This blog was last updated on December 26, 2023

Our October 24 Webinar, “Building the Tax Team of the Future to Successfully Navigate the Regulatory Storm,” is now available onDemand. During the webinar, we asked attendees a series of four detailed polling questions to help them measure their tax teams’ ability to deal with regulatory and business change. Questions were based on a Reactive-to-Proactive scale, 1 being the most reactive and 5 being the most proactive, based on the following attributes:

Download our Team Measurement Worksheet on the webinar recording assets page to review the questions with your team and learn how you compare with your peers who attended the Webinar.

So how did attendees of the webinar respond?

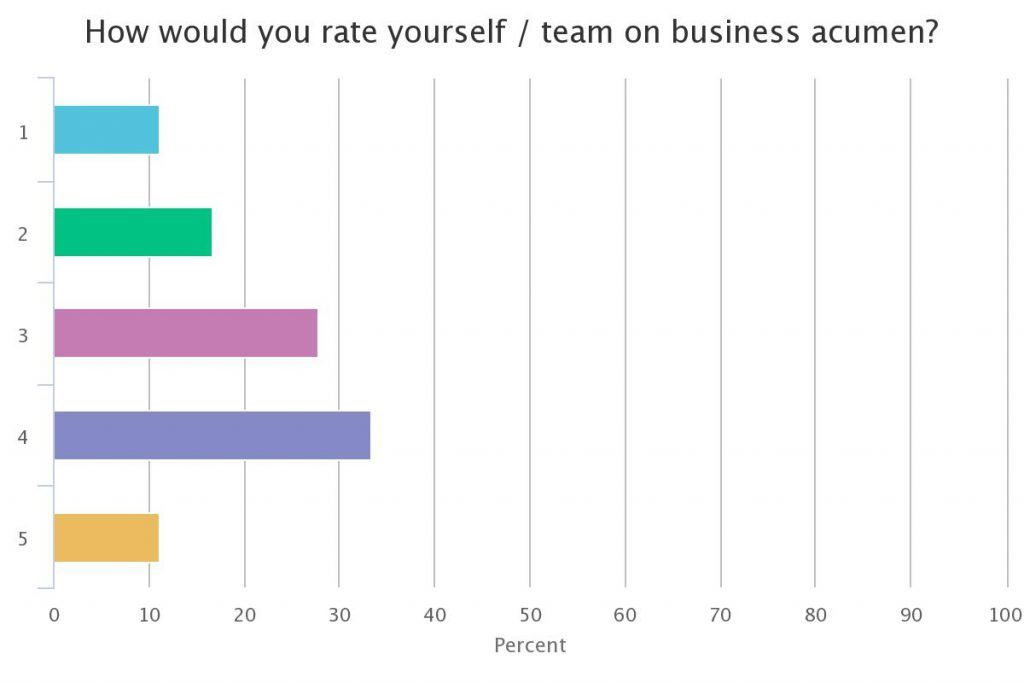

1. Team business acumen and ability to proactively prepare for business and regulatory change (5 detailed areas covered in Worksheet above)

As tax automation and data analytics become more prevalent, tax professionals will need to work more closely with other functions and turn data into insights to solve business problems that may inhibit growth. Communication and other soft skills, as well as change management, will also be paramount.

