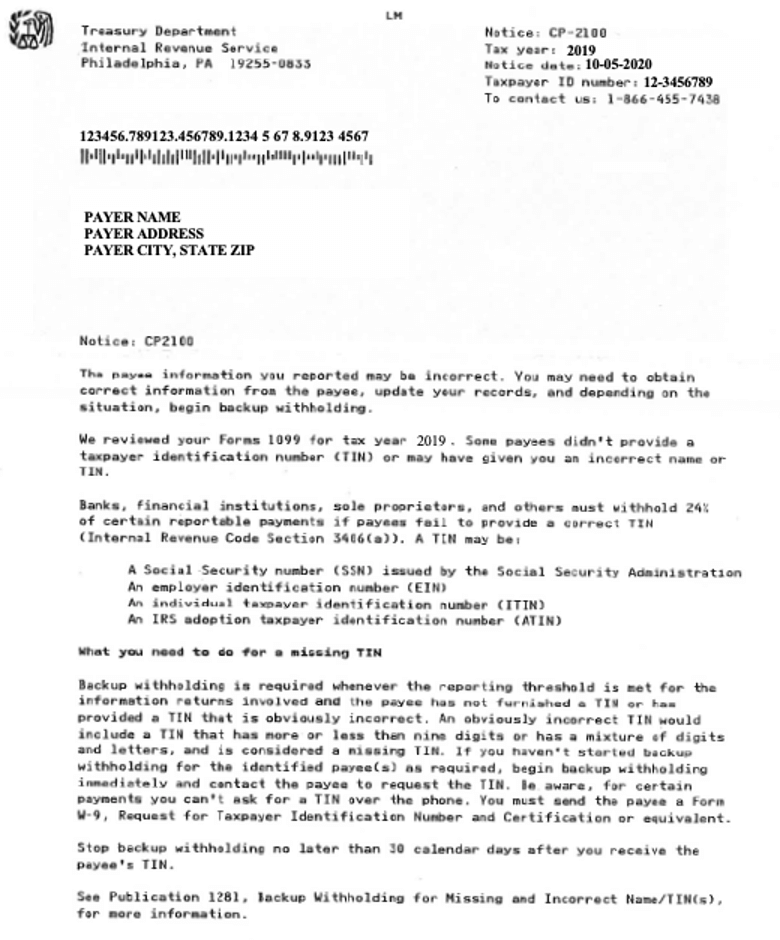

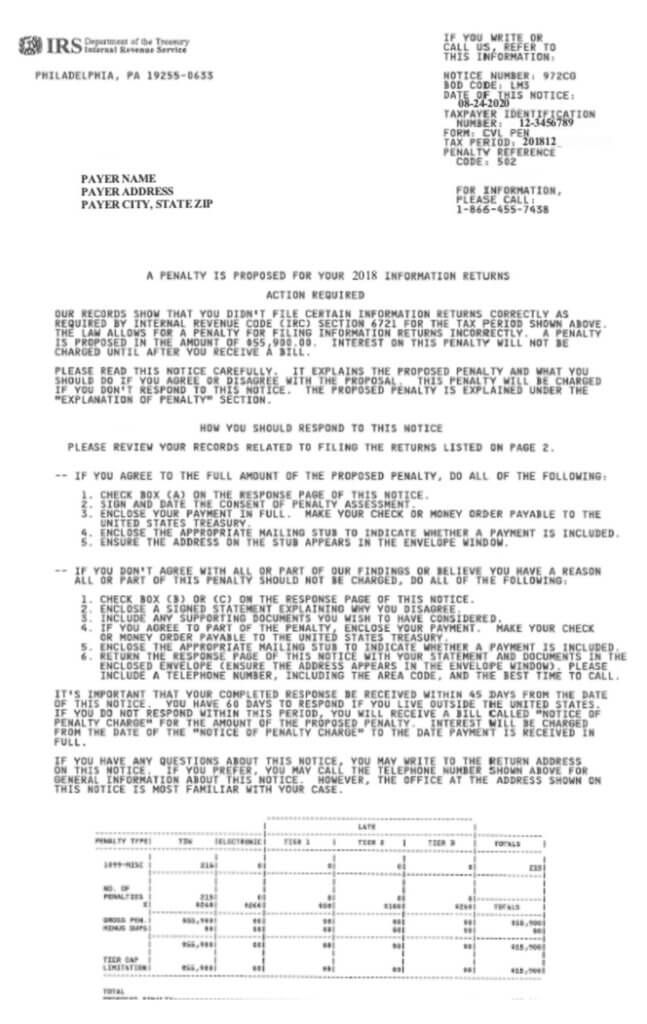

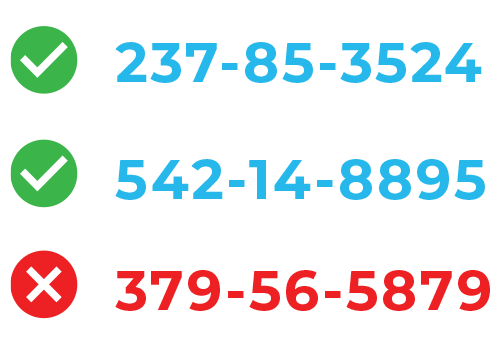

Governments care about tax identity management for one reason, revenue. According to a report by the Treasury Inspector General For Tax Administration (TIGTA), incorrect or missing tax identity information via Form 1099 returns has led to a $9B tax gap with the IRS. The TIGTA recommended enforcement of backup withholding in order to narrow that tax gap. Backup withholding, simply put, requires payors to withhold 24 percent of future payments that are made to recipients with incorrect tax identity information.