This blog was last updated on June 27, 2021

In the 5thpart of our series on the dangers of working only with a PAC in Mexico, I wanted to cover support and change management. These are the real cost drivers over the long term but are often not reviewed in the decision process. Why does this get overlooked? Two reasons:

- Changes in Latin America often happen quickly with timelines that require urgency. Therefore, they are typically not budgeted. Companies rush to get a solution in place and don’t often do the detailed due diligence required to understand the operating costs.

- The other major problem is that the decision on a solution has two different stakeholders: the local finance/user team and the corporate IT team that manages the ERP system. The most common mistake that multinationals make is to not have both of these stakeholders involved in the decision process. When you only have the local Mexico team make a decision, the SAP configuration and integration (by the way this is 80% of the implementation and ongoing change management) is not scrutinized. Instead, you get a local CFDI solution selected and the inevitable – hey corporate IT, you need to extract this file format from the ERP system and integrate with our vendor.

The result that most companies experience with a PAC is the following:

- Corporate IT ends up taking the majority of the costs. A common theme I hear from the corporate IT team is: theintegrationof the PAC/local solution ended up being 4-5x what the local team paid for the PAC. And 100% of the maintenance costs end up being passed on to the corporate IT team over the long run. In the end, they keep the SAP system configured, they manage the customer requests, they manage the SAP upgrades, unit testing, etc…

So when you evaluate your Mexico electronic invoicing strategy understand the following and include a true cost analysis. I have written a Mexico CFDI RFP for SAP ERP users – feel free to reach out and I can send a copy.

Support & Change Management

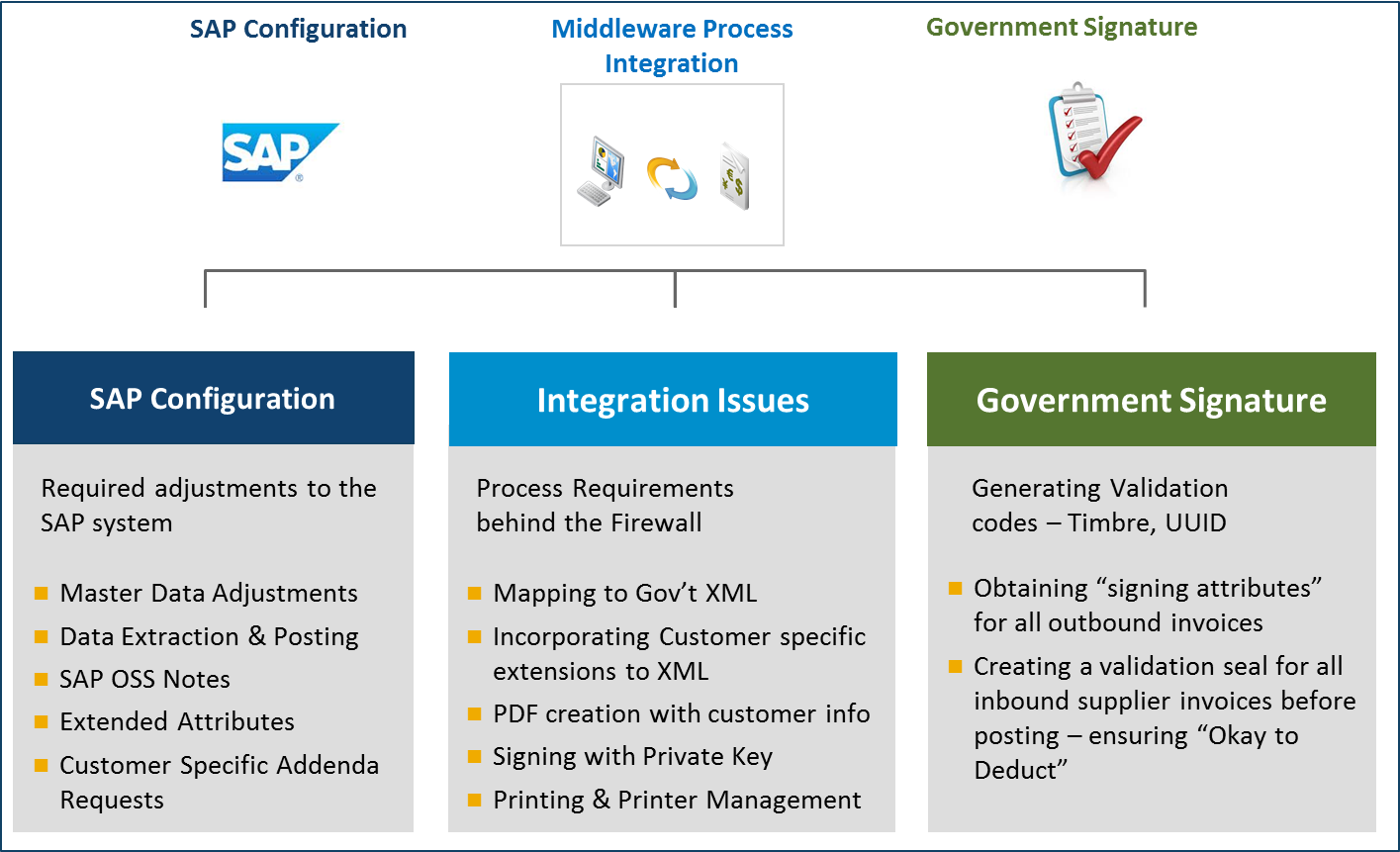

There are three major requirements in order to send, receive, validate and process electronic invoices CFDI) in Mexico for SAP ERP users. Each of the three core components must be evaluated to understand the Total Cost of Ownership for a Mexico CFDI solution for SAP ERP.

Questions:

- Who supports the SAP configuration? What is the cost of this?

- When a customer wants a change to the PDF or Addenda? Who implements? Who is involved in testing?

- Who supports the integration to the local solutions? Who builds and maintains the mapping?

- Does support stop at a Service Transfer Point? Where does the vendor support start and stop?

- Where does the SAP team need to get involved?

- When a change happens: who is involved, what is the cost?

- When an invoice is not printing at the warehouse? Who do I call?

The majority of PACs that we see just offer the government signature – leaving the implementation, monitoring and maintenance of both the SAP box and Middleware to the Corporate IT team. Talk with Corporate IT teams who have tried the PAC only strategy. They will give you a real picture of the total project cost and project pain.

We are delivering a large number of rescue projects in Mexico to multinationals who say “I wish I found you before we went down the local route.” These forgotten costs in hastened evaluations are where you will really experience the pain.