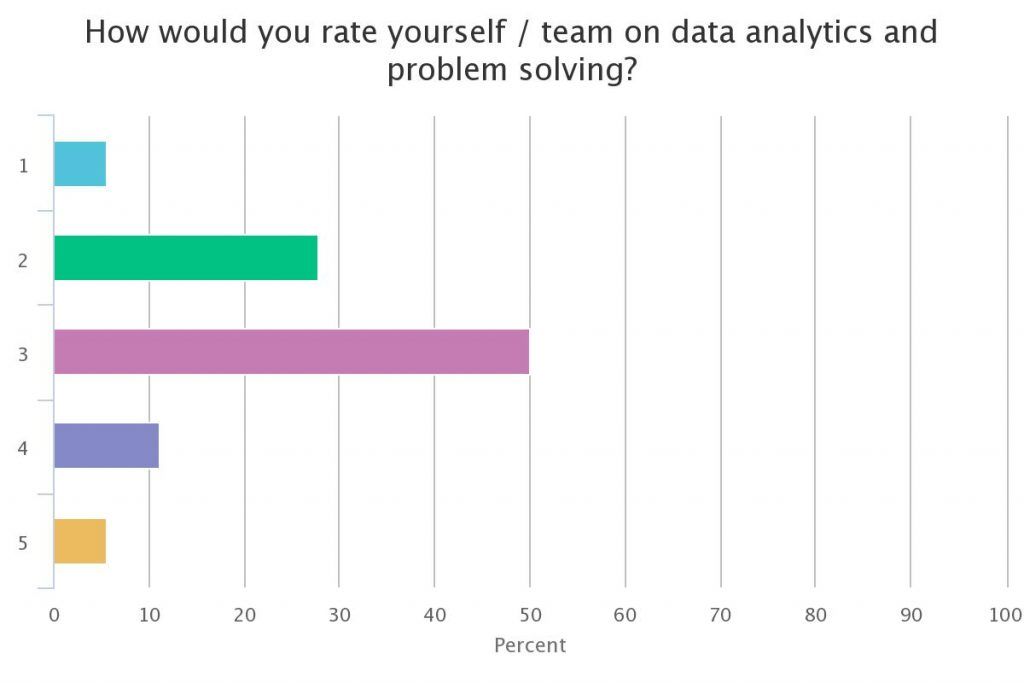

2. Team data analytics skills, ability to problem solve and implement process improvement (6 detailed areas covered in Worksheet above)

Data analytics and problem-solving skills among webinar attendees were generally on the lower end of the reactive scale. It is not immediately clear whether this is a result of the existing disparate tools they have to work with, manipulating spreadsheets beyond what they were designed for without introducing errors, or simply inexperience. However, one thing our experts agreed on was the tax professional will be manipulating larger volumes of data and have more insights at their fingertips. With the proper tools to remove manual processes and errors to enable tax pros to focus on proactive risk monitoring, process improvement and audit defense will improve outcomes.

