IDC MarketScape 2024

Value-Added Tax Management

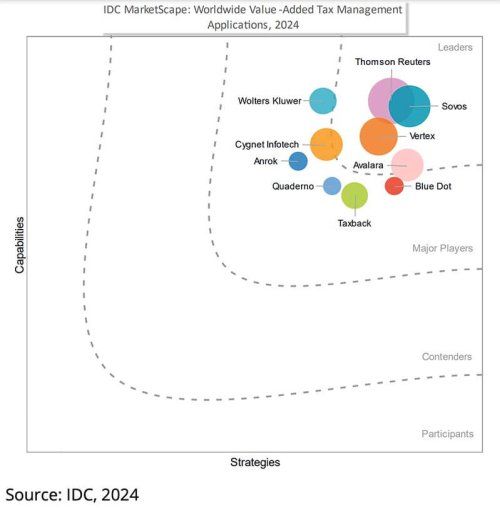

Sovos has been recognized as a Leader in the 2024 IDC MarketScape for Worldwide Value-Added Tax Management.

Gain clarity and direction for your VAT compliance journey. Whether your goal is to streamline global compliance, integrate with existing ERP systems, or prepare for future tax challenges, this report serves as a comprehensive guide to evaluating the best VAT management solutions available today.

The IDC MarketScape illustrates Sovos’ position among key providers, reflecting a proven ability to combine strong global coverage with innovative, user-focused solutions.

Get the MarketScape report

A New Standard for Global VAT Management

Why Businesses Choose Sovos for VAT Management

The Sovos Indirect Tax Suite stands out by offering businesses comprehensive, future-ready compliance solutions designed for global scale and local precision. With localized teams across multiple regions, Sovos enables our customers across the globe to overcome tax compliance challenges.

- Global coverage with support for VAT compliance in 68 countries, as well as localized solutions for reporting, recovery, and e-invoicing.

- Enterprise-ready, cloud-based platform seamlessly integrates with ERP and accounting systems, providing real-time insights and automation.

- Advanced e-Invoicing compliance capabilities are designed to meet global mandates, reduce errors, prevent fraud and ensure regulatory readiness.

“Consider Sovos when you need a solution that seamlessly integrates with—and is increasingly already embedded in—accounting or transaction management software.”

– IDC MarketScape for Worldwide VAT Management, 2024