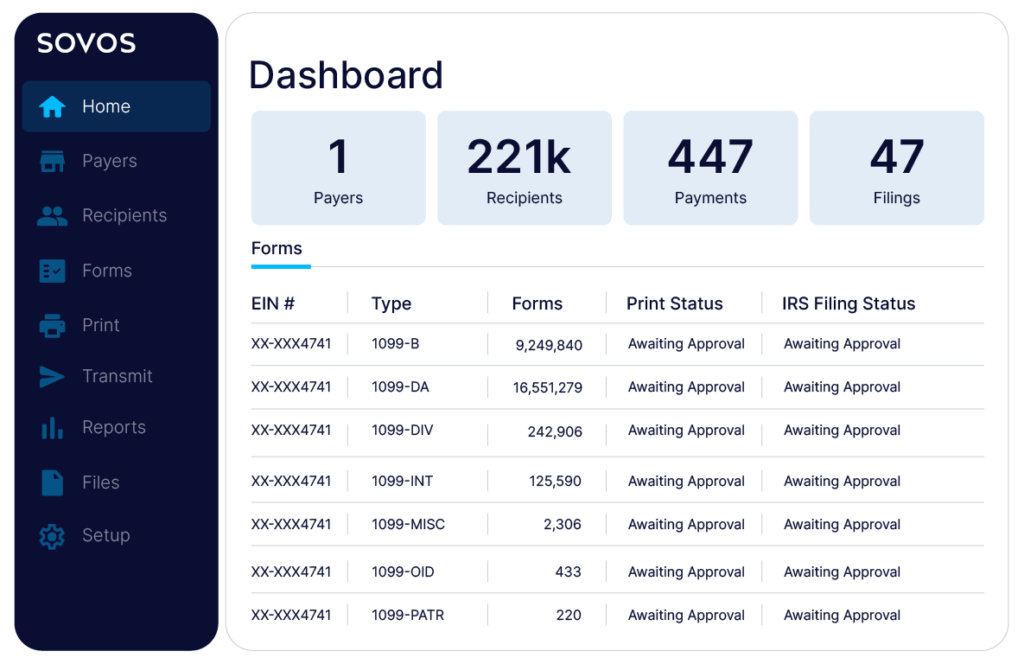

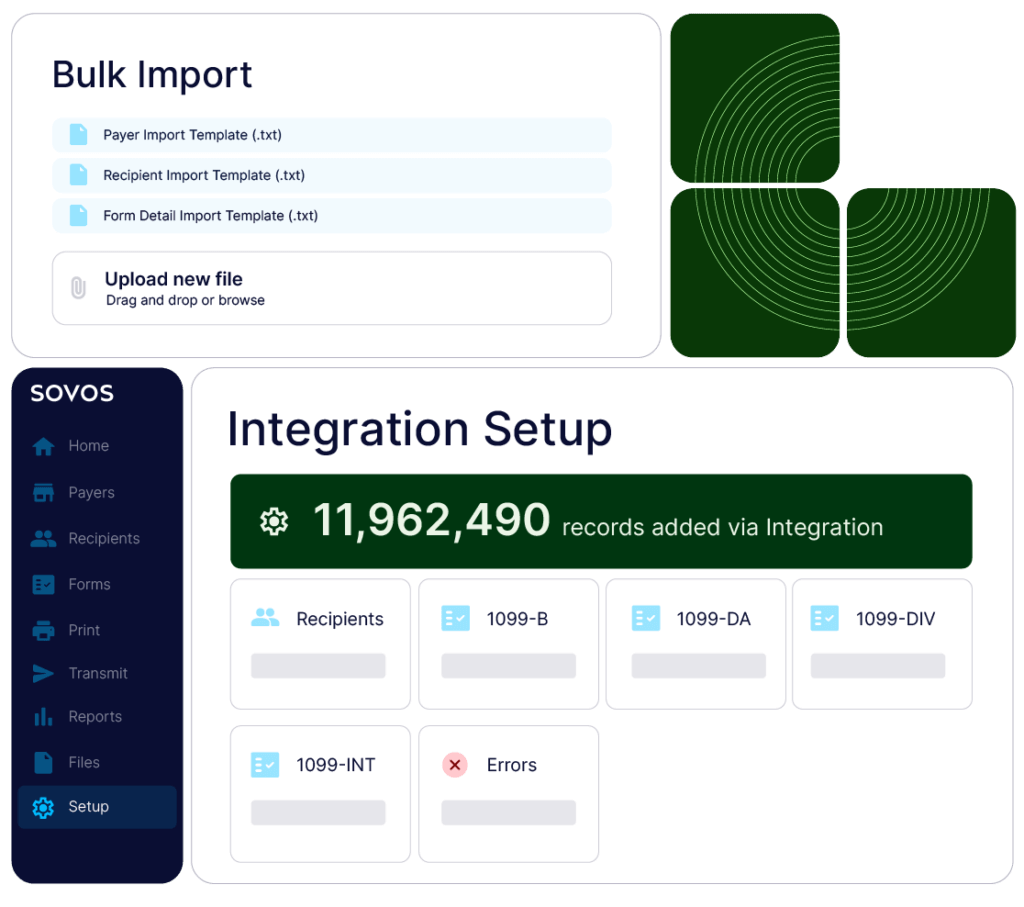

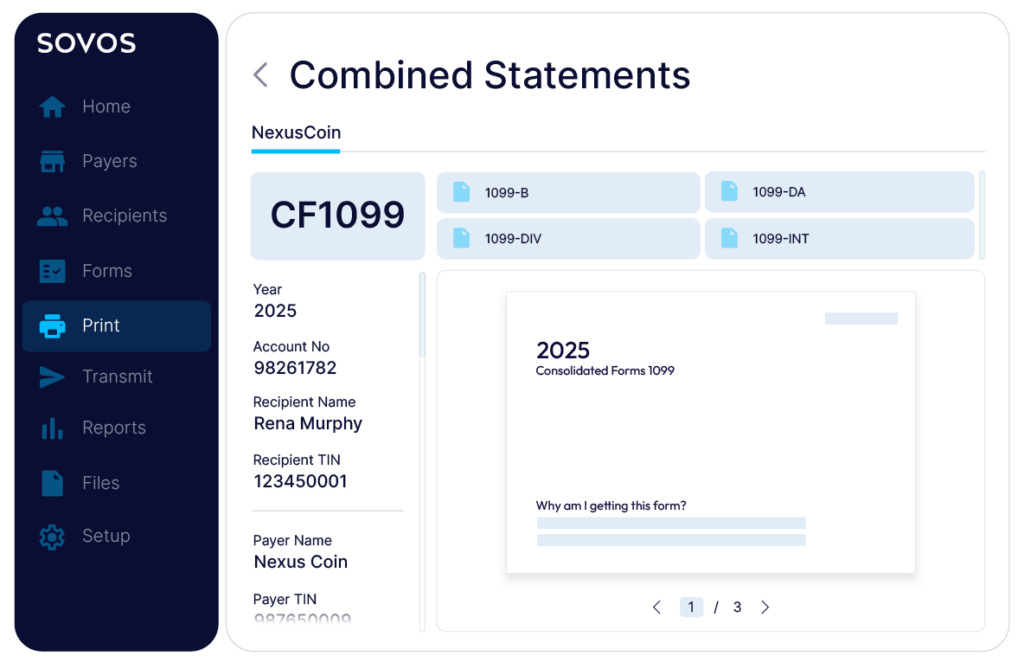

Leverage a proven solution

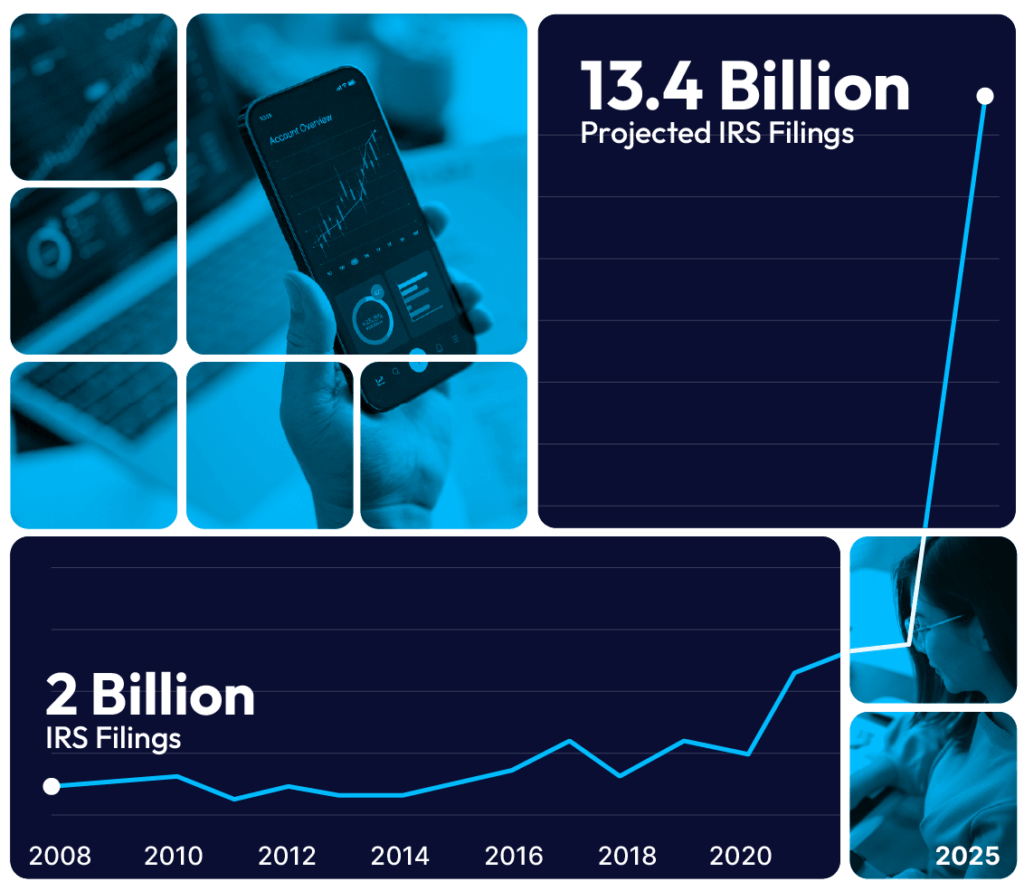

With nearly 40 years of expertise in information reporting, Sovos processes hundreds of millions of tax forms each year for over 30,000 customers. Since 2008, we have been a trusted partner in broker transaction reporting, seamlessly expanding into digital asset reporting to ensure compliance across all asset types.