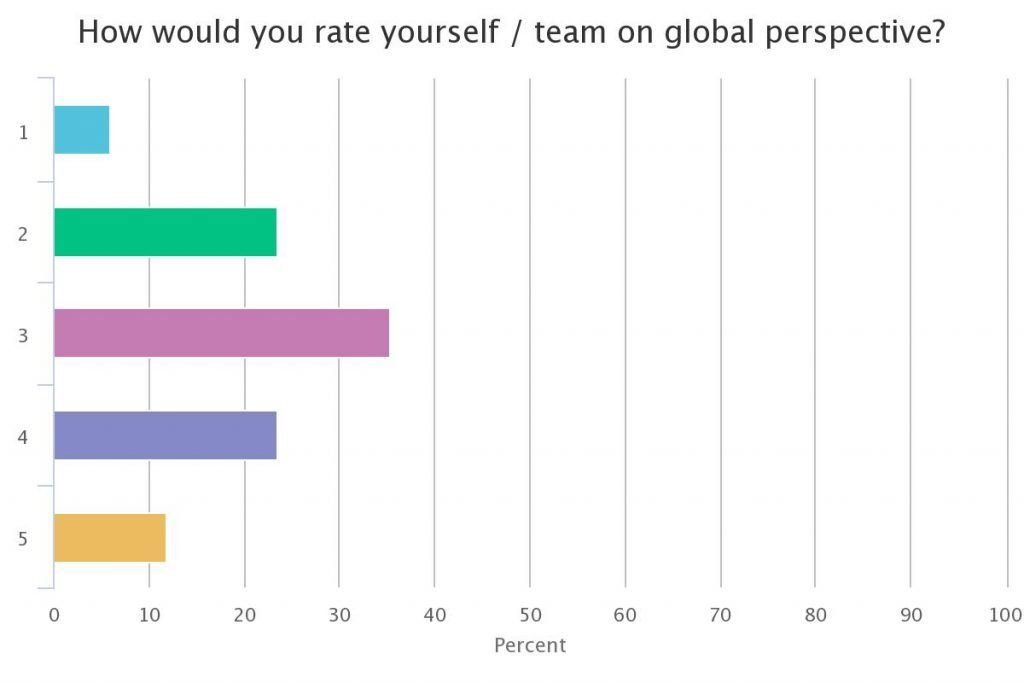

3. Team orientation to enable growth – global perspective (4 detailed areas covered in Worksheet above)

Webinar attendees gave answers across the board in response to this question that looked at whether teams worked independently or with a global mindset tied to local expertise, if processes were consistent and flexible or rigid and inconsistent, and if teams were able to easily adapt to change for rapid growth vs. change becoming a major crippling event each time.

Some recommendations to improve tied into business acumen, but on a global scale. In addition, partnering with department heads to develop rotation programs gives your team career growth opportunities and broader organizational vision. In one case study, a global manufacturer created a Tax Risk Manager role “responsible for coordinating audits and controversy globally, working with country tax specialists.” Because of the global oversight, efficiencies were created in information gathering for multiple jurisdiction audit requests, and quality of data submitted to authorities improved.

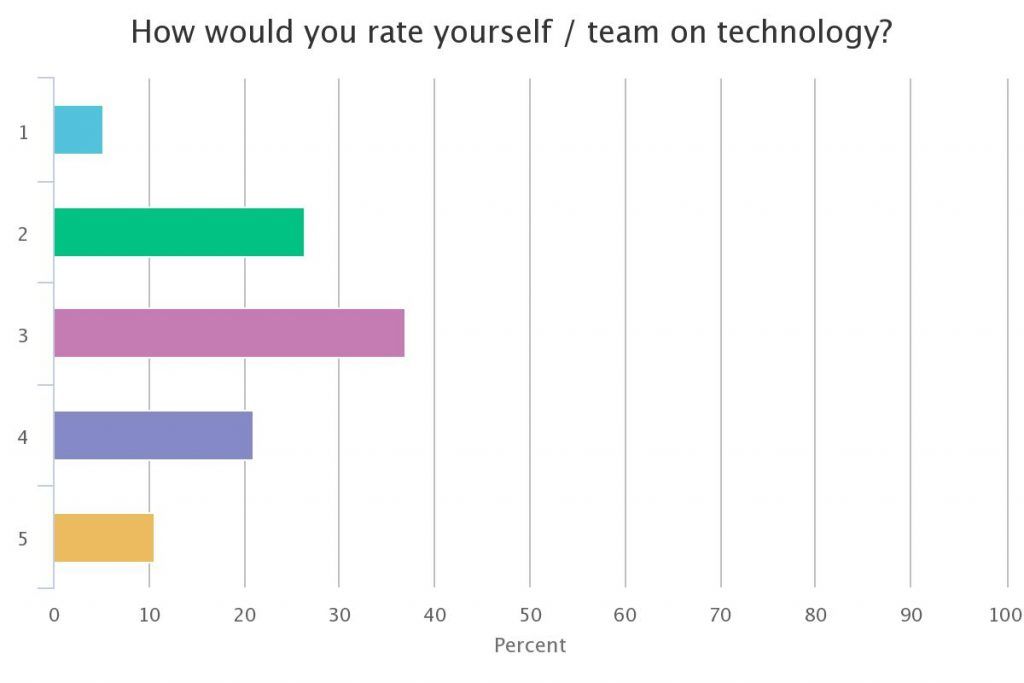

4. Tax technology, infrastructure to support rapid change, put control in the hands of tax and provide the needed data and analytics (5 detailed areas covered in Worksheet above)

Measured on attributes such as having little centralization, control and oversight, working with point solutions vs. having a single data warehouse, as well as limited use of analytics tools vs. full reporting and analytics capabilities, and more, webinar attendees were again all over the place in their responses.

