This blog was last updated on June 27, 2021

With Latin America constantly evolving their tax and electronic invoicing policies, corporate SAP teams are left with huge support costs and constant change management requests. With Brazil changing their requirements and mandating the adjustment to version 3.1 by the end of 2014, now is the time to look at the true cost of supporting Nota Fiscal with a centralized SAP system.

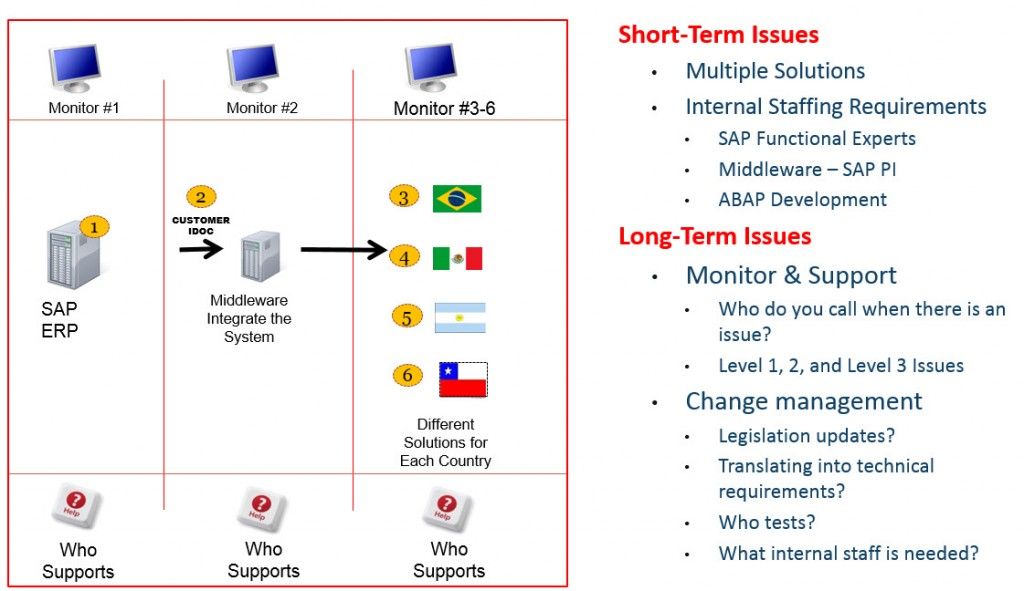

Most of these costs are overlooked as they are considered standard operating procedures. Below I want to describe the most common situation for Day to Day Support issues and Change Management when you have to manage Brazil Nota Fiscal with a global/centralized version of SAP ERP. Most likely your organization is dealing with this very situation in Brazil – and if you operate in Mexico, Argentina and Chile – well now you have 4 problems.

Before I jump into the example, it is important to understand the traditional architecture that has been implemented. This usually wasn’t implemented by design, it was implemented for three specific IT realities:

- Corporate IT wanted to standardize on a common SAP platform (Centralization)

- Because many multinationals acquired companies in Latin America to grow – there were legacy systems already in place. When the SAP transition came into play – the standard operating procedure was to integrate the existing local system. Since local country providers do not reach beyond borders einvoicing compliance was solved with multiple local country solutions

- In Brazil this meant a local provider

- In Mexico – this meant a local provider

- In Chile – another local provider

- In Argentina – you guessed it, another local provider

- A common SAP maintenance strategy is known as (N-1), this means that you stay one support pack back from the latest release. And often multinationals are many service packs back because applying OSS notes to a highly customized and configured and global SAP system has its issues.

Combine all of that together and you get the following – three distinct silos of support and change management. Apply Day to Day support and constant Change Management to this infrastructure and you can see why many companies are looking to Managed Service providers to completely take this problem off of their list of things to manage.

The results of this architecture are issues.

- Day to Day support –

- Who do you call to fix an invoice issues?

- The SAP support team

- The middleware support team or the 3rdparty system integrator that build the connector

- The local einvoicing solution support

- If you can’t fix, shipping is delayed or worse shut down

- This process consumes many resources and is wasteful – today there are solution providers that solve all the issues, help you monitor, take all the support calls whether in Portuguese, English or Spanish, and help you resolve the issue before you have to engage your internal teams

- Change management

- Government makes a change like version 3.1 for Nota Fiscal

- First – you have to get OSS Notes when they come out

- Then, you have to apply those Notes and regression test against your global COE – this could take 6-8 weeks in many organizations

- Then you have to get the updates from the local solution or the separate GRC box

- Then you have to adjust your middleware or call the SI to adjust the connector they built for you

- Then you have to align the SAP global team, the middleware team, and the local team to do and end to end test.

- What if something fails, how long does that take, etc…

- This process is lengthy and expensive – even the simplest of changes can take some companies over two months to move into production. There are solutions that eliminate all of these issues and makes all changes (whether gov’t, internal, or customer driven) as part of their Managed Service.

- Who do you call to fix an invoice issues?

Summary – the real cost is support and change management. Use a change like NFe 3.1 to re-evaluate your entire Latin America electronic invoicing – the amount spent to maintain these systems will often shock you.