Tax teams that work cross-functionally to enable transactional data to be received in a “tax-ready format” generally perform better than those that do not. Also, centralizing tax data into a single data warehouse or hub, and work with tax automation tools that provide end-to-end workflows to centralize processes, improve data quality and drive efficiency will also help ensure the tax team’s success. Look to enable your tax team with enterprise reporting and analytics tools, as well as a platform that enables rapid change with minimal business interruption to drive additional operational efficiencies within the organization.

So…

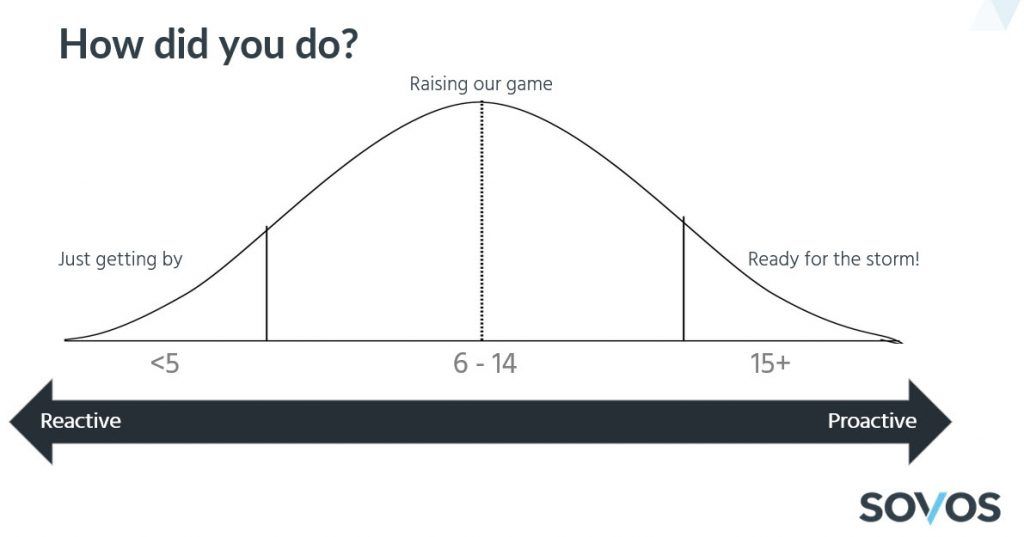

Did you score in the “just getting by” or need to “raise your game” segment of the reactive/proactive chart above, overall? If so, here are some recommended actions to improve:

- Establish a future vision and set of principles for your team – recognize the storm, implications and develop a strategy to overcome

- Develop a “persona” of the ideal tax team profile – define the qualities you are looking for, develop question sets to ensure a proper hiring profile

- Establish organizational KPI’s and monitor them rigorously (audit hours, number per year, late filings, penalties, etc.)

- Partner with department heads to develop a rotation program to give team career growth opportunities and broader organizational vision

- Encourage an innovation culture by developing recognition programs to motivate and reward engaged team members

- Give them tools to remove manual processes and errors so they can focus on proactive risk monitoring, process improvement and audit defense

Watch the full onDemand recording that covered:

- A brief overview of the changing regulatory landscape and what it means to your business

- Characteristics of the Tax Professional of the future and a way to measure your team’s abilities from the perspectives of:

- Business acumen

- Data analytics

- Cross-functional and global

- Technology

(Note: these are the areas you’ll be tested on in the Team Measurement Worksheet)

- And additional actions to improve

Take Action

Watch the onDemand recording of our Tax Tuesday webinar, Building the Tax Team of the Future to Navigate the Storm of Regulatory Change. Also, receive the Team Measurement Worksheet on the onDemand assets page to see how you measure up to your peers on the Reactive-Proactive Scale.